Many analysts predict that banks will be hurt by higher interest rates. Yet the best leading indicator of banks’ future profits – financial sector stocks – aren’t showing the slightest concern by this prospect.

Indeed, judging by the performance of the Bank Index (BKX) and the Broker Dealer Index (XBD), financial institutions seem to be quite at home with the idea of higher interest rates. This, we are told by some experts, is because higher rates allow banks to loan more money. Insurers also generate more returns on their investment portfolios with rising rates without having to rely on premiums.

Despite the nearly 9% jump in the Treasury Yield Index (TNX) on Friday, July 5, bank stocks were up by an average of 2.62% while broker/dealers were up 2.39%. Both the XBD and the BKX made new 52-week highs in contrast to the S&P 500, which is still below its previous high from May.

Rising rates aren’t good for everyone, however. Homebuilders and REITs are struggling under the weight of higher interest rates, as can be seen in the daily chart of the Dow Jones Equity REIT Index (DJR).

Yet rising rates are providing a near-term boost to home buying. As Dr. Ed Yardeni has pointed out, homebuyer’s initial reaction to rising mortgage rates has prompted would-be home buyers to close their deals as quickly as possible.

Could it be that the reason for the bank stock rally despite rising rates is that banks are benefiting from the short-term stimulating effect of mortgage activity? I’ll leave off commenting on the longer-term impact of this trend. Suffice it to say that the short-term implication is bullish since money continues to move into key financial sectors, thereby keeping the interim uptrend intact.

U.S. Economy

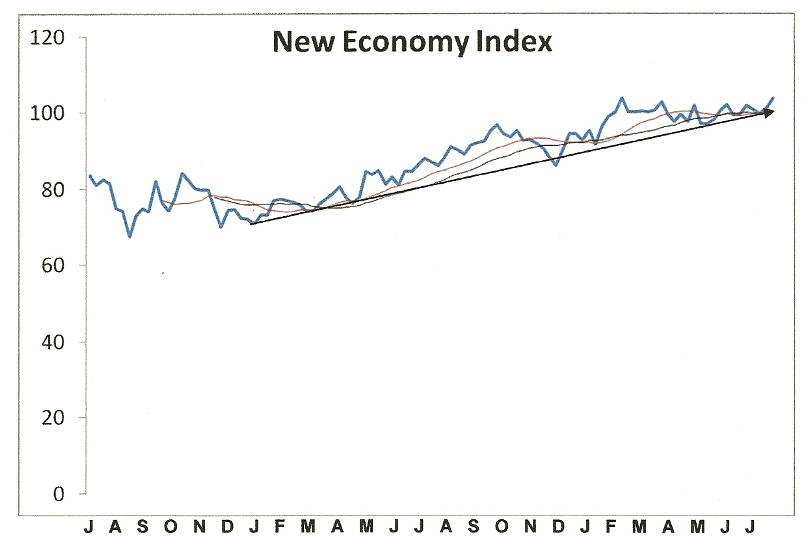

The event of the week, last week, was the (almost) new high in the New Economy Index (NEI), which is now back to its previous all-time high of 103.80. This was the level the index peaked out at on January 25 and hasn’t been revisited until now.

The recovery in the NEI after a 5-month period of consolidation is telling the story of continued economic strength in the U.S. retail economy. The intermediate-term uptrend for the U.S. economy thus remains intact after the index threatened to break the trend some weeks ago. NEI hasn’t given a confirmed economic “sell” signal in over three years.

Consumer optimism is most conspicuously reflected in the trend for auto sales, which has reached a multi-year high this year. Sales of cars, light trucks and commercial vehicles are moving at a torrid pace this summer, which can be attributed to the economic and financial market momentum from late 2012/early 2013. Rising interest rates – or the fear of higher rates down the line – are also a likely factor in spurring all kinds of big ticket purchases, from cars to houses.

The performance of the New Economy Index in the last few years raises a question: can the NEI be considered as a leading indicator for the stock market? There have been some notable instances of the NEI leading the stock market, both to the upside and the downside, in recent years. I don’t believe a correlation can be established between NEI and the market, however, as several more years of performance history are needed (the index only stretches back to 2007). Nevertheless, since NEI is comprised of the leading consumer/retail sector stocks, a breakout to a new high in NEI this week would carry bullish implications for the broad market.

Gold

While the bears continue to proliferate, there are also some respected professionals currently buying gold under the radar. One such example is Sebastian Lyon, the fund manager overseeing Personal Assets Trust, £600m investment fund whose overriding aim is to preserve shareholders’ capital.

Personal Assets Trust’s market-beating performance during the worst of the crisis was largely due to its big investment in bullion – currently more than 12 percent of its portfolio. While the gold price has fallen in recent months, Lyon has topped up gold holdings, according to reports.

The biggest entity of note to call for a short-term gold and commodities market bottom is of course Goldman Sachs. Goldman’s long-term historical accuracy for calling market bottoms is unsurpassed among major institutions and provides a degree of confidence that the yellow metal is indeed close to a bottoming out point. Goldman was joined by a bullish short-term call on gold a week ago by JP Morgan.

Various investor sentiment polls on gold show capitulation levels of bearishness, which increases the odds of a near-term bottoming process based on the contrarian principle. Between the recent increase in bullishness among “smart money” players and the extreme bearish sentiment of the crowd, gold should be able to feed off these conflicting emotions and grind out a bottoming pattern in the coming weeks.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Of Rising Interest Rates, Gold And The Stock Market

Published 07/11/2013, 02:29 AM

Updated 07/09/2023, 06:31 AM

Of Rising Interest Rates, Gold And The Stock Market

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.