Just days ago, billionaire investor and corporate activist Carl Icahn called the stock market “extremely overheated,” especially as it relates to high yield bonds. He communicated these comments over Twitter (NYSE:TWTR) after saying markets are “sailing in dangerous unchartered waters.” Given recent Greek developments regarding its inability to strike a debt repayment deal with eurozone leaders, Mr. Icahn might get exactly the volatility he expected when he made those comments. There’s no question a Greek default could definitely cause a short-term contagion effect, but there will be much larger fish to fry than domestic equity markets (I will have much more to say on the Greek topic in my monthly newsletter).

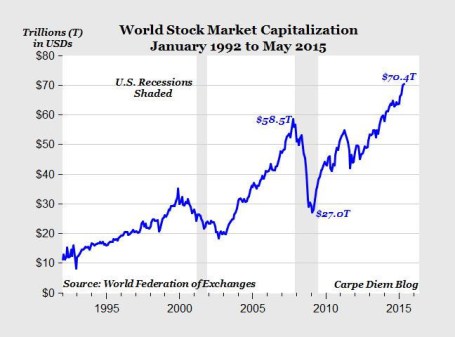

While it’s difficult to argue with Carl Icahn’s long-term investment track record, currently there is little objective data (unemployment, yield curve, corporate profits, GDP, etc.) signaling an imminent recession or economic collapse. Whether you are an optimist or pessimist, there is no doubt we have come a long ways since the lows of 2009.

Source: Mark Perry (Carpe Diem)

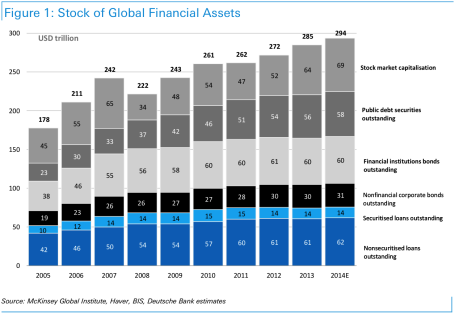

The rapid price appreciation has been undeniable, but Mr. Icahn and other equity bears may be missing the forest for the trees. There has been a disproportional increase in the value of bond assets versus equity assets. More specifically, as can be seen from the chart below, the value of global financial assets increased an estimated +21.5% to $294 trillion from 2007 to 2014. Of the $52 trillion increase in global financial assets, 92% of the increase ($48 trillion) was derived from expanding debt obligations – not stocks. I’ve said it many times before, but if you are worried about the pricking of an equity bubble, make sure to buy some heavy-duty industrial ear plugs for eventual pricking of the bond bubble.

Source: Business Insider / McKinsey

Former Treasury Secretary and Harvard President Larry Summers recently commented in an interview that a potential “Grexit” could have unforeseen consequences just like the situations leading to the collapse of Lehman Brothers, Long Term Capital Management, and the subprime market. At the time, those particular circumstances were underestimated and characterized as being “contained”. Today, we are hearing the opposite regarding Greece.

In a post financial crisis world, every financial molehill is made into a crisis mountain as it spreads through social media and appears on every TV show, blog, newspaper, and magazine article. In a post financial crisis world characterized with ultra-low central bank interest rate policies, a combination of excessive conservatism from individual investors and opportunistic corporate actions (e.g., share buybacks and M&A), has led to a lopsided increase in debt issuance. Case in point is the bloated debt balances held by the Greek government. There will inevitably be pain associated with a Greek default and potential exit from the euro, but due to its size (<2% of European GDP), Greece should be treated more like a pimple than a body rash.

If you want to reach your financial goals, you need to prudently manage your risk through a broad asset allocation and realize that experiencing turbulence is part of the investing game. The impending Greece default will not be the first financial crisis, nor the last one. Extreme growth in debt should be more of a concern than a tiny, financially irresponsible country missing a debt payment. But rather than panicking, it is wiser to maintain a long-term investment strategy coupled with a globally diversified portfolio across asset classes, which will allow you to not miss the forest for the trees.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs) , but at the time of publishing, SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision.