Noodles & Company (NASDAQ:NDLS) is scheduled to report fourth-quarter and full-year 2016 numbers on Mar 2, before the opening bell.

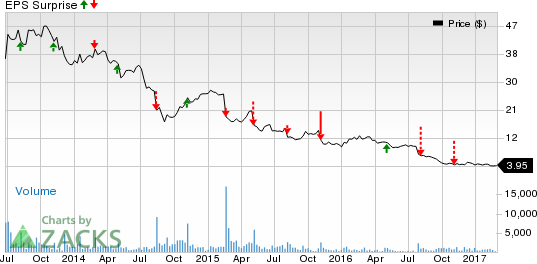

Last quarter, Noodles & Company posted a 33.33% negative earnings surprise. Moreover, the trailing four-quarter average earnings surprise is a negative 23.01%.

Let’s see how things are shaping up for this announcement.

Factors Likely to Influence Q4 Results

Various sales building initiatives undertaken by the company such as streaming of menu and its innovation, effective marketing strategy, increased focus on the catering program along with investments in technology-driven initiatives like digital ordering should boost the quarter’s results. Moreover, efforts to improve operational efficiency bode well and is likely to result in increased guest satisfaction.

However, continual underperformance of a small segment of its total restaurant base has been leading to earnings and margins declines over the past few quarters. This trend is likely to continue in the fourth quarter too. Additionally, this fast casual restaurateur’s fourth-quarter margins are further expected to be pressurized owing to higher costs as well as expenses related to the implementation of strategic initiatives.

Also, a soft consumer spending environment in the U.S. restaurant space might continue to hurt traffic and thereby comps in the to-be-reported quarter.

Earnings Whispers

Our proven model does not conclusively show that Noodles & Company is likely to beat the Zacks Consensus Estimate this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. Unfortunately, that is not the case here as elaborated below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Noodles & Company has an Earnings ESP of -14.29%. This is because the Most Accurate estimate stands at a loss of 8 cents, whereas the Zacks Consensus Estimate is pegged at a loss of 7 cents.

Zacks Rank: Noodles & Company has a Zacks Rank #2, which increases the predictive power of ESP. However, the company’s negative ESP makes surprise prediction difficult.

Notably, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks to Consider

Here are some companies to consider as our model shows they have the right combination of elements to post an earnings beat this quarter:

Staples, Inc. (NASDAQ:SPLS) has an Earnings ESP of +4.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Best Buy Co., Inc. (NYSE:BBY) has an Earnings ESP of +1.81% and a Zacks Rank #3.

Costco Wholesale Corporation (NASDAQ:COST) has an Earnings ESP of +0.74% and a Zacks Rank #3.

A Full-Blown Technological Breakthrough in the Making

Zacks’ Aggressive Growth Strategist Brian Bolan explores autonomous cars in our latest Special Report, Driverless Cars: Your Roadmap to Mega-Profits Today. In addition to who will be selling them and how the auto industry will be impacted, Brian reveals 8 stocks with tremendous gain potential to feed off this phenomenon. Click to see the stocks right now >>

Best Buy Co., Inc. (BBY): Free Stock Analysis Report

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Staples, Inc. (SPLS): Free Stock Analysis Report

Noodles & Company (NDLS): Free Stock Analysis Report

Original post

Zacks Investment Research