This article was written exclusively for Investing.com

The NASDAQ Composite has fallen sharply to start 2022, down nearly 13%. But don't expect the index to race back to record highs anytime soon. The index faces a battle on two fronts, higher rates, and falling earnings estimates.

That means the NASDAQ may struggle to find its footing over the next six months.

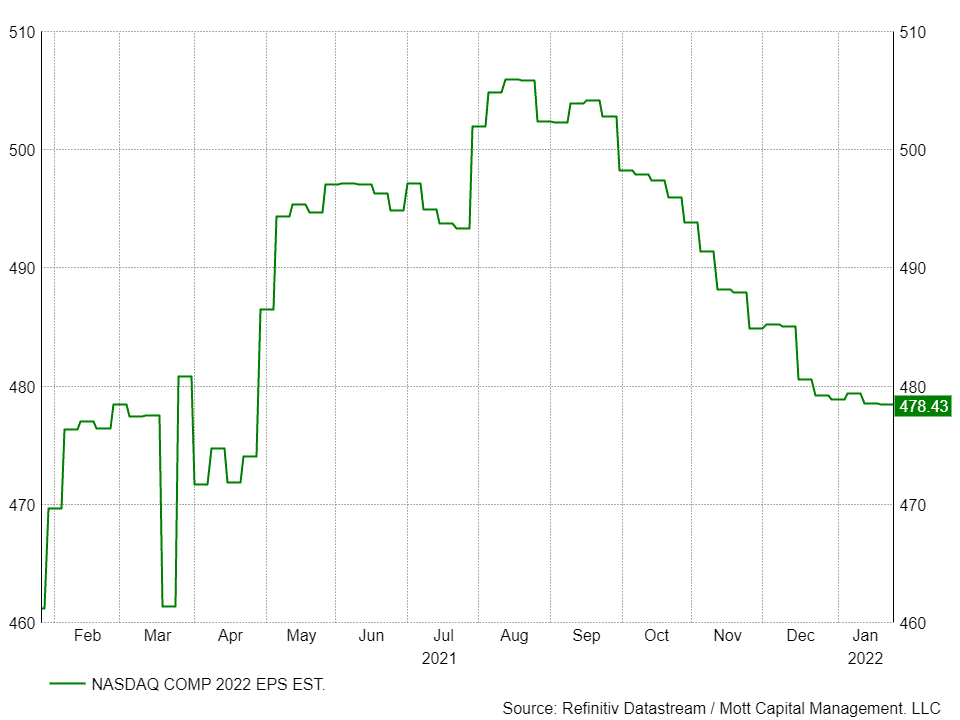

Earnings estimates for NASDAQ have dropped to $478.43 per share for 2022, down 5.5% from a peak of $505.83 on Aug. 25. The decline in earnings estimates is notable as rising real yields will lower the index's PE ratio. When combined, a lower PE and falling earnings estimates will limit the potential gains for the index.

A Lower PE Ratio

Even if the NASDAQ Composite saw its PE ratio return to a December high of 33.1, the value of the index would rise to only 15,835. That would be close to the intraday high of 16,212 from November but still nearly 2.5% lower. That means it will take even a higher PE ratio to surpass the previous highs for the NASDAQ.

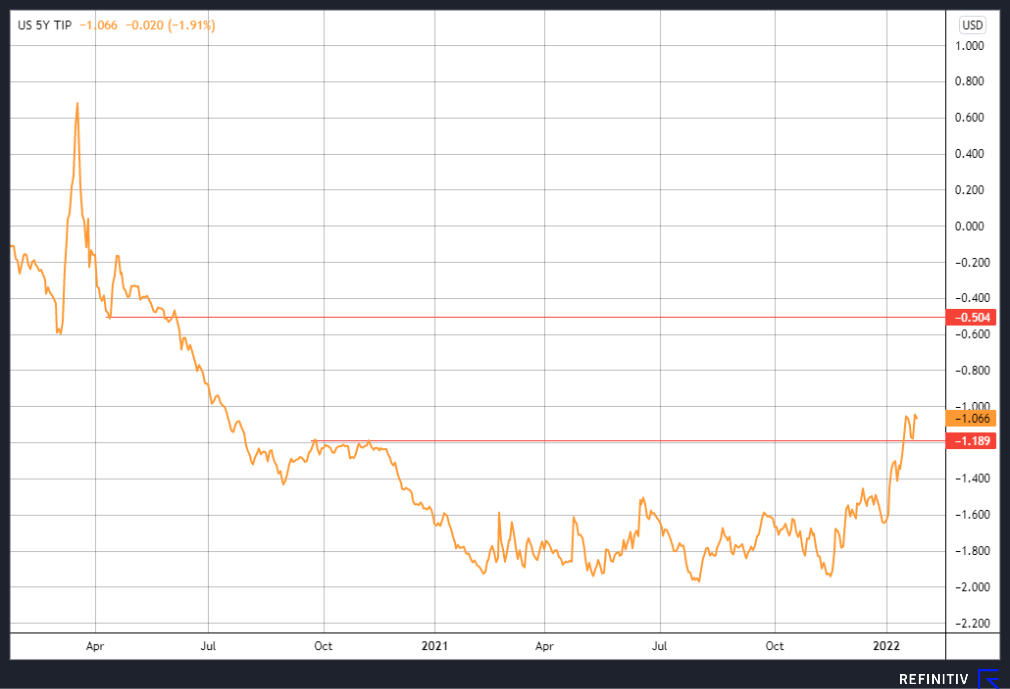

That may be tough to do, as real yields rise sharply, which will work to push the earnings yield of the NASDAQ higher and the PE ratio lower. The 5-Year TIP rate has risen sharply in 2022, jumping to roughly -1.05% from around -1.64% on Dec. 31.

Over the same time, the earnings yield for the NASDAQ Composite has risen to 3.49% from 3.06%, based on 2022 EPS estimates. Essentially, the more the real yield increases, the more likely it is that the earnings yields of the NASDAQ will rise as well.

The earnings yield is the inverse of the PE ratio, so as the earnings yield rises, the PE ratio falls. The problem is that the 5-year real yield is breaking out, and if the Fed continues to be as aggressive, as it seems, the break out may lead the 5-year TIP to rise to around -50 bps.

That would push the earnings yield of the NASDAQ even higher, potentially by another 60 bps to about 4%. That would equate to a PE ratio of 25. Given the 2022 earnings estimates of $478.43, it would value the NASDAQ Composite at 11,960, a drop of an additional 13%.

However, this all hinges on just how far real-yields rise. But expectations are for the Fed to begin to start hiking rates in March. Significant market drawdowns are likely to occur over the next six months as the stock market reprices for tighter monetary policy and higher rates.

Valuations Will Matter Again

But some stocks are likely to perform better during this process than others. Especially those stocks that have seen more substantial earnings growth and have more manageable valuations.

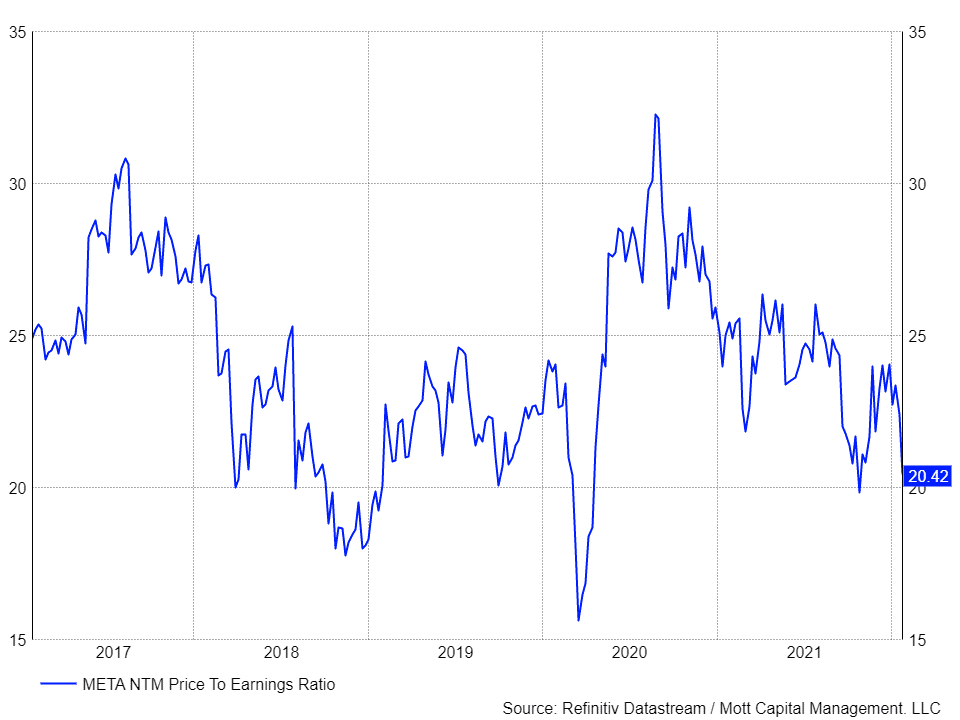

For example, a stock like Meta Platforms (NASDAQ:FB) has risen dramatically over the last 2-years, but it has also seen strong earnings growth. The stock trades at just 21 times its next twelve-month earnings estimates on a historical basis. While the stock could easily fall during a broader market drawdown, the lower valuation may offer a level where investors see value in Meta, supporting the shares.

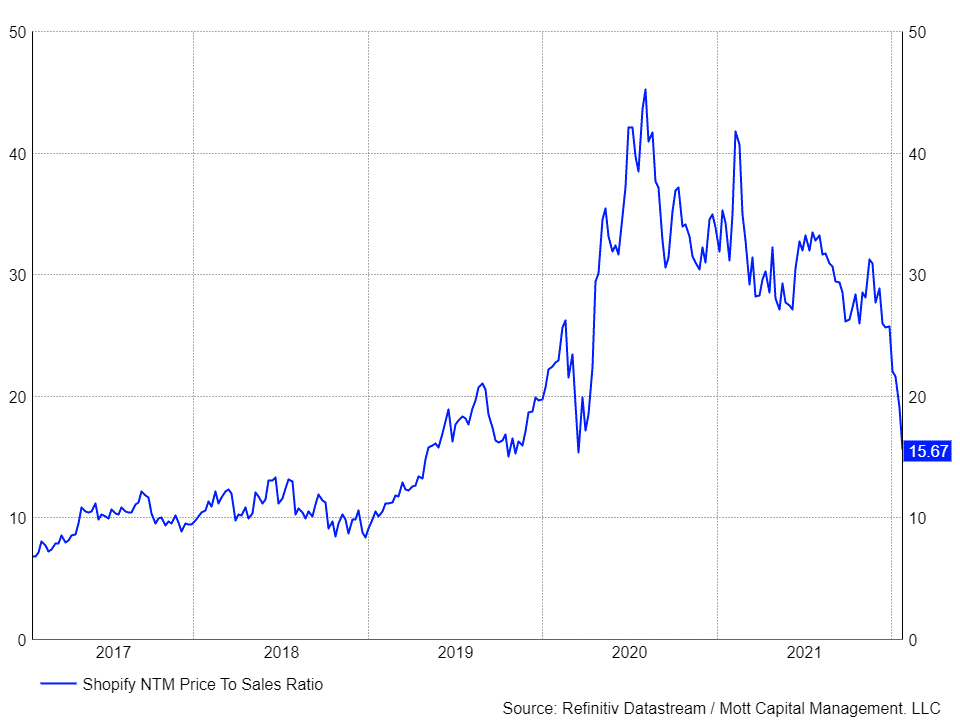

On the other hand, stocks like Shopify (NYSE:SHOP) may still have a more challenging time. The stock has already fallen sharply, but still, the shares trade at 15.6 times its next-twelve month's sales estimates, when historically it tends to trade between 9 and 12 times sales. Suggesting there could still be further downside for the stock during a broader market sell-off.

If interest rates rise from here, and the equity market's success has come on the heels of lower rates, it seems only natural for the market to reset and adjust for these changes. This means there is potential for earnings to be weaker so valuations will finally matter once again.