- Nike's inventories rose 44% in the latest quarter, hitting the retailer's margins

- Investors sent Nike stock tumbling amid uncertainty about the earnings outlook

- Despite the macro headwinds, investors have many reasons to feel optimistic about the company's long-term prospects

Strong consumer demand has been the primary source of confidence in the world's largest economy in the post-pandemic environment. Even as the Fed embarked on its most aggressive monetary tightening cycle in decades, many economists argued that a soft landing remained possible, given the substantial pent-up demand for consumer goods, such as shoes, clothing, and cars.

But yesterday's earnings report from Nike (NYSE:NKE) revealed that the strongest pillar of the U.S. economy might be endangered as consumers deal with a double blow in the shape of high inflation and surging interest rates.

The world's largest sporting-goods company told investors yesterday that it's dealing with a massive pile of unsold products—a challenge forcing the retailer to offer aggressive discounts and take a hit on its margins.

On Thursday, the Oregon-based company said global inventories had risen 44% to $9.7 billion in the quarter that ended on Aug. 30. In North America, the company's largest market, they were up 65% compared with a year ago, mainly due to slowing demand and late shipment arrivals.

Against such a backdrop, Nike will see its margins erode, dropping 200 to 250 basis points this fiscal year—the previous estimate was that margins would be flat or decline 50 basis points, maximum.

While full-year sales should still grow in a low double-digit range when adjusting for currency, real expansion is now seen in the low to mid-single digits.

A Buying Opportunity?

Investors sent Nike stock tumbling during Friday trading, with shares losing as much as 11.5% at the time of writing. Today's selloff has pushed Nike's year-to-date decline to almost 50%, more than double the losses of the S&P 500 during the same period.

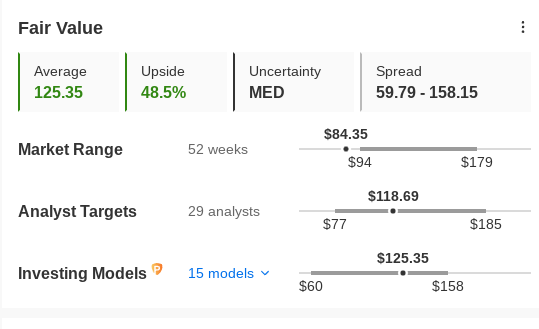

Despite the grim short-term outlook, I believe that Nike may recover from this slump and, thus, long-term investors have an excellent opportunity to buy this stock at an attractive valuation.

The maker of Air Jordan and Air Force 1 sneakers has a solid history of emerging with an even more significant market share from previous crises, including the 2000 dot-com crisis, the 2008-09 recession, and the 2020 COVID-19 pandemic.

Source: InvestingPro

While highlighting similar strengths, Goldman Sachs, in a note to clients, said:

"While Nike has encountered some bumps both in China and the U.S. when it comes to inventory, we remain constructive on the name given its: 1) current valuation looks attractive relative to historical average levels, 2) ongoing success in driving innovation, particularly in footwear."

Morgan Stanley also reiterated its overweight rating on the stock, saying there is a 26% upside potential from Thursday's close.

Another reason that makes Nike a reliable stock to hold during a tough economic environment is its rock-solid dividend. The company currently pays $0.30 a share quarterly payout and has hiked its dividend for 18 consecutive years. The average annual dividend per share growth rate was 11.20% during the past five years.

The company also uses its robust cash flows to support share buybacks. This summer, Nike's board authorized a new four-year, $18-billion stock buyback program, replacing its $15-billion share buyback program, which will end in this fiscal year.

Bottom Line

Nike's latest earnings show that the sailing is rough for the sportswear giant as consumer demand slows and inventories build up in the face of supply-chain challenges.

However, that weak period could turn out to be a buying opportunity for long-term investors aiming to benefit from the company's growth potential and income appeal.

Disclosure: At the time of writing, the author owns Nike. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.