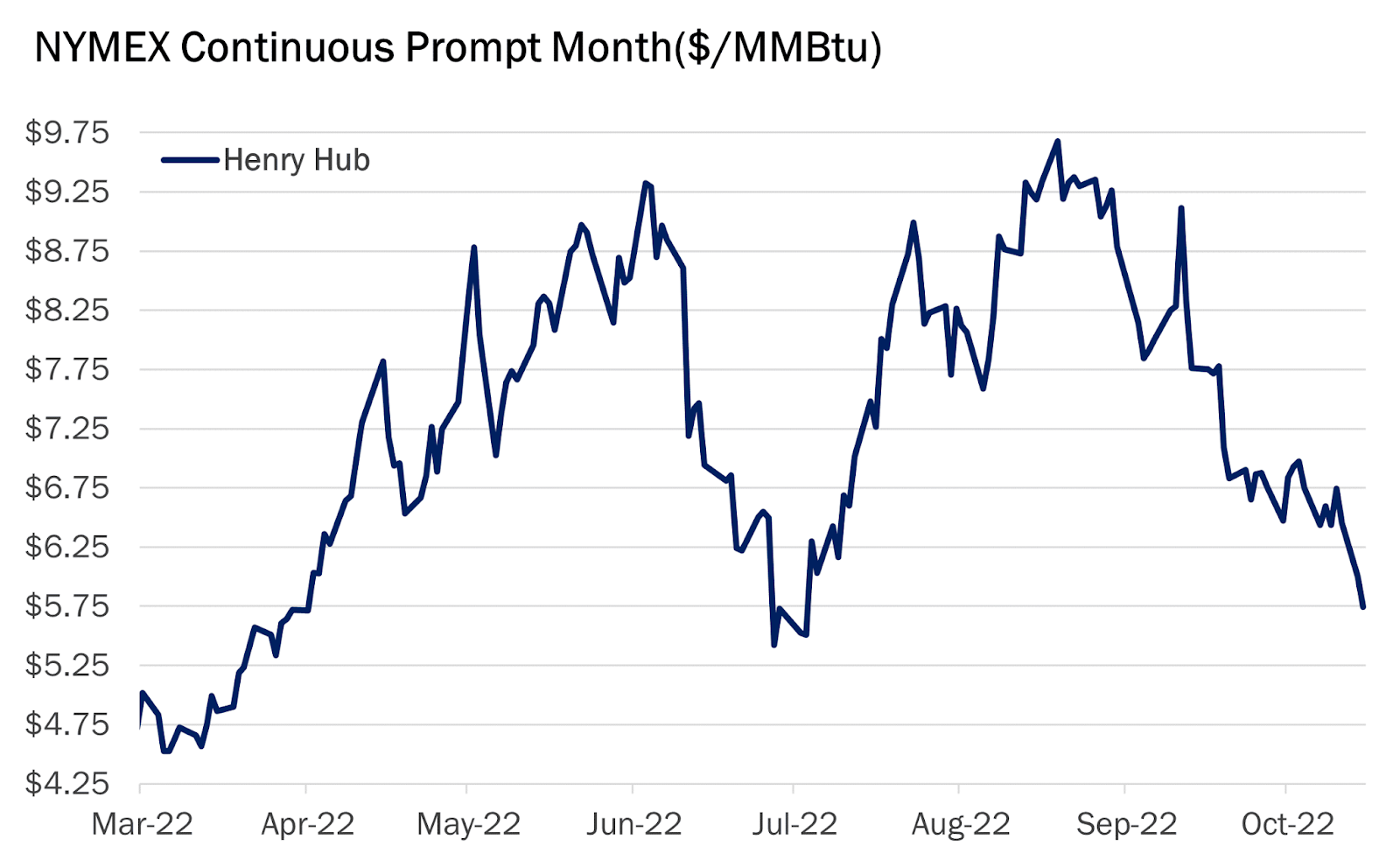

- Henry Hub’s front-month trades decisively below $6 vs. late August high of $10

- More pain for gas longs as heating demand lower than year-ago bearish levels

- US utilities likely added a larger-than-usual 105 bcf to storage last week

The bigger they are, the harder they fall—so the saying goes.

Some of the biggest hedge funds that held natural gas at unrealistic summer highs of $10 are likely nursing a ninth excruciating week of losses now as Henry Hub futures trade decisively below $6, amid looming warmth forecast in the US pre-winter cycle.

With heating demand even lower than the bearish levels this time last year, weather fundamentals as well as price charts point to more pain for those long the trade as gas bears run riot.

From a late August high of $10.03, Henry Hub’s front month on the New York Mercantile Exchange settled on Tuesday at $5.53—down about 45%.

Alan Lammey, analyst at Houston-based gas markets consultancy Gelber & Associates, said:

“In our view, the gas futures market still has room to fall, potentially down to $5.40, or perhaps even lower, as the outlook for the coming weeks and months ahead is downright bearish.”

Chart-wise, SKCharting.com’s chief technical strategist Sunil Kumar Dixit, doesn’t disagree, saying:

“A break below $5.80 can extend the correction further, towards $5.40 and $5.20.”

A flip would only come if the front-month can sustain above $5.80. “A short term rebound is expected to aim at $6.30 - $6.70 - $7.30 - $7.60,” Dixit said.

Leticia Gonzales, who blogs on naturalgasintel.com, notes that Henry Hub’s front-month was trading not far from year-ago levels, adding:

“Only at that time, prices were in the early stages of a sustained rally that eventually lifted futures to $10 in August. This time around, there’s not much in the near-term outlook for bulls to hang their hat on.”

“With the current chill expected to moderate beginning Friday, and production holding near recent highs despite fall season maintenance activities, traders [see] no reason for a recovery. If anything, the next round of government inventory data may send prices down another few notches if the injection comes in near expectations.”

And that “next round of government inventory data” will dawn upon the market in a few hours as traders brace for another weekly update of US gas storage from the Energy Information Administration.

US utilities likely added a larger-than-usual 105 billion cubic feet (bcf) of natural gas to storage last week as record output and an increase in wind power boosted the amount of fuel available, according to a Reuters poll on Wednesday.

The increase in wind power reduced the amount of gas power generators needed to burn to produce electricity.

The forecast gas injection for the week ending Oct. 14 compared with a build of 91 bcf during the same week a year ago and a five-year (2017-2021) average increase of 73 bcf.

In the week ended Oct. 7, utilities added 125 bcf of gas to storage.

If correct, the forecast for the week ended Oct. 14 would lift stockpiles to 3.336 trillion cubic feet (tcf), about 3.2% below the same week a year ago and 5.4% below the five-year average.

US temperatures were near normal last week, with around 66 total degree days (TDDs) last week, close to the 30-year normal of 69 TDDs for the period, according to Reuters-associated data provider Refinitiv.

TDDs, which are used to estimate demand to heat (Heating Degree Days (HDDs)) or cool (Cooling Degree Days (CDDs)) homes and businesses, measure the number of degrees a day's average temperature is below or above 65 Fahrenheit (18 Celsius).

As for production, Refinitiv said average gas output in the lower 48 US states rose to 99.6 bcf per day (bcf/d) so far in October, up from a monthly record of 99.4 bcf/d in September.

Reuters also reported that wind power produced about 11% of the nation's electricity last week, up from as little as 6% in recent weeks, according to federal energy data.

A study of current gas fundamentals versus a year ago by Investing.com shows that while the situation is different from the pre-winter conditions of 2021, there are also some similarities.

Storage-wise, at the end of the 2021 gas storage refill season, totals landed at 3,611 bcf as of Nov. 5, 2021, and topped out at 3,644 bcf as of Nov. 12.

Also, last winter, barring the anomalous spike in prices that occurred in February 2022, Henry Hub’s front-month traded as high as $6.466 and tumbled as low as $3.60 in December due to above-average temperatures during the first half of the winter.

Fast-forward to this coming 2022-23 winter: gas storage appears poised to total around 3,550 bcf to 3,600 bcf as of the first of November.

And if the temperature forecasts continue to show a warmish first half of November, gas storage totals may continue to grow and top 3.6 tcf.

However, there is one significant difference this year as compared to last year: Dry gas production hovering at around 100 bcf/d is at least 6 bcf/d higher year-over-year, which is a significant bearish catalyst.

Also, similar to last year, the forecasts for the 2022-23 winter coming from at least a dozen long-range weather models and several private and government forecast services are calling for a generally mild winter for the US as well as most of Europe.

Tuesday’s price weakness on the front-month took shape despite a cold snap currently happening across much of the eastern US region amid rising LNG feedgas demand.

Gelber & Associates analyst Lammey posits on this situation:

“Gas market players [are] instead fixated on an exceptionally mild last ten days of October and potentially equally as mild temperatures in the central and eastern areas of the nation during the first half of November.”

“In our view, the downside action in NYMEX gas futures is in line with our recent price forecasts that we have touted for the last several weeks. The price activity is entirely warranted and reflective of the current fundamentals. Once the calendar presses into December, and if the temperatures at that time remain warmish, it’s not out of the question that NYMEX gas futures could fall well below $5.00/MMBtu.”

Lammey said even with LNG export volumes poised to rise in the weeks ahead with the ‘possible’ return of the Freeport LNG terminal coming back into service in November, there may be some logistical issues with LNG cargo ships returning to the US from Europe that G&A is closely monitoring.

“This stems from European gas storage being nearly full and the potential for ‘floating LNG cargoes’ that will be hanging around waiting for cold weather in Europe to take place.”

Should the looming 2022-23 winter come in as mild as the models and forecast services are presently suggesting, then it could be a set-up for robust end-of-winter gas storage ‘carry-out’ totals in early April of 2023, which will set a bearish tone for NYMEX gas futures during the spring of next year, he added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of antsy market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold positions in the commodities and securities he writes about.