Bitcoin 4th Halving is on April 24th, 2024 - in about 5 months.

What should you make of it?

What is Bitcoin Halving?

Bitcoin halving is an event that happens approximately every four years where the reward for mining new Bitcoin transactions is cut in half. This means that miners receive 50% less Bitcoin for verifying transactions and adding them to the blockchain.

The halving is built into Bitcoin's code and it serves to slow down the rate at which new Bitcoins are created, making it more scarce over time. This is often compared to a reduction in supply, like cutting the production of new gold in half, which could affect the price if demand remains the same or increases.

Previous Halvings

As I said, we’re about 5 months before the next Halving.

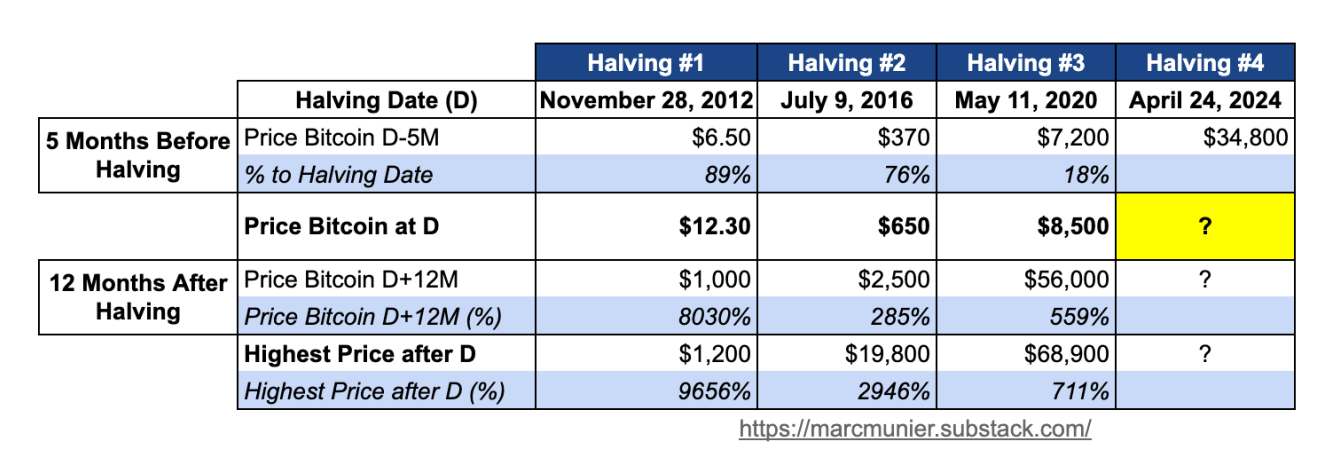

So I checked what happened (with Bitcoin Price) 5 months before each of the previous 3 halvings, and looked at the price 12 months after the Halving date (D), together with the highest price we’ve seen after a halving (and before the next one).

The results look like this:

Let’s take Halving #3 as an example. It happened on May 11, 2020, when Bitcoin price was about $8500.

- 5 months before, Bitcoin was worth $7,200. It moved up 18% to reach the price on May 11, 2020.

- 2 months after, Bitcoin was worth $56,000, which is up 559%.

- The highest price reached to date (before next halving) is $68,900, which is up 711% from the price on May 11, 2020.

This is the logarithmic chart of Bitcoin:

This is a very clear and visual rendition of Bitcoin halvings.

It just goes up...

Why Look at Log charts?

Logarithmic charts are useful, especially for things like Bitcoin prices, because they can help us see percentage changes more clearly rather than just absolute number changes.

When you look at a linear chart, the distance between the numbers on the chart is always the same, no matter the value. So, if the price of Bitcoin increases from $1 to $2, that move looks the same as if it increases from $100 to $101, even though the percentage increase is very different (100% vs. 1%).

In a logarithmic chart, the scale changes so that the same distance on the chart represents the same percentage change, not the same absolute dollar change. This makes it easier to compare relative growth rates over time. For assets like Bitcoin, which has had huge percentage increases and decreases in its history, a logarithmic chart helps to show the trend more clearly without the most recent price changes overshadowing everything else.

Now What?

Past performance is not indicative of future results, and the historical trend of an asset does not guarantee the same trajectory in the future.

That being said, looking at the table above, we (of course) cannot predict anything, but all the performances are (very) positive, especially after the halving dates.

Still, if we bought Bitcoin 5 months before the halving dates, we were positive on each occasion.

Here are the main takeways:

- Post-Halving Surges: Following each halving, there was a considerable increase in Bitcoin’s price, reflecting the classic economic principle of supply and demand.

- Growing Market Confidence: With each subsequent halving, the price both before and after the event was notably higher, suggesting increasing confidence and investment in the cryptocurrency market.

- Amplifying Factors: External economic factors, technological advancements, and increased adoption may also contribute to these shifts in value.

“History doesn't repeat itself, but it often rhymes” (attributed to Mark Twain)

The past halvings have set a precedent of bullish trends, yet each follows its own unique path influenced by a myriad of factors.

…So I guess risk takers (and math lovers) might consider to go extra long on Bitcoin.

***

Disclaimer: The content of this article is purely informational and does not in any way represent an investment advice or recommendation to buy or sell any commodity.

This article was originally published on the Trading & Investing newsletter, read by a community of traders, private investors and financial advisors. You can check it out here.