So, I suppose the good news is that policymakers have stopped pretending that prices will go back down to the pre-pandemic levels. My friend Andy Fately (@fx_poet) in his daily note today called to my attention these dark remarks from Bank of England Chief “Economist” Huw Pill:

“If the cost of what you’re buying has gone up compared to what you’re selling, you’re going to be worse off…So somehow in the UK, someone needs to accept that they’re worse off and stop trying to maintain their real spending power by bidding up prices, whether higher wages or passing the energy costs through on to customers…And what we’re facing now is that reluctance to accept that, yes, we’re all worse off, and we all have to take our share.”

I think it’s worth stopping to re-read those words again. There are two implications that immediately leap out to me.

The first is that this is scary-full-Socialist. “We all have to take our share” is so anti-capitalist, anti-freedom, anti-individualist that it reeks of something that came from the pages of Atlas) Shrugged. No, thank you, I don’t care to take my share of your screw-up. I would like to defend my money, and my real spending power, and my real lifestyle. If that comes at the cost of your lifestyle, Mr. Pill, then I’m sorry.

But the second point is that…it doesn’t come at the cost of someone else’s lifestyle. This is why I put “economist” in quotation marks above. There is still a lot of confusion out there between the price level and inflation, and what a change in the price level means, but if you’re an economist there shouldn’t be.

You see statements like these everywhere:

- " Food prices are up 18%. If people are spending 18% more on food, it means they’re spending less elsewhere.”

- “Rents are up 17%. If people are spending 17% more on rent, it means they’re spending less elsewhere.”

- “Pet food is up 21%. If people are spending 21% more on pet food, it means they’re spending less elsewhere.”

- “New vehicle prices are up 22%. If people are spending 22% more on new vehicles, it means they’re spending less elsewhere.”

- “Price of appliances are up 19%. If people are spending 19% more on new appliances, it means they’re spending less elsewhere.”

You get my point. All of those, incidentally, are actual aggregate price changes since the end of 2019.

This is where an actual economist should step in and say “if the amount of money in circulation is up 37%, why does spending 18% more on good or service A mean that we have to spend less on good or service B?” In fact, this is only true if the growth in the aggregate amount of money is distributed highly unevenly. In ‘normal’ times, that might be a defensible assumption but during the pandemic money was distributed remarkably evenly.

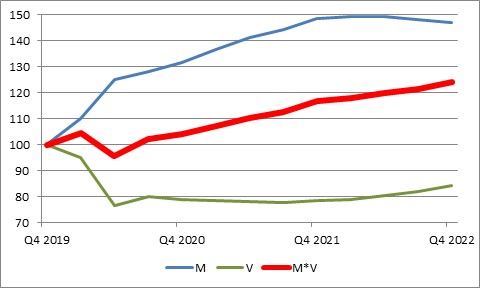

Okay…the amount of money in circulation is a ‘stock’ number and the prices of stuff changing over time is a ‘flow’ number, which is why money velocity also matters. M*V is up about 24% since the end of 2019. So a 20% rise in prices shouldn’t be surprising, and since there’s lots more money out there a 20% rise in the price of one good does not imply you need to spend less on another good. That’s only true in a non-inflationary environment. The world has changed. You need to learn to think in real terms, especially if you are a “Chief Economist.”

(N.b. to be sure, this is somewhat definitional since we define V as PQ/M, but the overarching point is that with 40% more money in the system, it should be not the slightest bit surprising to see prices up 20%. And, if velocity really does act like a spring storing potential energy, then we should eventually expect to see prices up more like 30-40%.)

Here’s a little bonus thought.

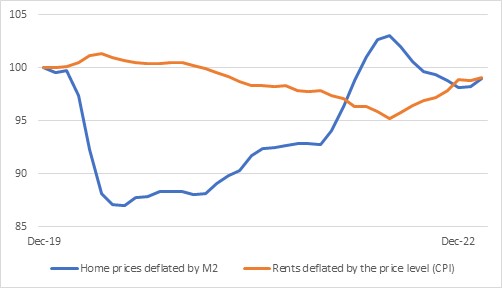

Rents are +17%, which is roughly in line with a general rise in the prices of goods and services. Home prices are up about 36% (using Shiller 20-City Home Price Index), which is roughly in line with the raw increase in M2.

Proposition: since the price of unproductive real assets is essentially an exchange rate of dollars:asset – which means that an increase in a real asset’s price is the inverse of the dollar’s decrease – then the price of a real asset should reflect the stock of money since price is dictated by the relative scarcity of the quantity of dollars versus the real asset. But the price of a consumer good or service should reflect the flow of money, so something more like the MV/Q concept.

Implication:

Discuss.