The natural gas futures are sustaining above the psychological support at $4 in today’s move as the demand will be strong through the weekend. A series of frigid blasts sweep across the Midwest, Plains, and East with snow showers and frosty lows of -20s to 20s, aided by lows of teens to 30s into Texas and the South, along with rain and snow showers.

The western US will be mild with highs of 40s to 70s, lows of 20s to 40s, and the colder Mountain West where highs will be in 10s to 40s with lows of -0s to 30s. Overall, the national demand will remain high through the weekend.

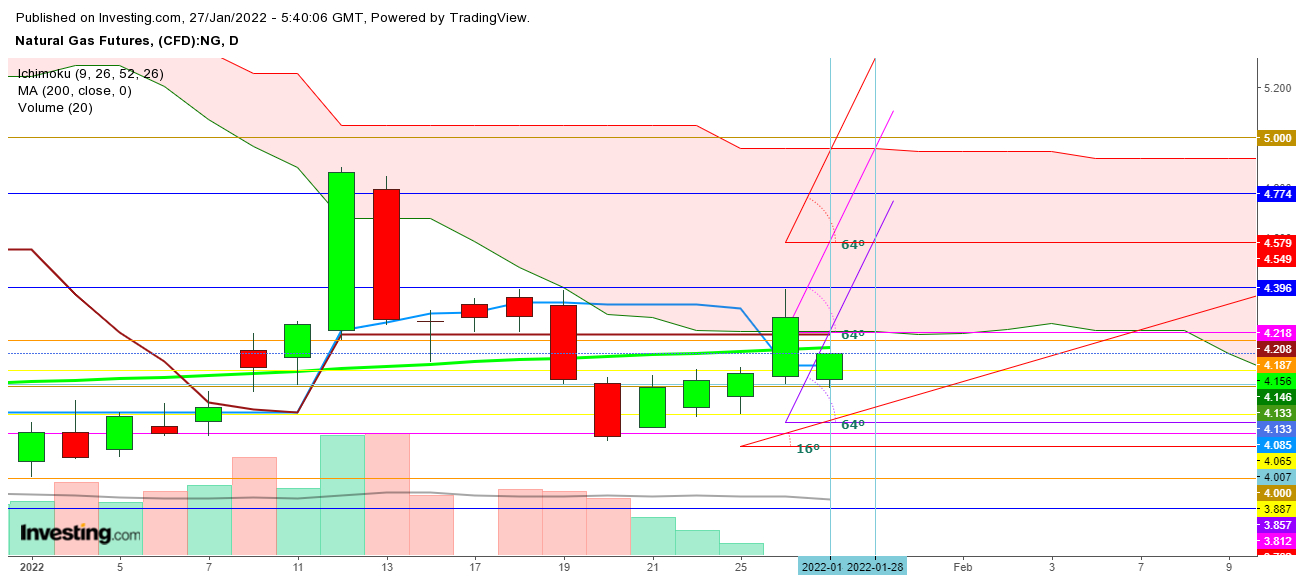

The natural gas futures have been maintaining a series of higher lows and higher highs since Jan. 20 from $3.782. On Wednesday, the natural gas bulls tried to sustain well above $4.197. On Thursday, the prices look ready for a bounce once again to sustain above the 200-days moving average, which is currently at $4.155 in a daily chart.

The weekly withdrawal levels could cross -200 Bcf this time, too could propel bullish sentiments till this weekly closing.

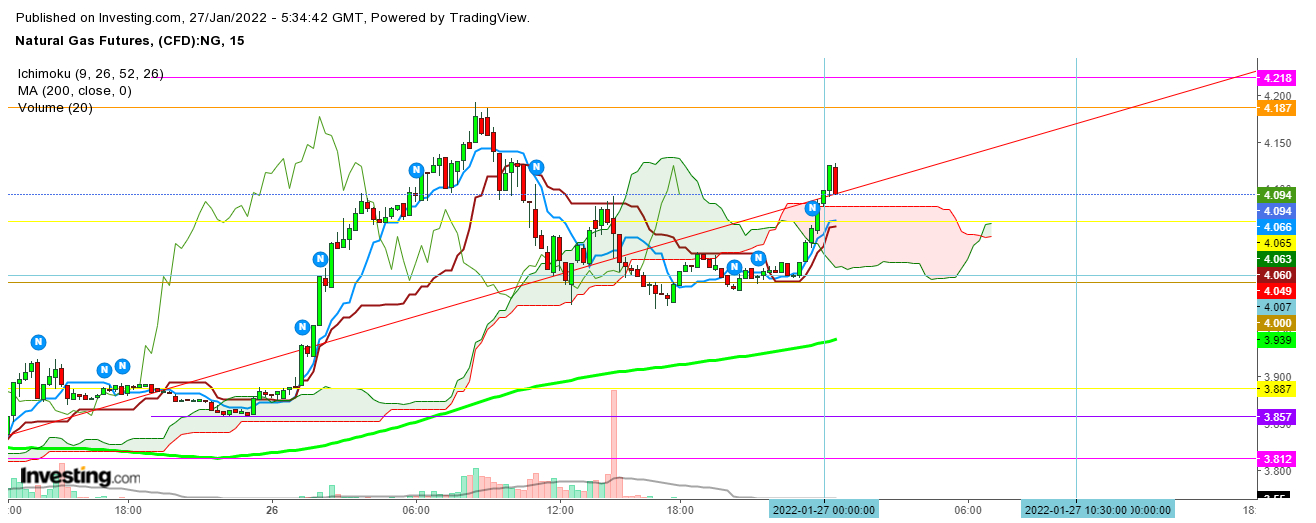

Currently, the natural gas futures are at $4.099, which confirms the strength of today’s opening. They could witness a volume-generated move in today’s trading session. The short-term trend will be decided at 07:00 A.M., but the volume-generated move could appear at 14:15 with the entry of strong bulls or the bears.

The prices could find first resistance at $4.218, second at $4.579, and third at $4.774 before closing this week. On the other hand, if they only sustain below 200 DMA for the next two hours, the first move could be downward. In that case, the natural gas futures could find first buying support at $3.887 and second at $3.857.

The volatility could remain higher on Thursday due to strong moves by the bears and the bulls, but Friday could find a one-side move amid growing expectations for the cold blast that might spark demand during the weekends. The weekly closing level will be decisive for the gap-up or gap-down on the first trading session of the upcoming week.

Disclaimer: The author of this analysis does not have any position in natural gas futures. Readers are advised to take any position at their own risk, as Natural Gas is one of the most liquid commodities in the world.