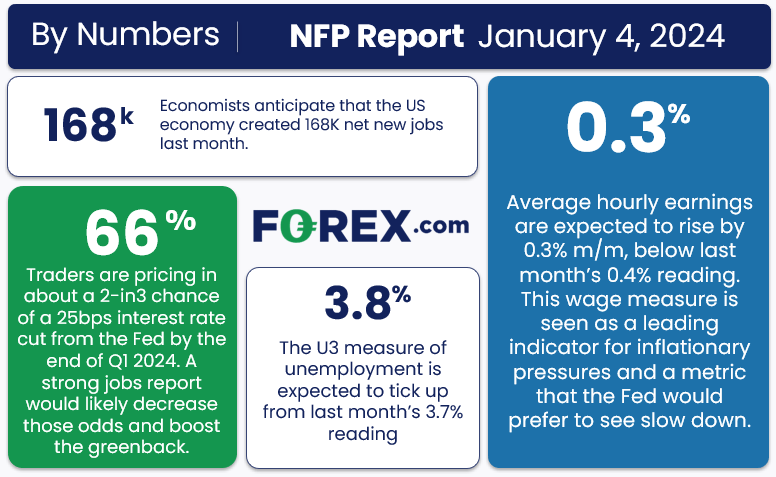

Key Points- NFP report expectations: 168K net new jobs, 0.3% m/m rise in earnings, unemployment ticking up to 3.8%

- March rate cut odds have declined to 66% from closer to 100% last month, so another solid jobs report could tip the scales closer to 50/50.

- USD/CAD remains in a technical downtrend ahead of Friday’s dueling jobs reports.

When is the December NFP Report

The December NFP report will be released on Friday, January 5 at 8:30am ET.

NFP Report Expectations

Traders and economists expect the NFP report to show that the US created 168K net new jobs, with average hourly earnings rising 0.3% m/m (3.9% y/y) and the U3 unemployment rate ticking up to 3.8%.

NFP Overview

It’s a new year on the calendar, but we’re still getting the last of the economic data from 2024, including the highly-anticipated Non-Farm Payrolls report. After last month’s better-than-expected increase of nearly 200K jobs, economists are once again expecting a slight moderation in job growth and an uptick in unemployment.

Source: TradingView, StoneX

More to the point, traders remain relatively confident that the Federal Reserve will start cutting interest rates soon, with markets pricing in a 2-in-3 chance of a March rate cut from the US central bank, per the CME’s FedWatch tool. That said, those odds have declined from closer to 100% last month, so another solid jobs report could tip the scales closer to 50/50.

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP Forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report, but given the vagaries of the calendar this month, the ISM Services PMI report will be released 90 minutes after NFP, leaving just three leading indicators of note:

- The ISM Manufacturing PMI Employment component rose to 48.1, a solid improvement over last month’s 45.8 print.

- The ADP Employment report showed 164K net new jobs, above expectations and up from last month’s 101K reading.

- Finally, the 4-week moving average of initial unemployment claims dropped to 208K, down from last month’s 221K reading.

Weighing the data and our internal models, the leading indicators point to a stronger-than-expected reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 175K-225K range, albeit with a bigger band of uncertainty than usual given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which came in at 0.4% m/m in the most recent NFP report.

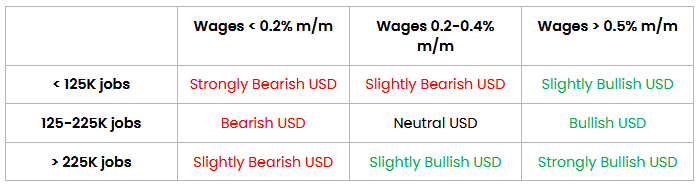

Potential NFP Market Reaction

The US Dollar Index dropped through most of December before finding a bottom and bouncing back over the last week. From a medium-term perspective, the dominant trend remains to the downside, favoring a slight bearish bias toward the greenback, especially if the jobs report misses expectations.

US Dollar Technical Analysis – USD/CAD Daily Chart

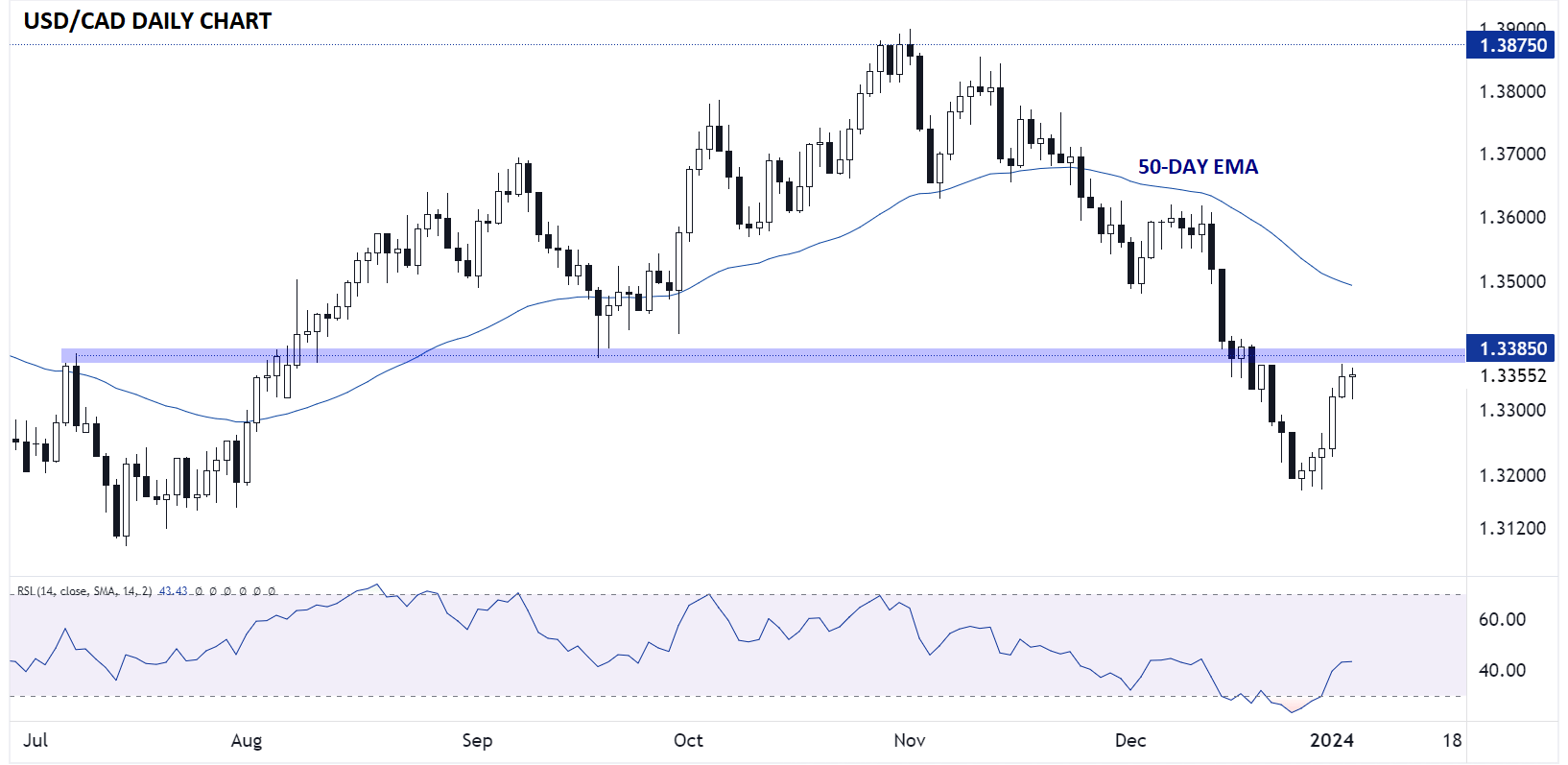

Source: TradingView, StoneX

Keying in on USD/CAD, which will see the simultaneous release of two key jobs reports, the trend was clearly to the downside throughout November and December. Much like the US Dollar Index itself however, USD/CAD has seen a sharp bounce to start the new year, alleviating its oversold condition and raising bullish hopes ahead of the NFP report.

From a purely technical perspective, the trend will remain to the downside as long as previous support-turned-resistance at 1.3385 holds, and even a break above that level may not change the medium-term outlook for the North American pair unless it can clear the 50-day EMA near 1.3500.