Cybersecurity networking firm Palo Alto Networks (NASDAQ:PANW) stock is one of the few companies recently hitting all-time highs this year despite the sell-off in benchmark indexes. The Company is running on all cylinders as the remote or hybrid work format underpins the demand for cyber security.

The Russian invasion of Ukraine also reinforced fears of potential cyber-attacks and the need to bolster defenses in this threat environment.

The Company continues to rack up big wins, as its million-dollar contract customers rose 20% in its recent quarter alone to 1,077. It’s Firewall-as-a-Platform (FaaP) business grew 40% continuing to demonstrate the demand for cyber security on both the enterprise, state, and national level. Prudent investors seeking exposure in the cybersecurity segment can watch for opportunistic pullbacks in shares of Palo Alto Networks.

Q2 Fiscal 2022 Earnings Release

On Feb. 22, 2022, Palo Alto released its fiscal second-quarter earnings report for the quarter ending in January 2022. The Company saw earnings-per-share (EPS) of $1.74, excluding non-recurring items, versus consensus analyst estimates of $1.65, beating by $0.09. Revenues rose 29.5% year-over-year (YoY) to $1.32 billion beating analyst estimates for $1.28 billion. Q2 billings rose 32% YoY to $1.61 billion beatings its prior guidance of $1.51 billion to $1.53 billion. RPO grew 36% YoY to $6.3 billion.

Palo Alto CEO Nikesh Arora commented,

"In Q2, our company continued to benefit from strength across our three security platforms, driven by strong cybersecurity demand, organizations architecting for hybrid work and growing their hyperscale cloud footprints. On the back of this strength, notably in our next-generation security offerings, we are raising our guidance for the year across revenue, billings, and earnings per share."

Upside Guidance

Palo Alto issued upside guidance for fiscal Q3 2022 EPS of $1.65 to $1.68 verse $1.64 consensus analyst estimates on revenues of $1.345 billion to $1.365 billion versus $1.35 consensus analyst estimates with Q3 billings of $1.59 billion to $1.61 billion.

The Company issued full-year fiscal 2022 EPS guidance between $7.23 and $7.30 versus $7.24 consensus estimates, up for its prior guidance of $7.15 to $7.25. The Company sees full-year fiscal 2022 revenues of $5.425 billion to $5.475 billion versus $5.39 billion consensus analyst estimates.

Conference Call Takeaways

CEO Arora discussed market trends including the continued strength in cyber security as indicated by no slowdowns in IT spending patterns or investments. He sees the rise in investments accelerating the shift to the cloud and efforts to redefine network architectures to accommodate "work from anywhere" or "hybrid work," which underpins the strong demand for cybersecurity.

He also sees an ever evolving and complicated threat environment which will drive the relevancy and importance of cyber security on enterprise, nation, and state levels. CEO Arora also pointed out,

"In addition to industry specific trends, we're seeing a trend that is unique to Palo Alto Networks. Given our investments in the areas and continued relevance across multiple platforms and needs of our customers, we're having more and more significant partnership conversations, which encompass the entire Palo Alto Networks offering.

"Whilst early, we believe this is the true differentiation that Palo Alto Networks provides both best of breed and integrated security that works."

They are building a more predictable business model as indicated by 30% revenue growth in the last quarter with leading billing and RPO metrics up 32% and 36%, respectively. Its $3.4 billion CRPO balance provides visibility in its next 12 months of revenues. Firewall as a Platform (FaaP) billings grew 40%m operating income rose 20% and adjusted free cash flow grew 33%.

Multi-platform deals are a win-win for client relationships with 47% of its Global 2000 customers using products from all three platforms which is up 38% YoY as the Company closed 221 seven-figure transactions, three of which over $20 million. Million-dollar contract customers grew 20% in Q2 at 1,077.

The sales momentum is continuing to result in more and larger deals. He concluded,

"On the back of this trend and based on what we’re seeing in our pipeline heading into the second half of fiscal year 2022, we are raising our total revenue, product revenue and total billings guidance for the year. Within this top line, given our confidence in both our pipeline and our sales execution NGS, we’re also raising NGS ARR for the year.

"Lastly, we’re delivering this top line while we continue to make significant investments in our business for future growth. We not only continue to see strong near-term demand but also strong medium-term trends in cybersecurity, fueled by underlying spend in IT spending and secular trends like hybrid work and cloud-native adoption."

PANW Price Trajectories

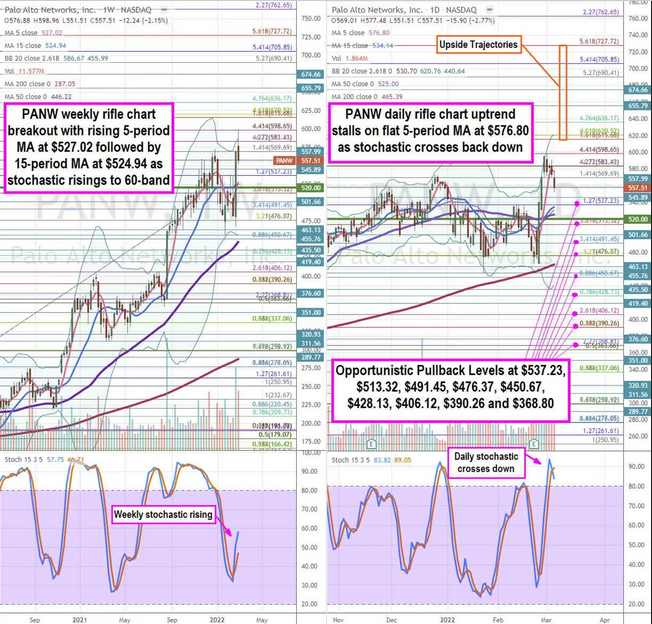

Using the rifle charts on the weekly and daily time frames enables a more precise near-term view of the price action playing field for PANW stock. The weekly rifle chart peaked near the $598.65 Fibonacci (fib) level on its earnings reaction. The weekly rifle chart triggered market structure low (MSL) breakout through $520 as the rising 5-period moving average (MA) is up at $527.02 and 15-period MA at $524.94 with weekly upper Bollinger® Bands (BBs) at $586.67. The weekly stochastic is rising through the 60-band.

The daily rifle chart uptrend peaked as shares fell under the flat 5-period MA at $576.80 followed by the 15-period MA at $534.14 and 50-period MA at $525 and daily 200-period MA at $465.39. The daily upper BBs sit near the $620.57 fib. The daily lower BBs sit at $440.64.

Prudent investors can watch for opportunistic pullback levels at the $527.23 fib, $513.32 fib, $491.45 fib, $476.37 fib, $450.67 fib, $428.13 fib, $406.12 fib, $390.26 fib, and the $368.80 fib. Upside trajectories range from the $615.58 fib level up towards the $727.72 fib level.