The energy sector has retreated markedly from its highs in the first days of March but remains a hot topic for markets. Europe’s gas market survived several bouts of fear that it would be without Russian gas.

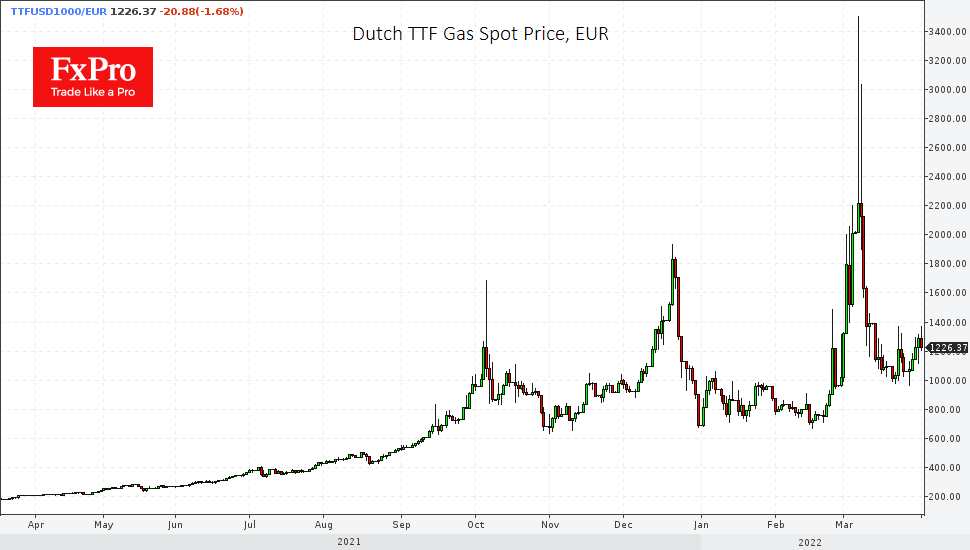

However, we only saw a fourfold increase in value in the first half of the month, followed by stabilization at high, but not extreme, levels. At the beginning of the last week of March, gas prices were supported by a fall to EUR 1000 per thousand cubic metres compared to a peak of EUR 3400.

This price dynamic clearly showed that the markets did not price for a gas disaster. The current gas payment scheme looks like a nice political compromise. Europe is paying for gas in euros and dollars (as negotiated), and Russia is getting roubles for gas (as it wanted). The net economic effect of such rearrangements is close to zero.

Also, these measures are not binding for LNG exports and settlements with Japan. Besides, there is a caveat that a special commission may allow receiving currency in payment for gas. An additional calculation here is that new contracts will always include clauses about alternative payment methods, but they have little effect on the price.

Nevertheless, the general upward trend in natural gas and oil prices is still in place. Spot gas prices in Europe are now six times higher than a year ago and two years ago in March. This does not mean a six-fold increase in prices for final consumers, as most supplies are under long-term contracts.

Therefore, what we see in the Dutch TTF prices is nothing more than a struggle between speculators and small buyers in a relatively illiquid market.

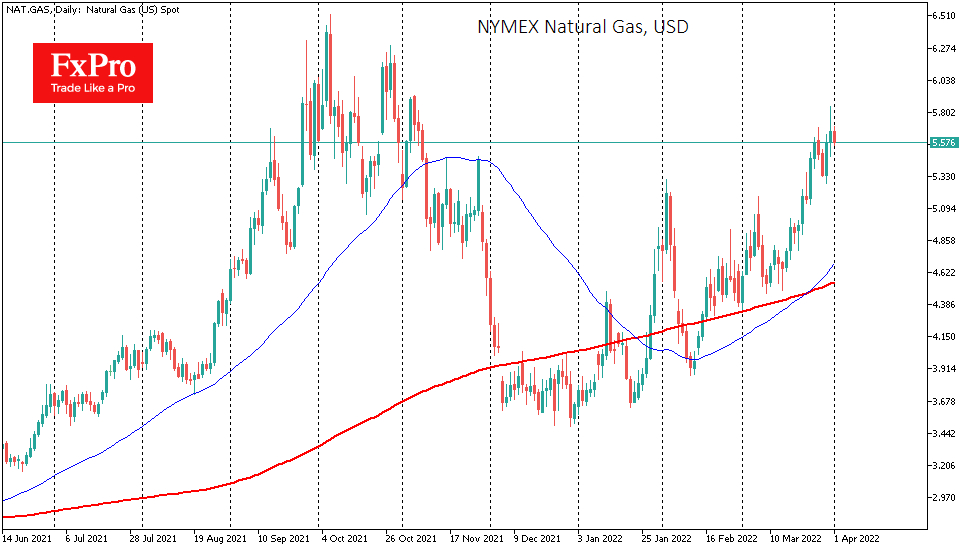

The NYMEX pricing is much more liquid and representative. Besides, it is pretty far from the conflict. Prices here are up 30% in one month and 130% year to date. Gas was up to $5.6 MMBtu yesterday but 14% below October’s highs near $6.5, making it hard to see market hysteria. Instead, it is just a relatively measured trend.

The development of this trend has the potential to return the US gas price to October highs by the end of April due to Europe’s increased interest in non-Russian gas. At the same time, signs that Europe and Russia have managed to formalize some gas purchase terms for themselves are likely to return Dutch’s spot prices to levels near or below EUR 1000.