Market Commentary

There has been a significant slide in the USD following Friday’s rally which failed to sustain on Monday despite the strong NFP data. It was a roller coaster ride for EUR/USD losing over 1% on Friday and then recovering all the losses, creeping steadily even towards late New York trading hours and finally gaining 1.6% on Monday. The gain was partly due to rise in German yields and better than expected industrial output figures, coupled with the unexpected shift in dollar sentiment as dollar traded heavy this week. It seems that the good payroll figure is not enough to convince market participants that it is a true reflection of the strength of the US economy.

The momentum is carried over this morning with EUR/USD above the 1.1300 pivot which seems to suggest that the euro bears are exhausted. To the downside, 1.1280 and 1.1185 are the support levels respectively which could provide good levels for entry. The resistance level could be seen at 1.1375 before moving towards 1.1450 which is critical level with increased volatility expectations on a break above.

USD/JPY trades through the pre NFP level of 124.80 (low of 124.29), and this area should be an initial resistance level. Market still bullish ahead of US retail sales figures. After 124.29, next support is at 124.00 and 123.50 which is pivotal for the near term bullish bias.

Trading interest in GBP remains relatively light, and it continues to be swayed in sympathy with the EUR and USD. Today we get April trade balance as well as industrial/manufacturing output figures, which should help set the mood ahead of a pivotal Thursday, which houses both Carney’s Mansion House dinner (cue the flashbacks from last year) and US retail sales later on that day. Last week’s high of 1.5440 should be the key level to watch ahead of these events, while downside support could now be expected towards 1.5300 initially

Technical Commentary

EUR/USD Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks) Bearish

While 1.11 contains downside reactions expect retest of 1.1466 and 1.15 above, below 1.1050 on a closing basis concerns near term bullish bias opening a retest of last weeks lows at 1.08

Daily Order Flow Neutral ; OBV sideways to down, Linear Regression bearish, Psychology pierces midpoint from below

Monitoring intraday price and Order Flow indicators on a test of 1.15 or 1.1050

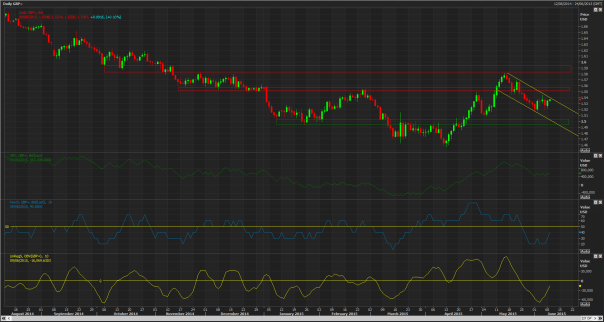

GBP/USD: Short Term (1-3 Days): Neutral – Medium Term (1-3 Weeks) Bearish

While 1.5450 caps upside potential to test 1.5050 support before a more sustained corrective phase, a break of the descending trendline resistance target 1.5550 ahead of May highs.

Daily Order Flow bearish; OBV sideways to up , Linear Regression and Psychology bearish but attempting midpoint test from below

Monitoring intraday price action and Order Flow indicators on a test of 1.5050 or 1.5450

USD/JPY: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks) Bullish

Eroding primary trendline support, while 124 contains pullback bulls target a retest of highs and 126.20 beyond. Below 123.50 opens pivotal 122

Daily Order Flow bullish ; OBV sideways to down, Linear Regression and Psychology rolling over to test midpoints from above

Monitoring intraday price action and Order Flow indicators on a test of 128 or 123.50

EUR/JPY: Short Term (1-3 Days): Bullish – Medium Term (1-3 Weeks) Bearish

Retesting last weeks highs en route to a symmetry target of 141.75 while this area caps the advance look for a retest of 137

Daily Order Flow bullish; OBV sideways to down, Linear Regression and Psychology bearish

Monitoring intraday price action and Order Flow indicators at 141.75 or 137