LUV Has A History Of Negative Earnings Reactions

Several travel names will report earnings tomorrow morning

Earnings season is underway, with the airline sector getting set to take its turn in the limelight. Among those on tap to report are American Airlines Group Inc (NASDAQ:AAL), JetBlue Airways Corporation (NASDAQ:JBLU), and Southwest Airlines Co (NYSE:LUV), and the options market is expecting outsized earnings reactions for each travel stock.

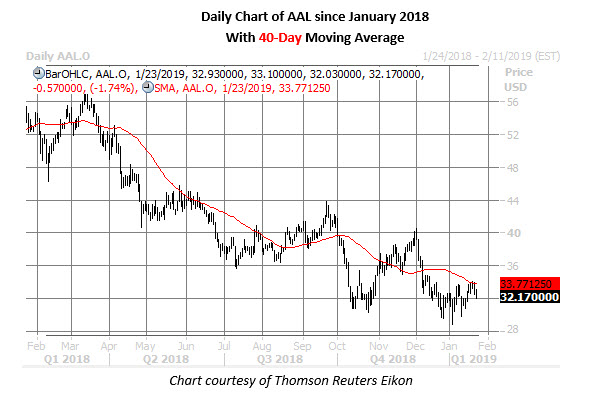

American Airlines Holds Below Key Trendline Before Earnings

Trade-Alert pegs American Airlines Group (NASDAQ:AAL)' implied earnings deviation at 10%, more than the 4.7% next-day move the stock has averaged over the last two years. While five of these eight earnings reactions have been negative, the last two were positive, with AAL averaging a one-day gain of 5.8%. Meanwhile, the stock plunged 4.1% on Jan. 10 after the company slashed its fourth-quarter unit revenue forecast.

Ahead of tomorrow morning's earnings reveal, AAL stock is down 1.7% to trade at $3217, bringing its year-over-year deficit to almost 45%. The equity has been struggling beneath its 40-day moving average since late November, and recently rallied up to this trendline after hitting a two-year low of $28.81. According to Schaeffer's Senior Quantitative Analyst Rocky White, in the seven other times American Airlines has come within one standard deviation of its 40-day trendline after a lengthy stretch below it, the security averaged a five-day loss of 3.1%.

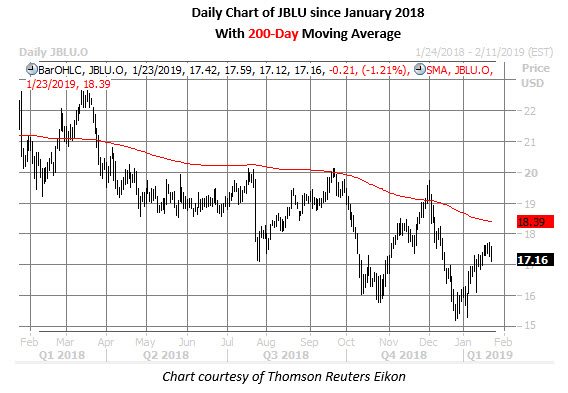

JetBlue Options Bears Active Ahead Of Earnings

It's been a toss of the coin as to whether JetBlue (NASDAQ:JBLU) shares closed higher or lower in the session after reporting, looking back over the past two years. With the airliner set to report fourth-quarter earnings bright and early tomorrow, the options market is pricing in a 6.6% swing for Thursday's trading, regardless of direction. Just one of the past eight earnings reactions has been big enough to exceed this -- a 10.2% plunge last July.

Today, JBLU stock is down 1.2% at $17.16, and has now shed 23.8% in the last 12 months -- with all rally attempts contained by the equity's 200-day moving average. Pre-earnings options traders have been bracing for bigger losses, too, per AAL's 10-day put/call volume ratio of 0.71 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which registers in the 84th annual percentile. In other words, puts have been bought to open relative to calls at an accelerated clip.

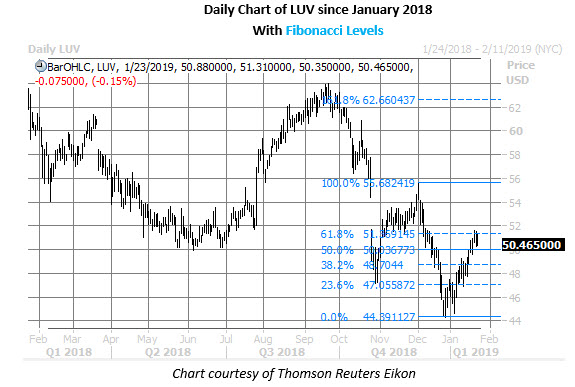

Southwest Airlines Stock Volatility Could Continue

Southwest Airlines (NYSE:LUV) will report its fourth-quarter results ahead of tomorrow's opening bell. The stock has a history of negative earnings reactions, having closed lower the next day in six of the last eight quarters. On average, LUV shares have moved 5.1% in the session subsequent to the travel name's results, regardless of direction. According to the equity's implied earnings deviation, the options market is expecting a larger 8.2% swing for tomorrow's session.

It's already been a volatile stretch for LUV, per the stock's 60-day historical volatility of 36.9%, which registers in the 100th annual percentile. Looking closer, the security has gained 14% since skimming a two-year low of $44.28 on Dec. 26. And while Southwest Airlines is trading above the round $50 mark -- last seen at $50.47 -- it's now staring up at the $51.40 region, home to a 61.8% Fibonacci retracement of the equity's December sell-off.