On Friday, oil bears lost several important allies when their opponents tested the barrier of $80. Are they completely lost?

Technical Picture of Crude Oil

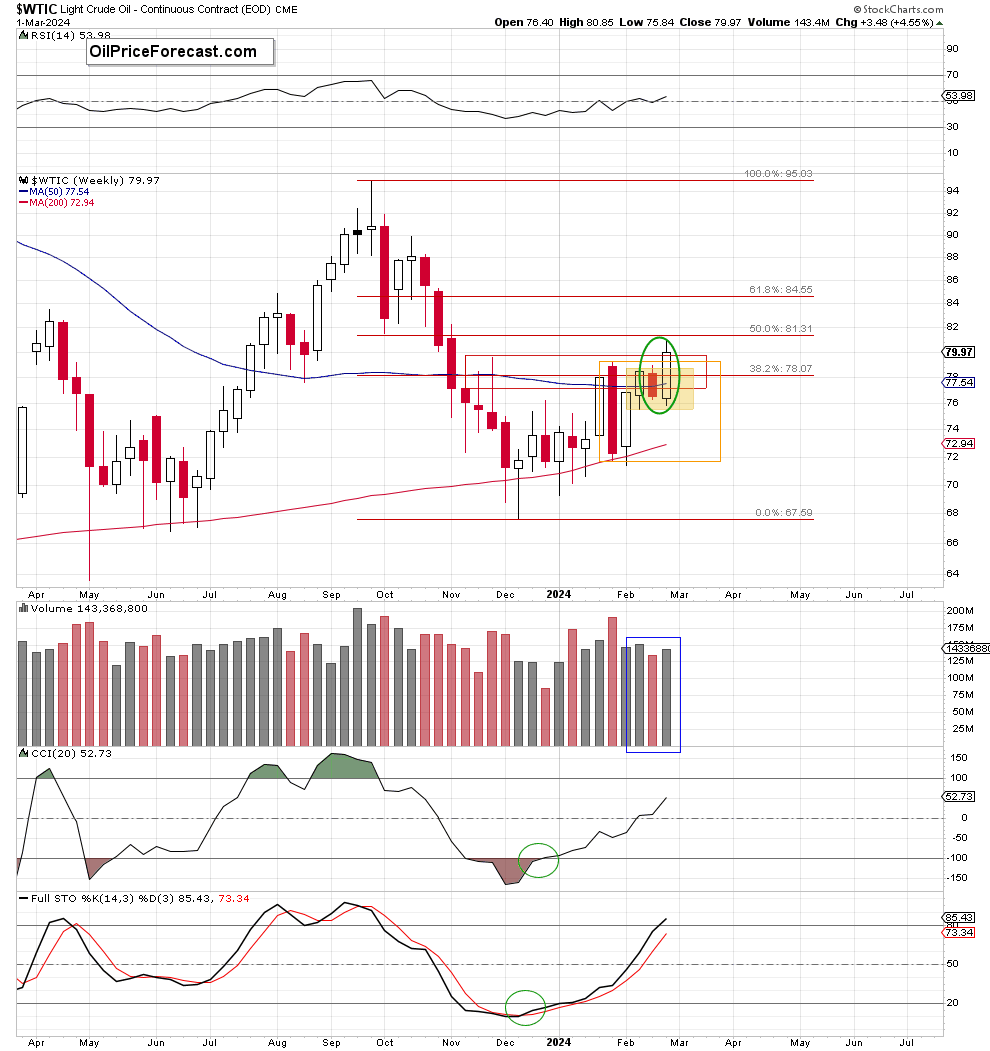

Let’s start today’s analysis with the medium-term picture of crude oil.

The first thing that catches the eye on the medium-term chart is a pro-growth candlestick formation – the bullish engulfing pattern (marked with the green ellipse), which caused a weekly closure above very important resistances: not only the 50-week moving average, but also above the previous peaks (formed in Nov. 2023 and Jan. 2024) and the 38.2% Fibonacci retracement.

Thanks to this upward move, the price of black gold also broke above the upper border of the yellow and orange consolidation, which, according to the rules of technical analysis, opened the way for the bulls to the north.

How high can oil grow according to these rules?

Let's start with yellow consolidation – the breakout above $78.77 opened the way to (at least) $82.02, where the size of the upward move would correspond to the height of the formation.

However, considering the orange consolidation, the upward movement could reach even $86.79, where it would be equal to the height of the red candle formed on Jan.29.

Will we see such increases in the coming week?

In my opinion, despite the buyers' Friday’s success, the road to the north will only be open for good when the bulls manage to successfully break the psychological barrier of $80 (as a reminder, the barrier of $70 effectively stopped the bearish appetite for lower price levels, which shows the importance of this type of support/resistance for market participants).

How has the recent price action affected the short-term picture of the commodity?

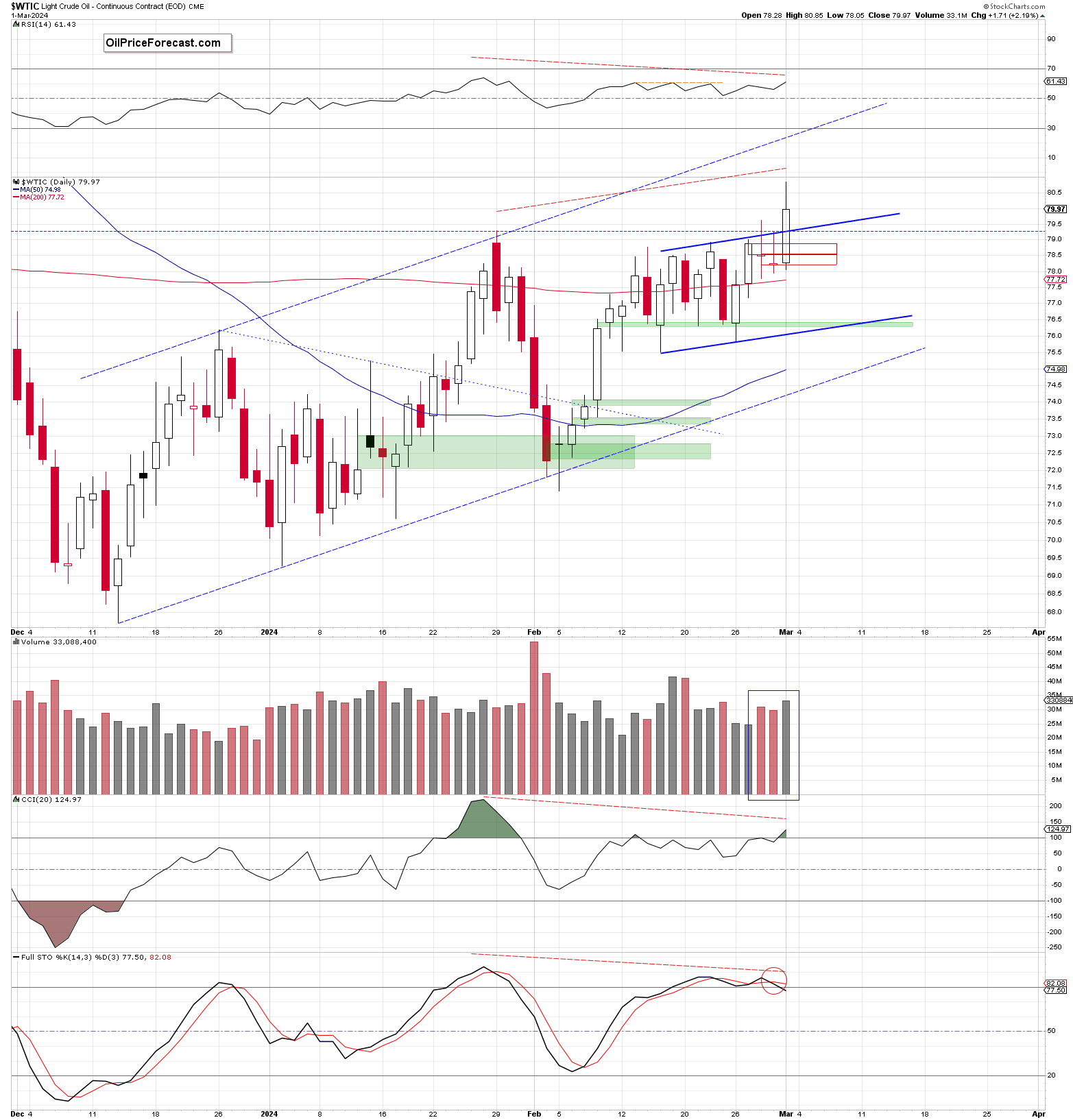

From this perspective, we see that oil bulls managed not only close two red gaps created in the previous week, but also broke and closed the day above the upper border of the blue channel and the Jan.29 peak, neutralizing this way the bearish engulfing pattern formed during one of the last sessions of January.

Positive developments?

Yes – especially when we take into account a visibly higher volume during Friday’s session, which confirms the bulls’ involvement in shaping the white candle.

Thanks to this upswing, the price of light crude tested the strength of the barrier of $80, hitting an intraday high of $80.85. Despite this improvement, the buyers didn’t manage to hold gained levels, which caused a pullback that took the commodity below this psychologically important level.

As a result, a prolonged upper shadow appeared on the chart, signaling that the bears might be more active in this area (despite the loss of very valuable allies mentioned above).

Are there any technical factors left on their side?

Yes.

Firstly, the sell signal generated by the Stochastic Oscillator remains in the cards.

Secondly, visible negative divergences between the RSI, the CCI, the Stochastic Oscillator and the price of black gold, which suggests that the space for gains might be limited and reversal in the coming days can’t be ruled out.

Nevertheless, as long as the commodity is trading above the previously broken levels all potential downswings could be nothing more than verifications of Friday’s breakouts.

And speaking about space for gains… let’s take a closer look at the daily chart from a bit broader perspective.

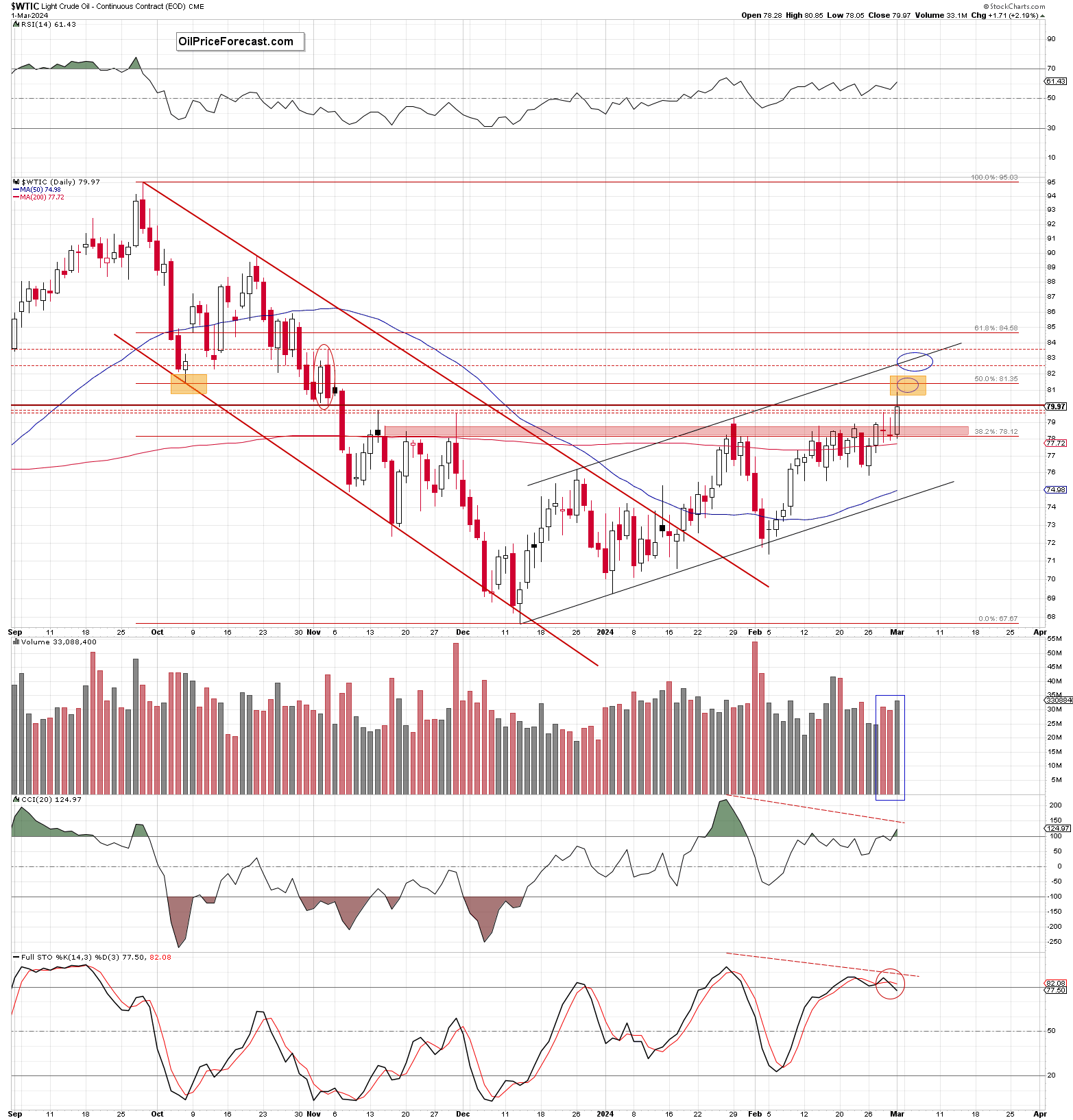

Looking at the above chart, we see that the last upswing also approached light crude to the 50% Fibonacci retracement based on the entire late-Sep.-mid Dec. Downward move), which serves now as the first resistance after the breakout above the barrier of $80.

At this point it is also worth mentioning that in this area is also the bottom of the first wave in the mentioned Sep.-Dec. declines, which serves as an additional resistance.

What Could Happen if Bulls Move Higher?

In the case of a potential breakout, the next target for the buyers would likely be the upper border of the black rising trend channel, which was strong enough to stop the bulls at the end of Jan. (currently at around $82.60).

At this point, it is also worth keeping in mind the fact that in this region additional resistance will be the pro-declining formation (the bearish engulfing pattern marked with the red ellipse) created at the beginning of Now. 2023.

Nevertheless, in my opinion (as I mentioned before), higher prices of the commodity will be more likely only if we see a successful breakout above the barrier of $80. Until this time, it seems that observing the bulls' behavior (especially confirming their strength) is a good decision.

Summing up, crude oil shot up during the last session of last week and broke above the nearest resistance zone, depriving the bear of valuable allies. Despite this success, the barrier of $80 still remains unbroken, which, combined with negative divergences between all daily indicators and the price of black gold, suggests increased caution when making investment decisions.