Actionable ideas for the busy trader delivered daily right up front

- Thursday higher if ES breaks above pivot, else lower.

- ES pivot 1582.92. Breaking above is bullish.

- Friday bias uncertain technically.

- Monthly outlook: bias lower.

- ES Fantasy Trader standing aside.

Once again, the ES pivot held the key to the market. It fell through just before the open ad never looked back. The result was a 139 point tumble for the Dow and a equally bad 15 down for the SPX on Wednesday. Tonight we face a tricky situation and I'm not sure the charts will be of much use for Thursday, but let's do a quick run-down anyway.

The technicals (daily)

The Dow: The technicals worked great for the Dow on Wednesday. A bearish hanging man and RTC exit both on Tuesday plus a highly overbought RSI, and bada bing, down we went, right back into last week's consolidation area. RSI has now clearly peaked and the stochastic has executed its bearish crossover. With a chart like this, more downside seems to be coming.

The VIX: Interestingly though, while the market was off nearly a whole percent, the reaction of the VIX was fairly muted, as it gained only 7.17% on Wednesday. I'd normally expect a bigger move than that. In any event, this move was enough to break the VIX out of its week-long trading range, form a bottom in the indicators at oversold, and form a bullish stochastic crossover. SO this chart looks ready to move higher again on Thursday.

Market index futures:Tonight all three futures are higher, by non-trivial amounts for a change, at 1:20 AM EDT with ES up by 0.24%. The big drop in ES on Wednesday took it decisively out of its rising RTC for a bearish setup. I'd say odds are good that this trend (from April 18th) is over. We also have indicators now descending from overbought and a newly completed bearish stochastic crossover. So on a daily basis, this chart would appear to have more room to run lower on Thursday.

ES daily pivot: Tonight the pivot drops from 1589.25 to 1582.92. Unfortunately, even with ES drifting higher in the overnight, this drop in the pivot was not enough to bring us above it, so this remains a bearish sign.

Dollar index: On Wednesday the dollar took another big gap down, losing 0.35% on an inverted hammer that stopped right at the 200 day MA. The last two times this happened (both last year), it provided support once, and the dollar fell right through the other time. But this time we're more oversold than then so I wouldn't be surprised to see the dollar bounce off the 200 MA on Thursday. I note too that the dollar exited its descending RTC on the left side, an unusual move that often signals a bottom.

Euro: I really thought the euro was looking lower for Wednesday. Instead, it continued on up to actually close above its upper BB at 1.3200. That helped drive RSI more overbought. But a sell off that began mid-afternoon Wednesday is continuing in the overnight, now down 0.31%. A combination of upper BB hit, overbought indicators, a stochastic about to form a bearish crossover, OBV turning lower, and a break under its pivot all make me think the euro is headed lower on Thursday. This would sync with my call for a higher dollar.

Transportation: I needn't have hesitated in calling the trans lower last night as they more than doubled the Dow's losses, falling 2.32% on Wednesday. This provided a bearish RTC setup, a bearish stochastic crossover, ad drove RSI halfway back to oversold from Tuesday's reading of 100. With this chart cycling again, it looks like it could move lower again on Thursday.

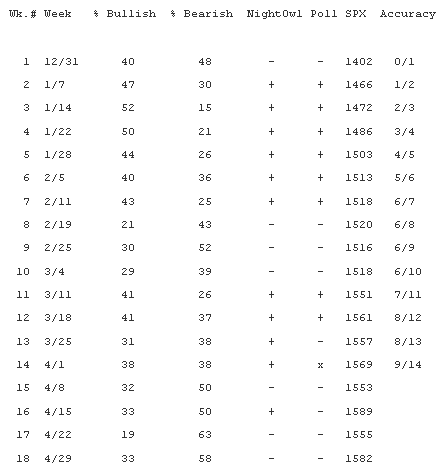

Sentiment: Once again it's time (actually it was time two nights ago) for the latest weekly TickerSense Blogger Sentiment Poll. We continue to track the poll to see how well it performs.

Again, the SPX number is the closing price of the S&P on the Friday before each new poll comes out. The "NightOwl" column is how I voted. The "Poll" column is how the majority of participants voted. Since the poll is for 30 days out, after the first four weeks we're able to see how well we did. This week we see that I voted bullish four weeks ago, so that was correct. However, the poll as a whole was exactly tied, so there's no winner there. We therefore continue the year with an accuracy of 9 for 14, or 64%. The poll as a whole remains at 8 for 13 or 62%.

This week we see a small retreat in bearish sentiment from last week's two year record highs, and a larger bump in bullish sentiment as more people come off the sidelines. But the majority remains bearish, and I'm with them, based on my reading of the weekly and monthly SPX charts.

Everything's still looking pretty bearish tonight, with the one exception of the futures. I've learned to be very cautious when the futures start moving contrary to the general technical direction in the overnight. It usually means something's up. And what's up in this case, I believe, is the expectation of ECB rate cuts, plus who knows what else Super Mario might say Thursday morning. With this wild card on the table, it would be imprudent of me to make a flat-out call lower (which is what I would otherwise do), so we're going conditional again: if ES breaks above its pivot by mid-morning Thursday, we'll close higher, else lower.

ES Fantasy Trade

Portfolio stats: the account now rises to $107,750 after 11 trades (9 for 11 total, 4 for 4 longs, 5 for 7 short) starting from $100,000 on 1/1/13. Tonight we stand aside again in view of the conditional call.