Last Wednesday, natural gas futures hit a weekly high at $8.546, but some profit-booking followed this move.

On Thursday, NG had a strong reversal from the day’s low at $7.908 and despite the bearish weekly injection of 89 Bcf, the post-inventory announcement move by the commodity was quite bullish, hitting the day’s high at $8.503.

Friday was frisky for natural gas traders as strong reversal from the day’s low at $7.837 was found, hitting the day’s high at $8.189 before closing the week at $8.083.

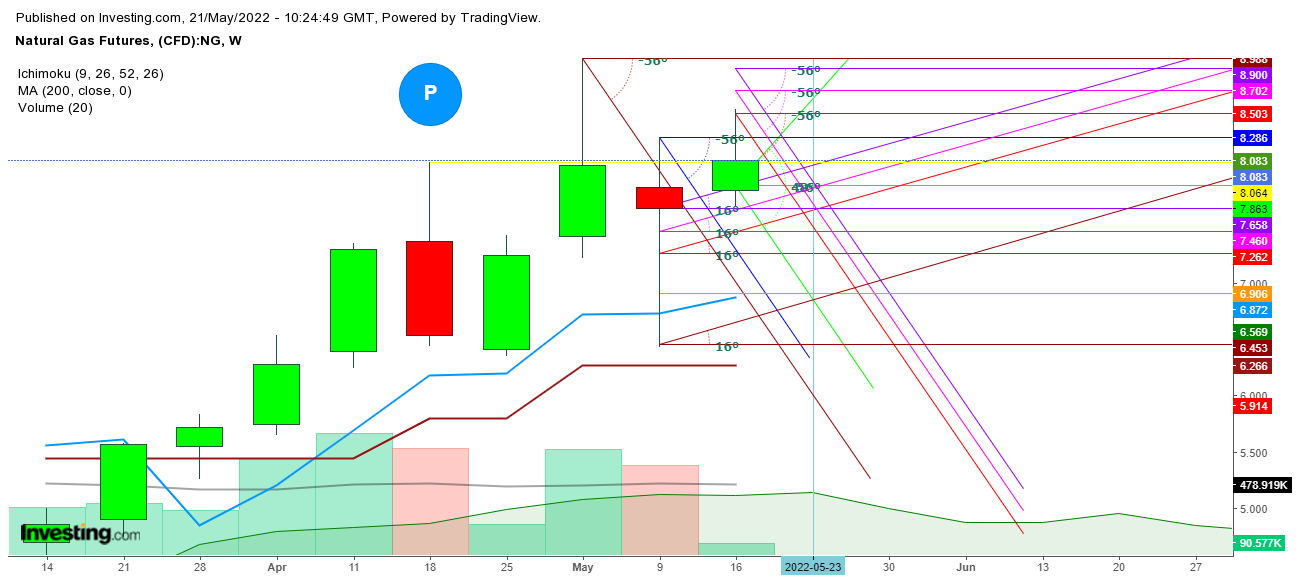

No doubt, NG maintained its price above the last week’s opening gap and finally closed the week above the next launching pad at $8.063.

Natural gas futures have been maintaining the steep uptrend after a breakout move above $4.751 on Mar. 21 as the storage phobia had started to deepen, and the seasonally generated demand for natural gas was overlooked, as together with the Russian energy embargo, remain.

AccuWeather forecasted high temperatures in Philadelphia, jumping from 79 Fahrenheit (26.1 Celsius) on Thursday to 87 on Friday and 95 on Saturday. The city's normal high at this time of year is 75.

NG could find itself in an extended trading range from $6.5 to $9.7 as the uncertainty could continue to attract bears and the bulls remain active during the weeks ahead.

Only a breakout or a breakdown of this trading range could turn the trend one-sided.

Technically, the weekly chart shows NG still maintaining inside the bullish territory which got confirmation with the weekly close above the launching pad at 8.063.

However, the formation of an exhaustive candle in the weekly chart could continue to increase selling sprees below $8.575. A breakout move by NG above $8.640 will be the confirmation of next attempt to hit a new peak during the upcoming weeks.

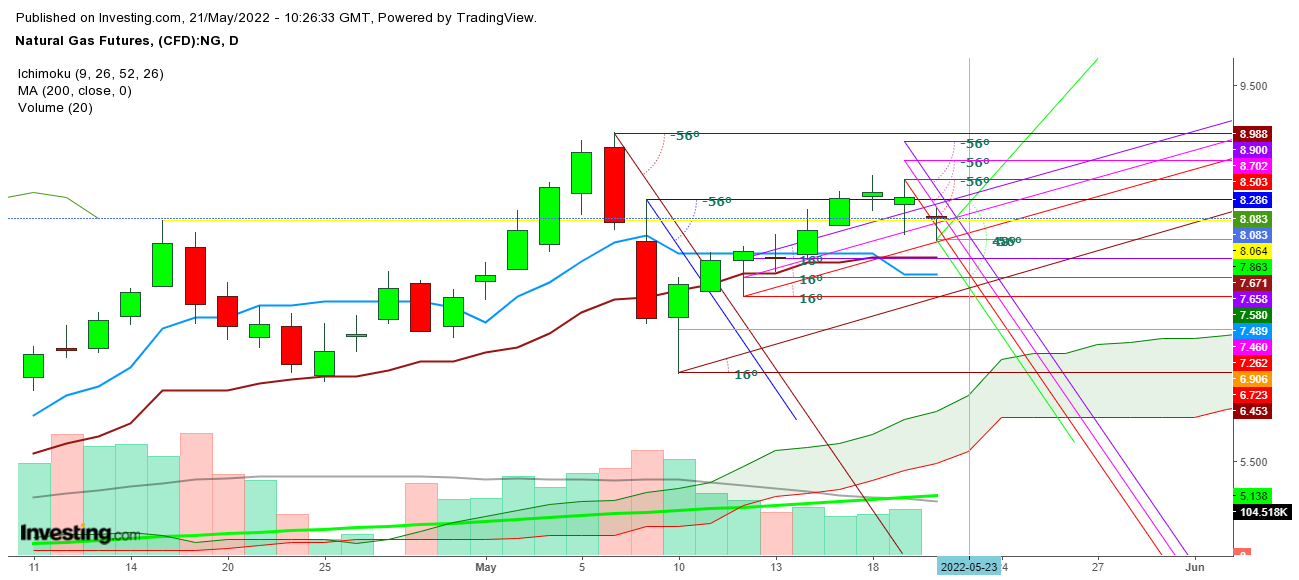

In the daily chart, we see a strong reversal last Friday that could be confirmed with a gap-up opening on the first trading session of the upcoming week.

No doubt that there could be a rollover gap on the first trading session, but a sustainable move by the futures above $8.460 will confirm the continuity of the current uptrend.

On the other hand, the formation of a bearish crossover in the daily chart could extend some bearish pressure during the upcoming week.

Undoubtedly, the currently prevailing geopolitical moves, along with these uneven weather patterns, could generate highly volatile moves in natural gas prices.

Disclaimer: The author of this analysis does not have any position in Natural Gas futures. Readers are advised to take any position at their own risk; as Natural Gas is one of the most liquid commodities of the world.