Chemical maker Methanex Corporation (NASDAQ:MEOH) recorded net profit (attributable to Methanex shareholders) of $32 million or 38 cents per share in the third quarter of 2017 against a loss of $11 million or 12 cents logged a year ago and a profit of $84 million or 89 cents in the second quarter of 2017.

Earnings declined on a sequential basis mainly due to a decrease in average realized methanol price during the quarter.

Adjusted (barring one-time items) earnings per share for the reported quarter was 60 cents per share, beating the Zacks Consensus Estimate of 55 cents.

Adjusted EBITDA in the quarter was $143 million compared with $74 million in the prior-year quarter.

Production for the third quarter was 1,765,000 tons compared with 1,749,000 tons in the year-ago period.

Revenues rose roughly 41.2% year over year to $720 million in the reported quarter.

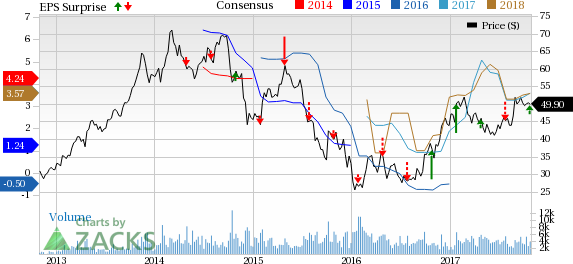

Methanex Corporation Price, Consensus and EPS Surprise

Financials

Cash flows from operating activities in the third quarter were $131 million compared with $74 million for the prior-year quarter. Cash and cash equivalents were $307.5 million at the end of the third quarter of 2017, up 31.6% year over year. Long-term debt was around $1.45 billion, down roughly 3.6% year over year.

Outlook

Methanex noted that its outlook for the fourth quarter is positive. The company expects global methanol prices to improve in the fourth quarter supported by healthy demand. Methanex anticipates production, sales of produced products and EBITDA to be higher in the fourth quarter compared with the third.

Price Performance

Methanex’s shares have moved up 37.3% over a year outperforming the industry’s gain of 34.9%.

Zacks Rank & Other Stocks to Consider

Methanex currently carries a Zacks Rank #2 (Buy).

Some other top-ranked companies in the chemical space are FMC Corporation (NYSE:FMC) , Cabot Corporation (NYSE:CBT) and Air Products and Chemicals Inc. (NYSE:APD) .

Cabot Corporation has expected long-term earnings growth of 10.7% and sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

FMC Corporation has expected long-term earnings growth of 11.3% and flaunts a Zacks Rank #1.

Air Products has expected long-term earnings growth of 12.1% and carries a Zacks Rank #2.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Methanex Corporation (MEOH): Free Stock Analysis Report

FMC Corporation (FMC): Free Stock Analysis Report

Cabot Corporation (CBT): Free Stock Analysis Report

Original post

Zacks Investment Research