Indices enjoyed excellent gains last week, but the rate of market ascent is not one which can be maintained in the long run. How markets consolidate over the coming week will say much about the strength of these—very positive—breakouts.

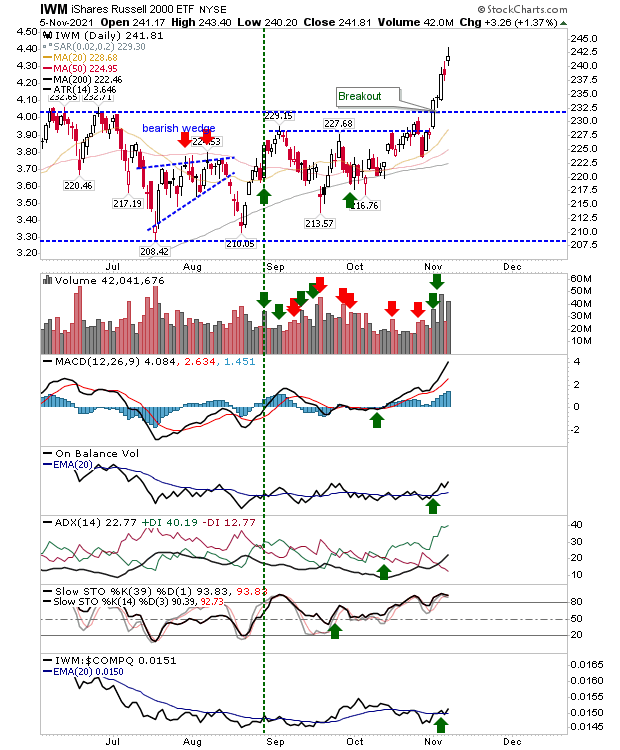

The Russell 2000 (via IWM) finished with a neutral candlestick but the buying of last week came with three heavier days of accumulation. There was a relative performance uptick versus the NASDAQ to go with these gains.

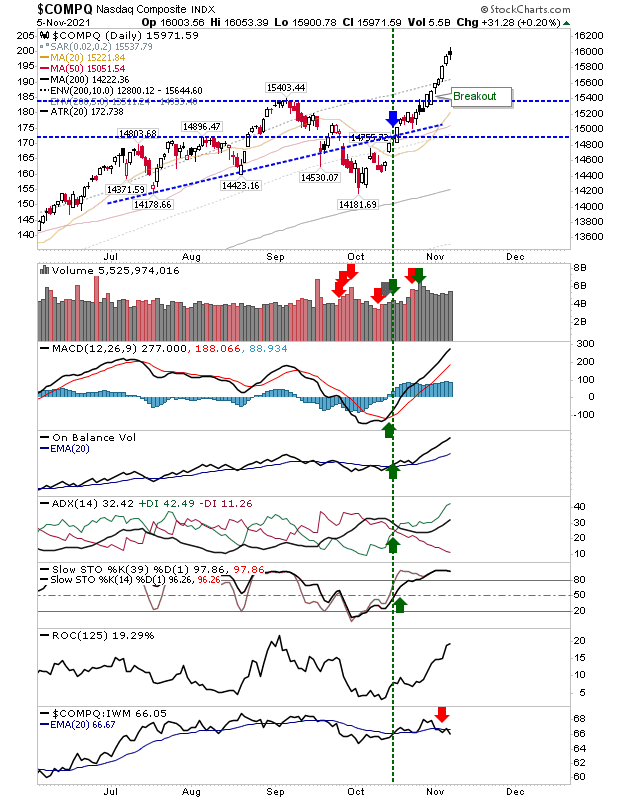

The NASDAQ didn't suffer a single down day last week, instead it has registered eight consecutive up days in a row, with Friday ranking as an accumulation day. Friday's black candlestick at the end of an advance is typically bearish so we will see what Monday brings. If there is a pointer to that it's that relative performance has taken a tick lower.

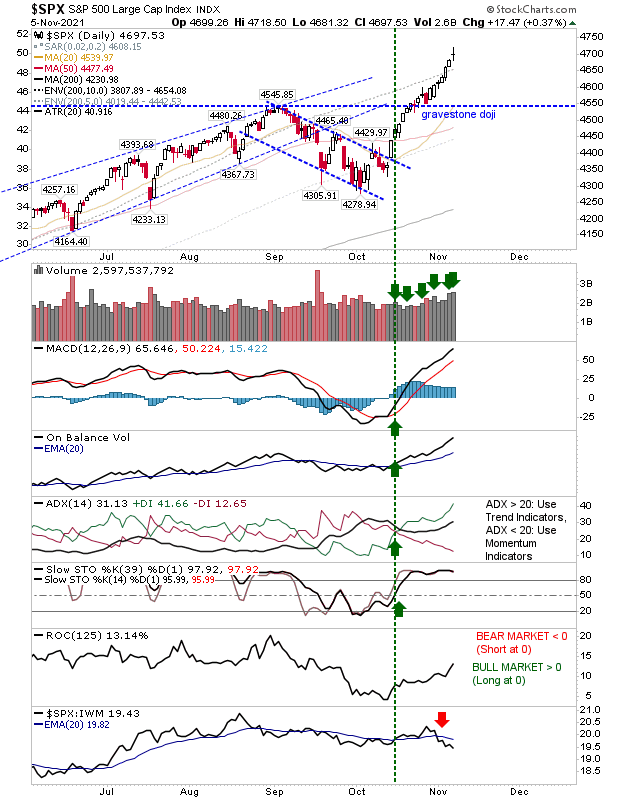

The S&P closed with a neutral doji on higher volume accumulation. Technicals are all bullish, but as with the other indices it has barely paused its advance since it cleared its downward channel. As with the NASDAQ, the index has underperformed relative to the Russell 2000.

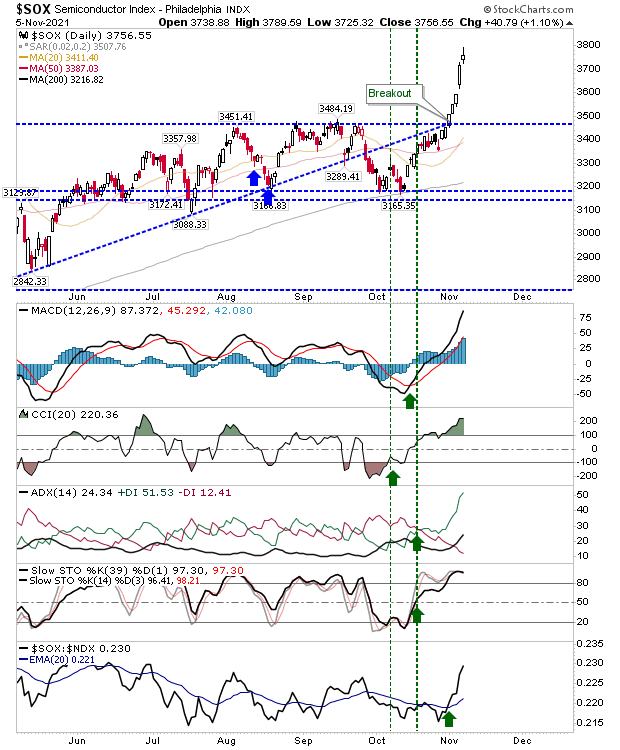

Strength in tech indices has been driven by gains in the Semiconductor Index. The relative performance of the sector to Tech indices has seen marked improvement in recent days, although it hasn't quite established itself as a bullish trend. Those lucky enough to have bought the tag of the 200-day MA back in October will be sitting pretty.

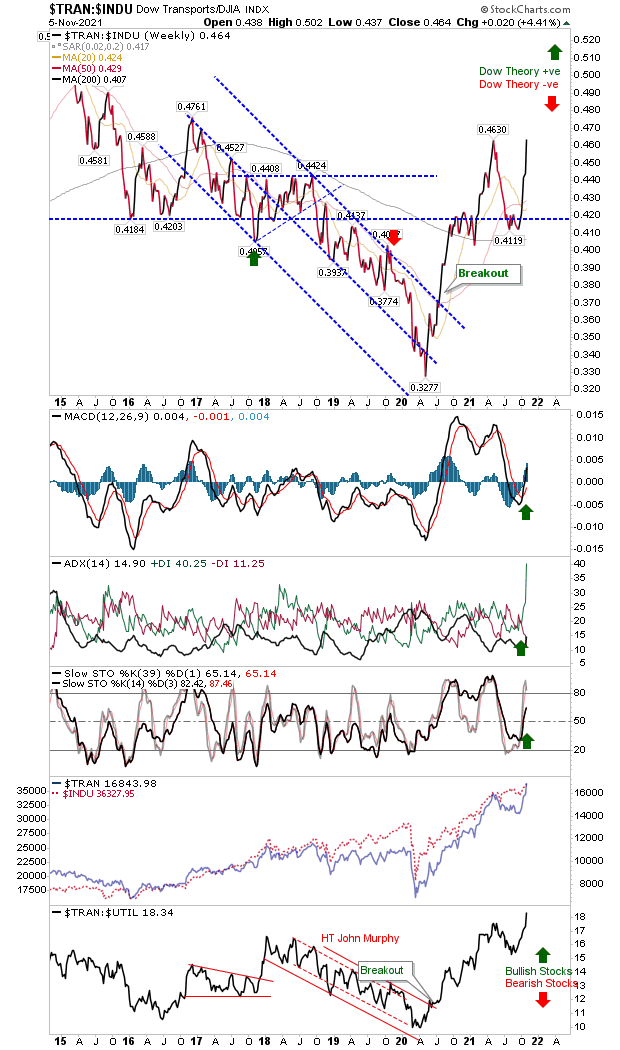

Another sector performing well is the Transport industry. The sector has enjoyed a second wind in the latter half of 2021, outperforming the parent Dow Index. This is bullish on the Dow Theory scale after years of underperformance; another tick in the market bullish column.

Last week was good, this coming week will be about consolidating these gains.