Improving Macro Backdrop

In light of a shifting global macro backdrop that we can finally sink our teeth into with respect to a bullish orientation on the gold stock sector, I thought it might be a good idea to publicly post some bottom line thoughts from this week’s NFTRH report.

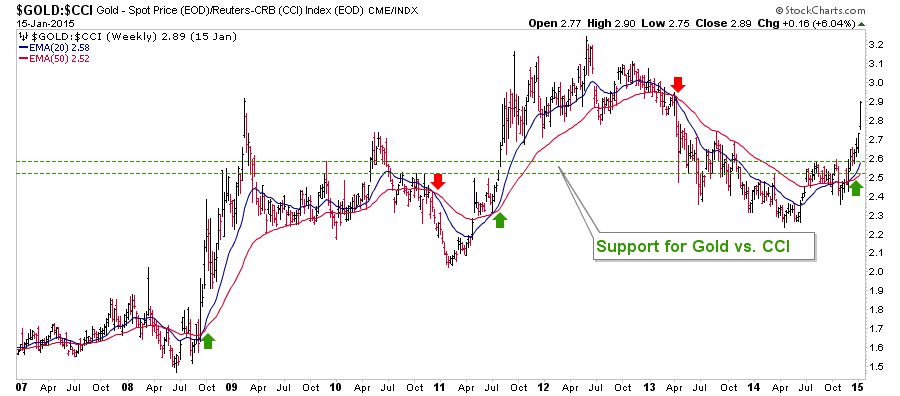

The report went into great detail to explain why more fundamentals that matter are starting to come in line, after the chart below refused to make a signal against our big picture view of global economic contraction, which has been the biggest key for the counter-cyclical gold mining sector.

During the worst of the gold sector cyclical bear market we used Gold vs. Commodities to gauge a higher low to the 2011 low, which despite perceptions at the time, kept our longest-term macro view intact (as noted to subscribers several times, if Au-CCI had broken down we’d have had to admit that the view had failed, no ifs ands or buts).

The moving averages have triggered, a higher low has been made, and the long-term thesis is being confirmed.

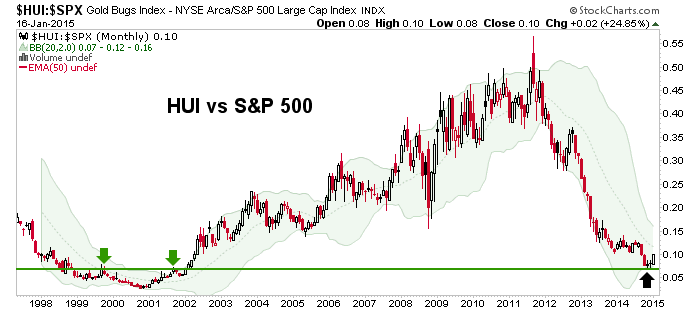

Hence, a bullish stance on quality gold mining operations (a unique counter-cyclical sector) has finally come about and the relevance of this chart of HUI vs. the S&P 500 now means more than simply one market crashing in terms of the other. It means RISK vs. REWARD is on the side of the counter-cyclical gold mining industry vs. the cyclical broad US stock market.

But as any long-term gold trader knows, volatility rides hand in hand. So I thought I would pass along some of what I perceive as important general points going forward in the current cycle. The ‘bottom line’ thoughts followed extensive detailed analysis of short and long-term technicals for gold, silver and the miners along with an in-depth review of the Commitments of Traders structure and technical updates on what I see as quality individual gold stock situations.

Precious Metals Bottom Line

The macro appears to be shifting in favor of the gold mining sector, which could leverage a gold rise in relation to other asset prices into bottom line fundamental improvements across the sector.

Within this, silver can lead the initial rally but over the long-term I like gold and gold stocks better. Even there, please do not get caught up in hype that sees gold going to 2000, 3000… $5000 an ounce. We are mainly looking at a relative performance by gold vs. cyclical assets in a distressed global financial environment.

Gold mining can however, eventually get dynamic because miners would leverage the gold out performance, rather than just play 1 for 1 to gold.

Short-term, the CoT data are indicating a coming negative reaction. It is up to individuals to decide how to play it because there is a whole stew of inflammatory global policy stuff going on now, including for the coming week. As with the broad markets, it could get volatile.

If you make a trade you have to own it. Trade out of the sector due to profit taking and concern about short-term risks and be ready to deal with it if the sector does not come back to let you in. Stay in and if a hard reaction comes about, be ready for the negative ‘if only I’d have…’ stuff to crop up.

It is all psychology. The bottom line is that the macro backdrop is becoming more positive for the counter-cyclical gold sector and that is something that – given the unbroken NFTRH view of global economic contraction (ref. Gold-CCI ratio as the primary indicator) – I have awaited for a long while.

So I myself am going to consider what I’ve written above about trading psychology before making reactionary decisions (though, as discussed many times in previous editions, profit taking is always a positive thing; it is the #1 job of a speculator, either sooner or later).