There is sustained UK progress is the headline message from the H120 Norcros (LON:NXR) update in our view. Low single-digit growth here is not eye-catching but is certainly better than underlying markets. Management expectations and our own estimates are unchanged and consistent delivery against these benchmarks should be reflected in an improved rating in our view.

Outperforming challenging markets

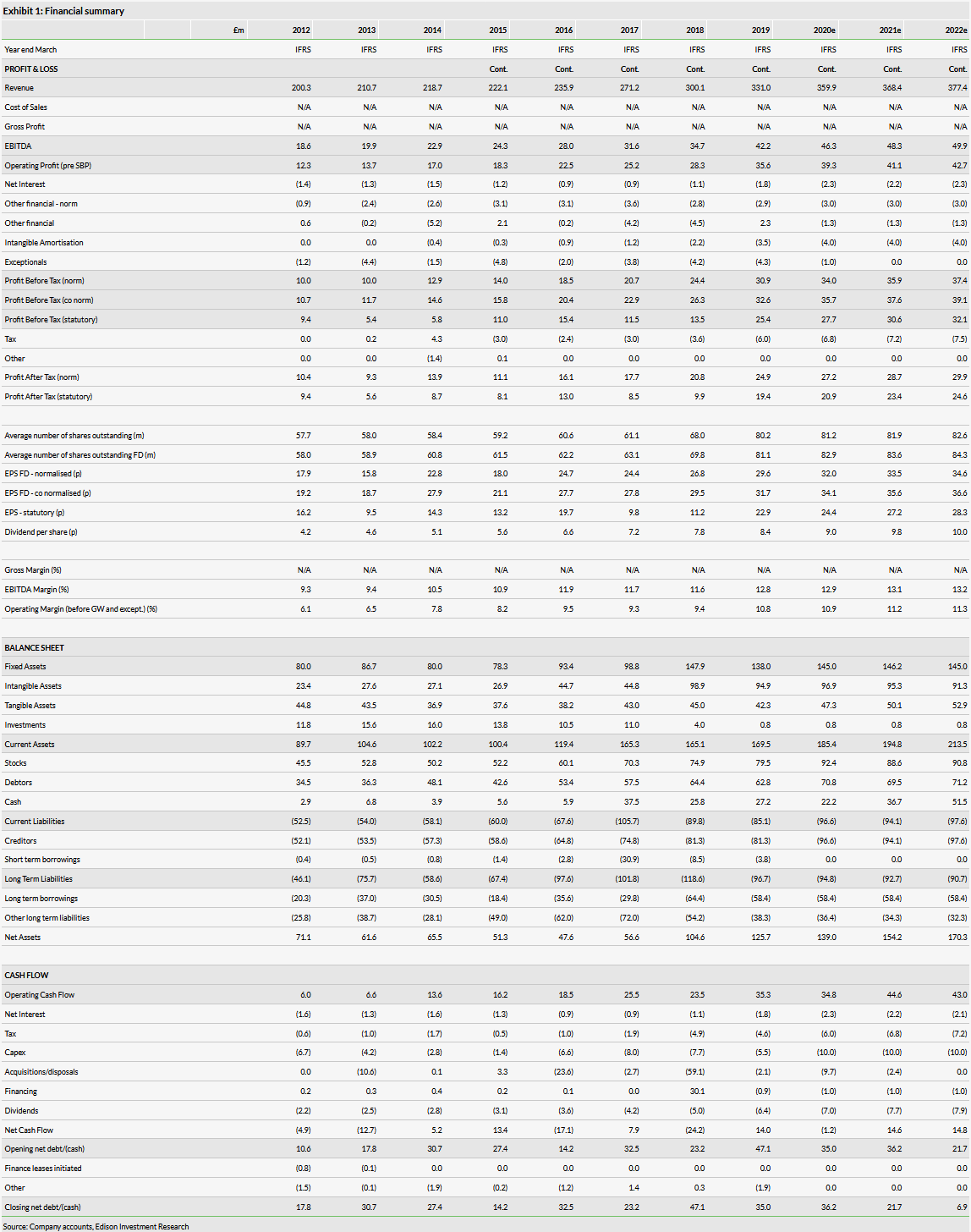

In underlying terms, H1 revenues grew by 1.3% y-o-y in the UK operations and were flat in South Africa (compared with -0.4% and +0.8%, respectively, at the end of Q1). The progress in the UK was all organic and comprised domestic growth of 3.4%, including market share gains arising from both new products and existing listings, together with some benefit from wider supply chain challenges. While the general UK market tone is soft, the Norcros multi-channel proposition (leading brands, breadth of product portfolio, service and financial strength) continues to outperform. After a relatively weak start to the year, UK export performance improved in Q2 although it still currently lags prior year levels. In South Africa, domestic conditions remain challenging, especially in commercial and export markets. Hence, at face value, comparable underlying revenue to H119 looks creditable. House of Plumbing was acquired at the beginning of the year for c £10m; initial integration steps have now been completed and its revenue contribution in the first six months was in the order of ZAR225m/£12m. Business development planning is underway here and future aspirations may become more apparent as the year progresses. Lastly, the flagged period end net debt position of c £42m implies a small underlying cash inflow in H1 (prior to the acquisition), compared to a small outflow in H119.

Valuation: Credit due for relative performance

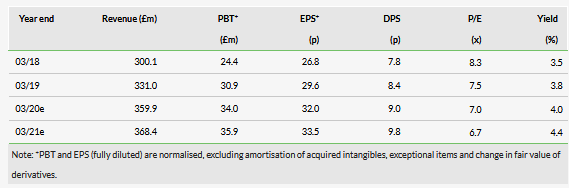

The shares having hit a year high of 243p earlier this month, recent gains have subsequently retraced; the stock is currently c 17% ahead ytd and up c 4% on a one-year view, slightly ahead of the FTSE All-Share Index over the same period. Norcros is navigating its markets carefully and gaining share in the process, although it is receiving little credit for doing so in our view, measured by its rating. The P/E and EV/EBITDA (adjusted for pensions cash) are slightly improved from our last note but still sit at just 7.0x and 5.1x, respectively, for the current year and with a prospective 4% dividend yield.

Business description

Norcros is a leading supplier of showers, enclosures and trays, tiles, taps and related fittings and accessories for bathrooms, kitchens, washrooms and other commercial environments. It has operations in the UK and South Africa, with some export activity from both countries.