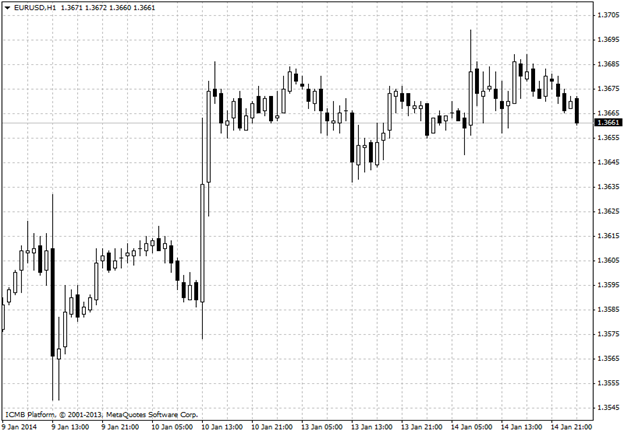

EUR/USD

The euro was little changed against the dollar on Tuesday after data showed that U.S. retail sales rose more strongly than expected in December, bolstering expectations that the economic recovery will continue to strengthen. The Commerce Department said U.S. retail sales rose 0.2% last month, beating expectations for a 0.1% increase. Core retail sales, which exclude automobile sales, climbed 0.7% in December, above forecasts for a 0.4% increase. The euro rose to session highs against the dollar earlier after European Central Bank Governing Council member Ewald Nowotny said the euro zone economy might surprise to the upside this year. The ECB revised its growth forecast for 2014 slightly higher in December, saying it expected growth of 1.1 meanwhile, data released on Tuesday showed that industrial production in the euro zone rose more-than-expected in November, easing concerns over the outlook for growth. Eurostat said industrial production rose 1.8% in November, beating expectations for a 1.4% gain, recovering from a downwardly revised decline of 0.8% in October. On a year-over-year basis, industrial production rose 3%, more than double expectations for a 1.4% increase. EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="433">

EUR/USD Hour Chart" title="EUR/USD Hour Chart" width="624" height="433">

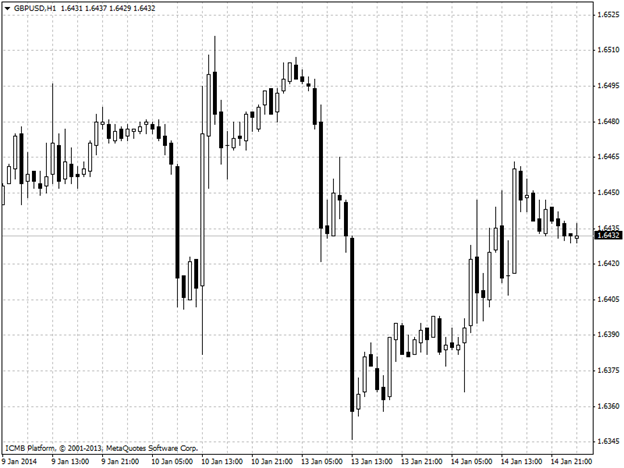

GBP/USD

The pound rose for the first time in four days versus the euro as inflation slowed to the Bank of England’s target for the first time in more than four years, boosting optimism the U.K.’s economic recovery will strengthen. Sterling climbed the most in two weeks versus the dollar as a report showed inflation reached the central bank’s 2 percent threshold last month, helping Governor Mark Carney to keep interest rates at a record low for longer. U.K. government bonds erased gains that had sent 10-year gilt yields to the lowest level in six weeks. “Abating price pressures would continue to support the real purchasing power of U.K. consumers and prop up growth,” said Valentin Marinov, head of European Group-of-10 currency strategy at Citigroup Inc. in London. “The improving macroeconomic background should continue to support sterling and it could be a buy on dips.” The pound appreciated 0.4 percent to 83.14 pence per euro at 4:28 p.m. London time after weakening 1.1 percent in the previous three days. Sterling rose 0.4 percent to $1.6448, the biggest advance since Dec. 27. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="433">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="624" height="433">

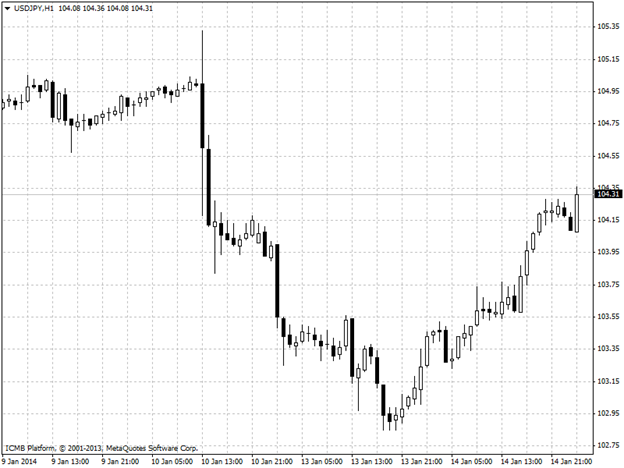

USD/JPY

The yen fell the most in four weeks versus its U.S. peer after a government report showed Japan’s current-account deficit widened to a record in November. The dollar gained for the first time in four days as U.S. retail sales rose more than forecast in December, giving the world’s biggest economy a lift at the end of 2013. The Swedish krona strengthened as a report showed inflation was faster in December than economists forecast. South Africa’s rand slid to a five-year low against the dollar on speculation labor disputes at platinum producers will reduce exports. “Dollar-yen is a bet everyone wants to be long on -- investors are buying on a dip because of the Japanese data,” said Vassili Serebriakov, a foreign-exchange strategist at BNP Paribas SA, by phone from New York. A long position is a bet an asset, in this case the dollar, will appreciate. “The retail sales report makes the payroll numbers look more one-off instead of the economy looking to be on a soft patch.. USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="433">

USD/JPY Hour Chart" title="USD/JPY Hour Chart" width="624" height="433">

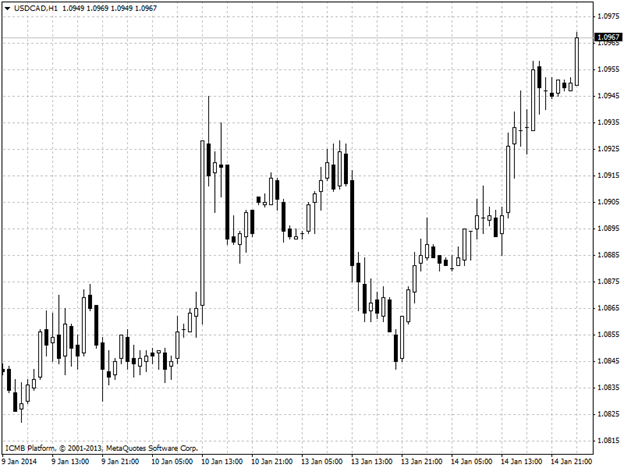

USD/CAD

The U.S. dollar extended gains against the Canadian dollar on Tuesday, re-approaching recent four-year highs after data showed that U.S. retail sales rose more-than-forecast in December. The Commerce Department said U.S. retail sales rose 0.2% last month, beating expectations for a 0.1% increase. Core retail sales, which exclude automobile sales, climbed 0.7% in December, above forecasts for a 0.4% increase. The data helped bolster expectations that the economic recovery will continue to deepen going into this year. The Canadian dollar remained under heavy selling pressure after a recent series of weak economic data undermined the outlook for growth and reinforced expectations that the Bank of Canada will stick to its dovish stance on interest rates. USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="433">

USD/CAD Hour Chart" title="USD/CAD Hour Chart" width="624" height="433">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Pairs: Pound Rose For First Time In Four Days Versus Euro

Published 01/15/2014, 05:50 AM

Updated 04/25/2018, 04:40 AM

Major Pairs: Pound Rose For First Time In Four Days Versus Euro

ICM Brokers

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.