Key Points:

- Kiwi Dollar depreciating strongly against the Japanese Yen.

- RSI Oscillator close to oversold levels.

- Watch for a bounce to breakout of the bearish channel in the days ahead.

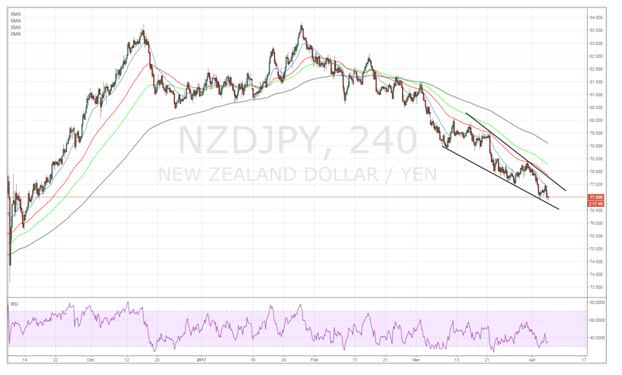

The past few months have been relatively rough for the pair as the Kiwi Dollar has traded within a strongly bearish channel that has taken it from a high around 83.50 all the way down to price actions current level at 76.90. However, although things might presently be looking relatively bleak for the pair, it should be noted that there are some technical indicators presenting an interesting case for a short term breakout.

In particular, the RSI Oscillator is currently plumbing oversold levels which implies that we are likely to see, either a short term reversal, or at the minimum a period of moderation. There also appears to be another iteration of an ending diagonal evident on the 4-hr chart which would seems to suggest that a breakout could be afoot over the next few sessions. Subsequently, there are quite a few technical factors suggesting that, at the very least, we may see some moderation in the days ahead.

However, there are still plenty of fundamental bears waiting in the wings given the Yen’s current status as a “safe haven” currency. In addition, the New Zealand Retail Sales figures are also due out early next week which is forecast to contract by around 0.6% m/m. Subsequently, there could be a few negative surprises awaiting the Kiwi Dollar in the coming days.

Regardless, the presence of another ending diagonal, along with RSI nearing oversold levels, would seem to suggest that we could be in the early stages of seeing a short term breakout. Subsequently, the most likely scenario is one where price action rallies to breach to the top of the descending trend line around the 77.50 mark before commencing a run towards the first major resistance point at 78.50. However, it would be prudent to wait for a confirmation candle to close above the trend line before considering any form of entry.

Ultimately, the deep depreciation of the Kiwi Dollar can only go so far before we see some mean reversion in play. At this stage, price action is already depressed enough that a rebound is highly likely, especially given the technical indicators. Subsequently, watch for a bounce to the long side over the next few sessions.