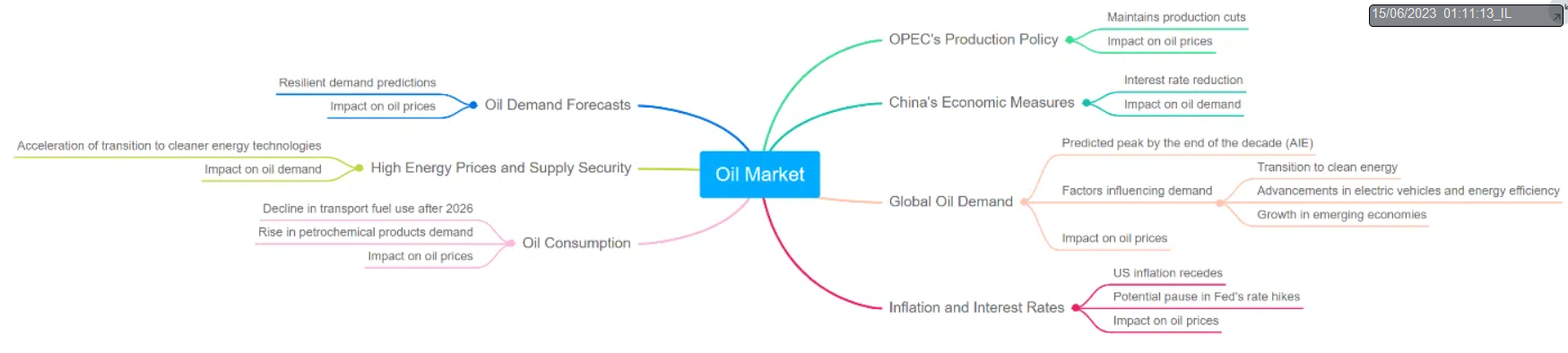

The oil market is in a state of flux, with OPEC maintaining its demand predictions, the International Energy Agency (IEA) forecasting a peak in oil demand, and oil prices responding to various global signals.

OPEC's Demand Predictions

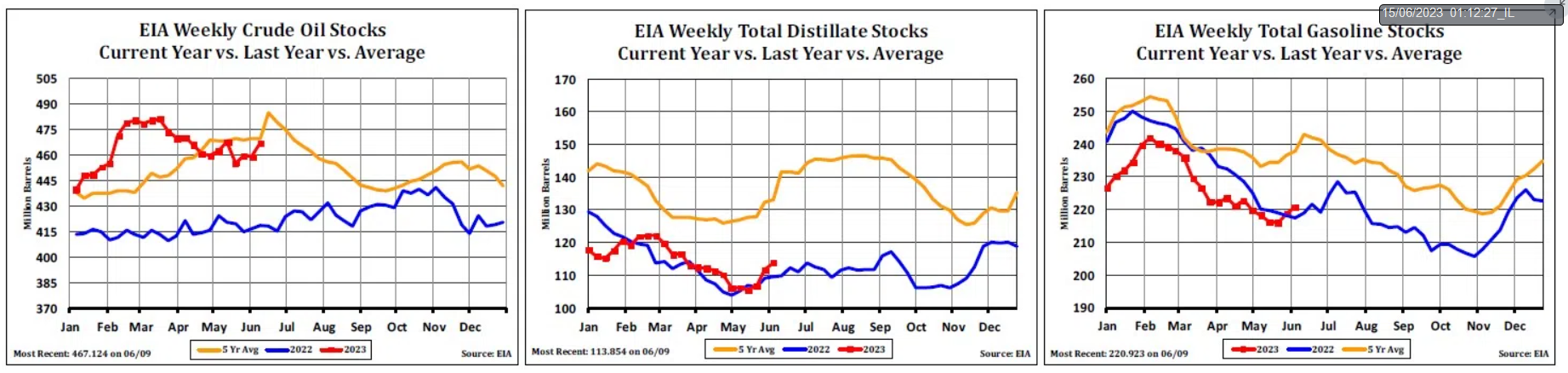

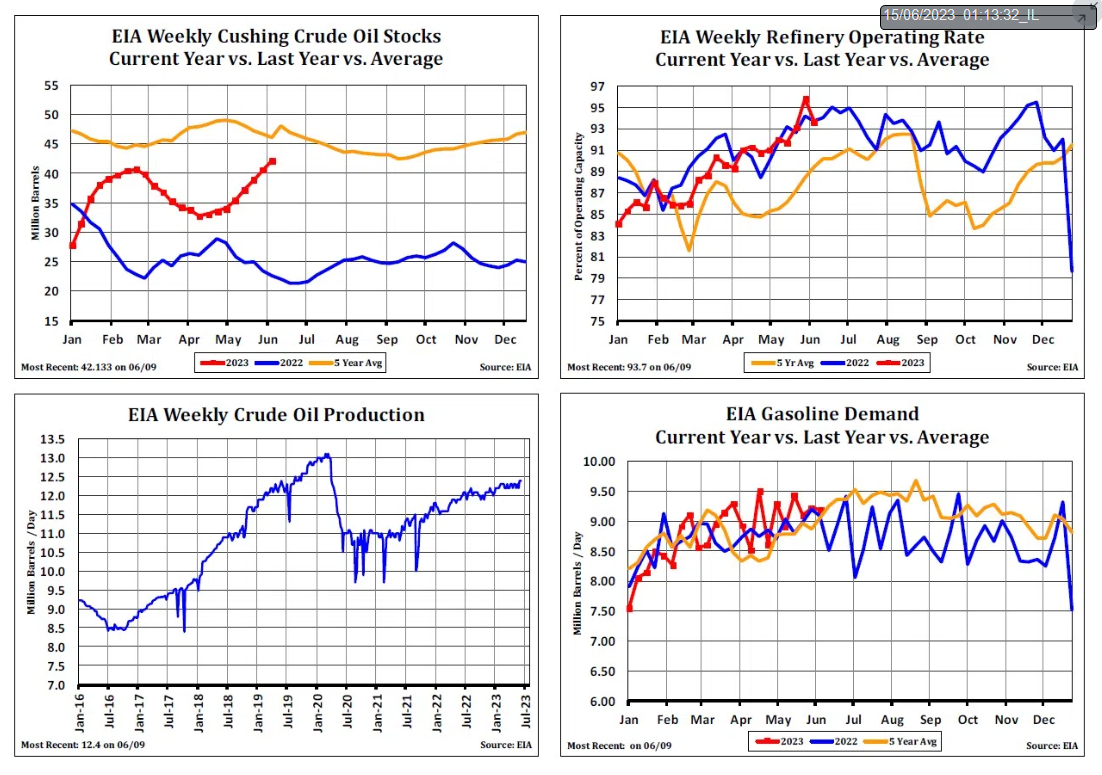

The Organization of Petroleum Exporting Countries (OPEC) has maintained its growth predictions for global oil demand in 2023, despite uncertainties surrounding economic growth. This forecast comes as a relief to the market, which has been grappling with various global economic signals.

The Peak in Oil Demand

The International Energy Agency (IEA) predicts that global oil demand will reach a peak before the end of the decade. This prediction, part of an annual report, is the first time the IEA has forecast a peak in demand within this timeframe. The transition to a cleaner energy economy is accelerating, with electric vehicles, energy efficiency, and other technologies advancing. However, the growth in demand is expected to significantly slow down by 2028.

Oil Prices Respond to Global Signals

Oil prices are benefiting from resilient demand forecasts and the decline in inflation in the United States. High energy prices and global supply security issues, exacerbated by the war in Ukraine, are accelerating the transition to cleaner energy technologies. In the OECD area, this will even result in a decline in oil demand from 2024.

Oil Market Map (Summary)

As we navigate these complex dynamics, several questions arise: How will the global oil market adapt to the predicted peak in demand? What will be the impact of the transition to cleaner energy technologies on oil prices? How will the decisions of major central banks affect the global oil market?

- Prior to EIA report:

- Following EIA report: