Nifty or the Sensex always become too attractive whenever the share prices cross every economic equations which are designed to map the real prize of a share. Commoners start to try their luck to make easy money in share trading without any prior experience and knowledge. Just a phone starts ringing and a novice welcomes with “Good Morning Sir, do you trade in Stock Market? If you are not doing, don’t worry, we will help you.” And a quick process starts from the same day for an account opening and the commoner feels happy when earns a small money for first time without much efforts in a overflow. And the process of quantum of trading in penny stocks grows well beyond expectations.

The first time a novice starts gossiping proudly about how easy it is to make quick money by share trading in public gatherings. Voices for speedy movement of various lesser known or completely unknown companies echo all around. Various new trading companies come at the front to attract various novices through attractive advertisements and offers. All of a sudden various so called stock market stalwarts start appearing on news channels and start giving their views that they now find this and that company’s share price more attractive, even at the life time high price.

But, I have never seen any stalwart to tell in advance that the Index is about to start falling in my life. My ultimate question from all such Stock Market Stalwarts, what they claim themselves on a News Channel is, if they can not define when the Nifty or any other Index is going to nose dive, they are not even eligible to give their comments to common people about the reason why they found a company’s share price attractive at its life time high price level.

Secondly, I would like to ask all the first time entrants in a stock market that when they go to buy a refrigerator for their home first time, they start their survey very much in advance about the fare value of a good refrigerator from their friends and relative where they have to invest only a small amount of their saving, then why do they give a large amount of their hard earned money in a stretch to a novice who attract them towards making easy and quick money.

Thirdly, the ultimate fact is that the time has come to be too much careful to save hard earned money from before it is too late. I find that the history has enough evidence when we find the gold as the only real money whenever any Indices’ Crash occurs. A well define prime indicator is swollen Indexes all over the World when the share prices of the companies, with or without fundamentals, go more higher in terms of earning per share and market manipulators become Tarzan Traders and finally unequivocally everything seems to be bullish. Then, a sudden jolting creates upheavals overnight what one even cannot expect before an hour in advance.

My aim is not to create panic among the investors; I only wish to analyze the importance of investing in real money. I find that than only the question of real money arises when a vicious time zone of eight years is about to complete. But once the investors escape this vicious circumstance and even knowingly do not want to understand the realities well in advance due to their growing greedy instinct, which prevent them to overlook all prevalent economic scenarios and also the importance of real money.

After going through any big economic jolt, investors feel the need of an advance step what one should have taken well in time to save his hard earned wealth what he has had lost in such jolts. And the need of the real money is more deeply felt, when rates of shares of fundamentally strong companies are available at the cheapest price but one can’t even afford to buy them in the absence of real money.

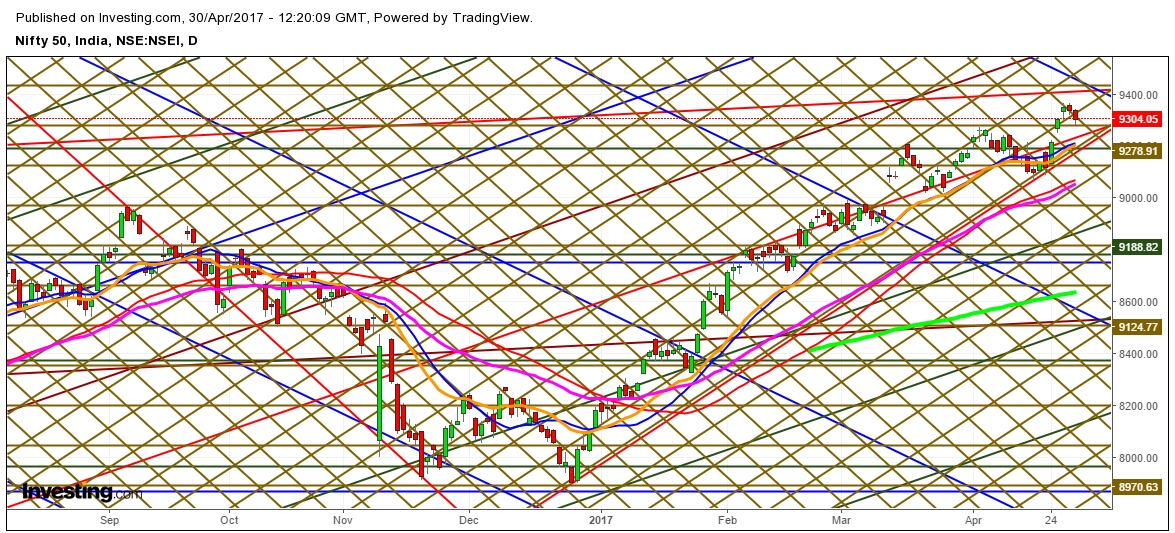

I find that all the primary symptoms as per their time frame are already there as they are always be very much before a “Market Crash”; are clearly visible in advance this time too, what I have already explained above. On analysis the movement of Nifty in various time zones, I find that the technically, Nifty has already given a warning signal for a downward move in a Daily chart very clearly. Although, a jolting move may appear sooner or later, even after a once more upward quick up move but, most of the technical indicators seem to be in favor of a sudden downward move in a very short time.

Have a Nice Trading Time.

Disclaimer: This analysis is purely based on the observations. I do not have any position in any Share or Nifty. One can create position in Shares of Nifty at his/her own risk. This analysis is only meant for investors’ educational purpose.