The New Zealand dollar is set for a busy week with the upcoming Official Cash Rate (OCR) announcement and CPI data. Nevertheless, the main focus will be on the OCR announcement from the Reserve Bank of New Zealand. The OCR is set to be a big event on all the developed economies’ calendars as New Zealand becomes one of the first developed countries globally to start raising rates.

While most traders will be banking on a jump from the currency in the upcoming OCR announcement, I believe that markets have already priced in a rate rise, given how high the NZD/USD cross is.

Over the last few months, many prominent banking economists have called for a rate rise earlier, given the state of the NZ housing market and the need to cool it slightly. Though LVR restrictions (low deposit restrictions) have certainly supressed the heat, it has not stopped speculative home owners flushed with cash, hence the desire of many to start seeing a rise from the record low OCR and a return to the normal monetary policy enacted by the RBNZ.

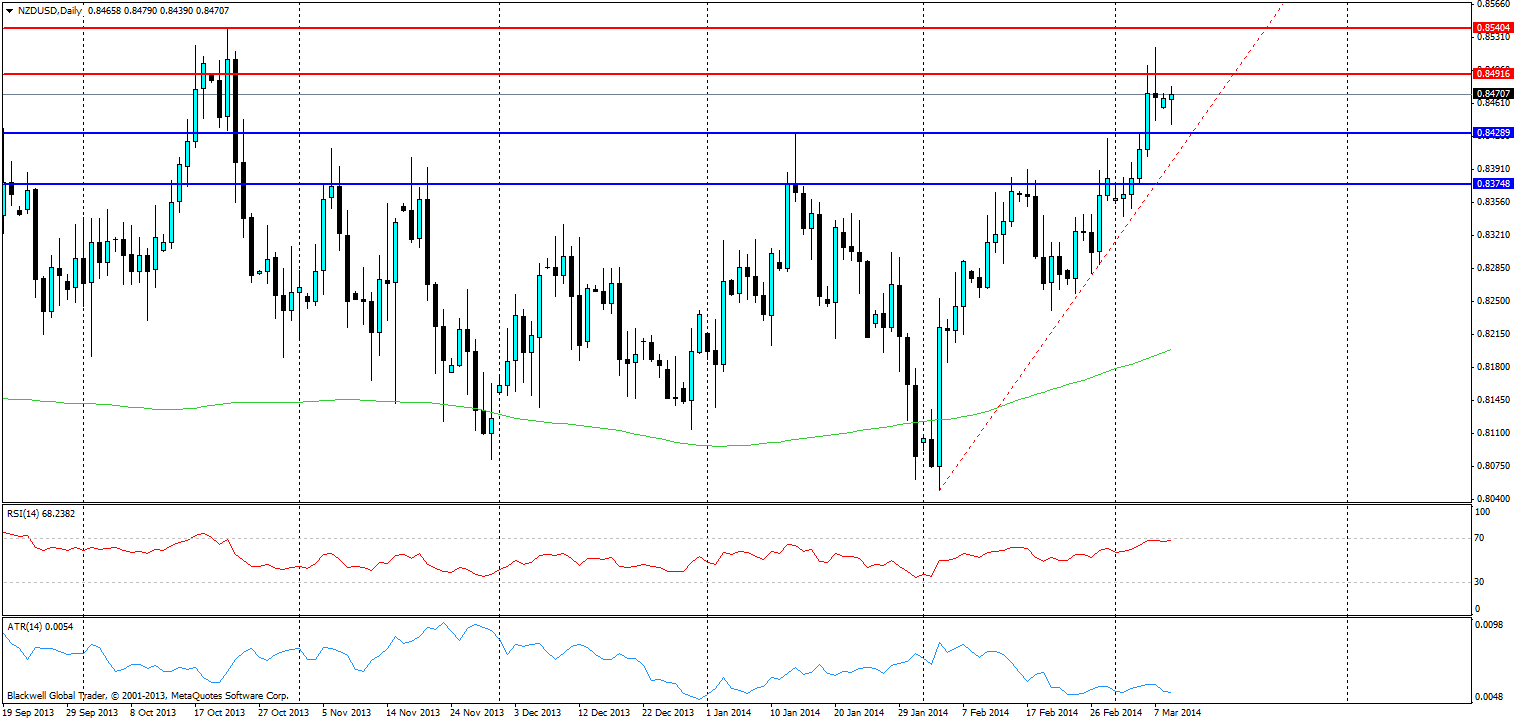

Current market sentiment is certainly very bullish for the NZD as anyone can see from the charts, it has fluctuated heavily over the last few trading days as it pushed up to the 85 cent zone, a zone where the NZD becomes uneconomical and never stays for very long. The RSI is trending just below the overbought level as markets look to keep the pressure on the NZD/USD.

Even if we do get a jump after a rise in interest rates, the 85 cent mark certainly seems the most likely option and it's unlikely that it would extend any further than the 0.8540 resistance level that is a dominating feature on the charts. A bullish trend line is also in play at this stage and is very steep, which implies that it's not very strong and can break if given enough downward pressure.

Given the recent bullish nature and the complete standstill that the pair has found itself currently, it looks likely that the NZD is steeped for a major swing lower. When looking at the charts, it’s clear that the NZD ranges heavily, it does not just stop and sit for an extended period of time. So where to next? I believe that after the OCR announcement, we will see a swing lower, back down into the lower 80 cent range.

Why do I believe this? Given the NZ economy (export dominated economy) and its dislike for a strong dollar, I believe that markets will look to take the push upwards of the OCR, and then we will see a spate of aggressive short selling from traders as they look to push it lower on the back of the NZD being far too strong. Supporting this is the ATR which shows that volatility has certainly slacked off as markets wait to see it gain direction. Obviously, it’s likely to range a little higher of a positive OCR statement but I would certainly watch the trend line in play and look to enter as it crashes through.