Upon analyzing this week's movements of natural gas futures, it becomes evident that the bulls are striving to maintain the August futures above $2.676, with the aim of experiencing wild price swings upon expiration on Aug. 27, 2023.

The recent price consolidation phase seems to be a significant factor contributing to a sudden surge in demand. This is largely due to increasing expectations for high pressure that may persist over the southern, western, and eastern US, resulting in temperatures ranging from the upper 80s to lower 90s.

According to natgasweather.com:

“The hottest patterns of the past 40+ years for July 26-30 with highs of upper 80s to 110s over most of the US and little coverage of comfortable highs of 70s to lower 80s for very high demand/CDDs. However, weather systems arriving over the Great Lakes and Northeast Aug 1-7will drop national demand from to only slightly stronger than normal, but with the EC several CDDs hotter v/s the GFS. Expiration of Aug’23 contracts Wed-Thu likely to aid wild swings this week”.

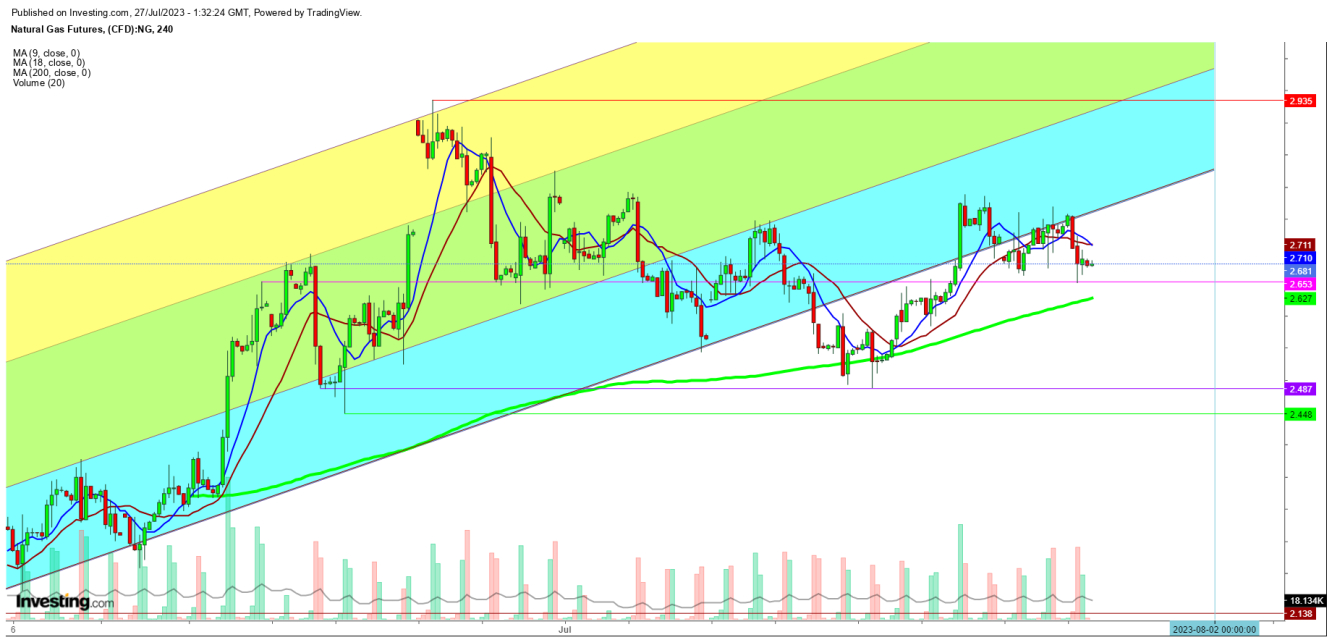

Looking at the 4-Hour chart, there is substantial support at the 200 DMA ($2.627), which appears to be a strong buying point that could potentially drive prices toward the psychological resistance level at $3 before the week's closing.

I expect that the ongoing consolidation phase, with natural gas futures holding above the immediate support at $2.653, is likely to continue today, and this could lead to volatile price swings following the announcement of weekly storage data.

In conclusion, should the August futures experience a sudden dip to $2.448, it may present a favorable opportunity for long positions. Conversely, if there is a sudden surge above $3.248, bears may be attracted to short positions.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. All readers should create any position at their own risk as Natural Gas is one of the most liquid commodities in the world.