European equity markets bounced from their lowest levels in 2 months, following the positive close in the US after Alcoa beat expectations for its quarterly earnings report. Treasury bonds in both Spain and Italy were seen higher on the session and the euro posted gains against most of the major currencies. Both the Euro Stoxx 600 and the S&P 500 were higher by nearly 1 percent which is the first positive performance in 6 trading sessions.

European Central Bank (ECB) members were making headlines, after giving comments that the ECB still has the ability to restart its purchases of government in troubled regions, and this was viewed as an official response to the increase in Spanish Treasury Bonds, which are now trading at yields of nearly 6 percent. The main macro event today will be the release of the US Federal Reserve’s Beige Book, which will come later in the session.

In commodities, Aluminum rose (along with the Alcoa earnings) to trade above $2,080 per metric ton while Brent Crude Oil remains above the $120 per barrel level, breaking two days of losses. The three month copper contract was up 0.6 percent but gold failed to match the trend and dropped 0.3 percent, which was the first negative session this week.

Trading in the coming sessions is likely to involve some reductions in volatility as there is little in the way of macro data to provide a clear direction. Central bank commentary has been getting more of a reaction than normal lately, so remain watchful of any comments made by ECB officials. Today’s Beige Book release could also get more attention than usual because of this, as it will give the Federal Reserve’s assessment of various economic regions in the US.

Consolidative and sideways trading conditions are likely to remain the main theme through the middle of the week, with most trading positions based on technical analysis rather than driven by news events. NZD/JPY" title="NZD/JPY" width="764" height="421">

NZD/JPY" title="NZD/JPY" width="764" height="421">

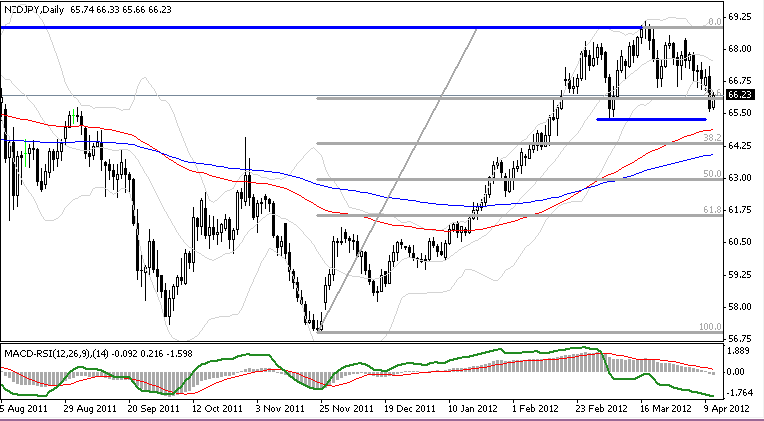

The NZD/JPY is following most of the yen pairs lower, after forming a recent top at 69.05. We are seeing something of a head and shoulders pattern on the shorter term charts, with the neckline now seen at 65.20. Despite the bearish pattern, however, prices are likely to have some difficulty falling much lower as there is Fibonacci and moving average support clustered near 64.30. Buy positions can be established in this area, targeting a move back to the previous month’s highs.

The DAX continues to post declines after reversing at major resistance, now seen at 7215. Looking at the daily charts, we can see that prices are currently dealing with significant historical support in the 6610 region, with prices seeing a bounce here of roughly 100 points. A daily close below support will target the 38.2% Fibonacci retracement level of the move from below 5000 and this is also where the 100 and 200-day EMAs reside, so prices are unlikely to fall through this area on first test. Wait for a test of Fibonacci support before entering into new long positions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Markets See Modest Lift On Positive Alcoa Earnings: April 11, 2012

Published 04/11/2012, 09:53 AM

Updated 07/09/2023, 06:31 AM

Markets See Modest Lift On Positive Alcoa Earnings: April 11, 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.