Noble Energy Inc. (NYSE:NBL) announced that it has signed a definitive agreement with PDC Energy, Inc. (NASDAQ:PDCE) to enhance its acreage in Wells Ranch by 20% to nearly 78,100 acres. Per the agreement, Noble Energy will receive 11,700 net acres from PDC Energy in Wells Ranch in exchange of 13,500 net acres primarily out of Noble's Bronco area, located southwest of Wells Ranch.

Rationale behind the Exchange

Noble Energy already has operations in Wells Ranch and getting new properties adjoining its existing assets will create long lateral drilling opportunities for the company. PDC Energy will on the other hand benefit from cost savings and operating synergies. Additionally, management of both companies believe the higher contiguous acreage positions should result in fewer surface locations, lowering the above-ground impact.

Noble Energy is currently focusing to develop and strengthen its existing operation in Wells Ranch and East Pony in the DJ Basin.

The acreage exchange is only confined to leasehold and the existing production on the acreage will remain with the original holder. The transaction is expected to be completed in the fourth quarter of 2016, subject to title examination and other adjustments.

Noble Energy’s 2016 Outlook

Along with the first quarter 2016 earnings release, Noble Energy raised its total sales volume guidance for 2016 by 4% to 405 thousand barrels of oil equivalent per day (MBoe/d) from 390 MBoe/d. Production growth of onshore assets in the DJ Basin will play a significant role in achieving the higher production target.

Noble Energy is implementing new technology and using horizontal drilling to increase recoveries of liquid-rich hydrocarbons in the DJ Basin, where the company holds more than 363,000 net acres.

Bigger Picture

Noble Energy’s volumes for the first quarter of 2016 increased 31% year over year to 416 MBoe/d. Out of this, liquids contributed 45%. Compared with the first quarter of 2015, total liquids volumes were higher by 50 thousand barrels per day (MBbl/d). Liquids volumes are expected to improve further in the second half of 2016.

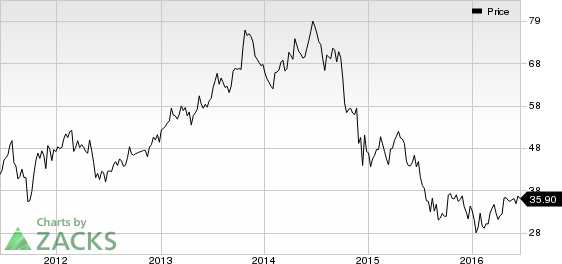

Oil prices have started to move up gradually from the depressed levels it had fallen to in February this year. Indications are that oil prices will improve further in the second half of 2016. Noble Energy will also gain from the revival in prices as liquids form an increasing part of its total production mix.

Zacks Rank

Noble Energy currently has a Zack Rank #3 (Hold). A couple of better-ranked stocks in the same space are Eclipse Resources Corporation (NYSE:ECR) and Laredo Petroleum, Inc. (NYSE:LPI) , both carrying a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

NOBLE ENERGY (NBL): Free Stock Analysis Report

ECLIPSE RESRCS (ECR): Free Stock Analysis Report

PDC ENERGY INC (PDCE): Free Stock Analysis Report

LAREDO PETROLM (LPI): Free Stock Analysis Report

Original post

Zacks Investment Research