Fund holdings affect fund performance more than fees or past performance. A cheap fund is not necessarily a good fund. A fund that has done well in the past is not likely to do well in the future. Yet, traditional fund research focuses only on low fees and past performance.

Our research on holdings enables investors’ to find funds with high quality holdings – AND – low fees.

Investors are good at picking cheap funds. We want them to be better at picking funds with good stocks. Both are required to maximize success.

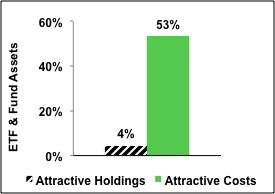

Figure 1 shows that 53% of funds assets are in ETFs and mutual funds with low costs but only 4% of assets are in ETFs and mutual funds with Attractive holdings. This discrepancy is astounding.

Figure 1: Allocation of Fund Assets By Holdings Quality and By Costs

Sources: New Constructs, LLC and company filings

Two key shortcomings in the ETF and mutual fund industry cause this large discrepancy:

- A lack of research into the quality of holdings.Not enough research focuses on the quality of Portfolio Management of funds

- A lack of high-quality holdings or good stocks. With about twice as many funds as stocks in the market, there simply are not enough good stocks to fill all the funds

These issues are related, in my opinion. If investors had more insight into the quality of funds’ holdings, I think they would allocate a lot less money to funds with poor quality holdings.

Traditional ETF and fund research focuses only on low fees and past performance. Investors deserve research on the quality of stocks held by ETFs and mutual funds.

Quality of holdings is the single most important factor in determining an ETF or mutual fund’s future performance. No matter how low the costs, if the ETF or mutual fund holds bad stocks, performance will be poor. Costs are easy to find but research on the quality of holdings is almost non-existent.

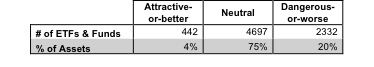

Figure 2 shows investors are not putting enough money into ETFs and mutual funds with high-quality holdings. Only 442 of 7471 (4% of assets) of ETFs and mutual funds allocate a significantly to quality holdings. 96% of assets are in funds that do not justify their costs and over charge investors for poor portfolio management.

Figure 2: Distribution of ETFs & Mutual Funds (Count & Assets) By Portfolio Management Rating

Source: New Constructs, LLC and company filings

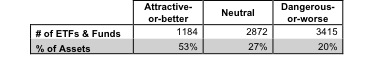

Figure 3 shows that Investors successfully find low-cost funds. 54% of assets are held in ETFs and mutual funds that have Attractive-or-better rated Total Annual Costs, my apples-to-apples measure of the all-in cost of investing in any given fund.

Out of the 7,471 ETFs and mutual funds I cover, 1,184 (54% of all assets) earn an Attractive-or-better Total Annual Costs rating.

Clearly, ETF and mutual funds investors are smart shoppers when it comes to finding cheap investments. But cheap is not necessarily good.

Vanguard Specialized Funds: Vanguard REIT Index Fund (VGSIX) is one of many funds with low costs but a Very Dangerous Portfolio Management rating. It gets an overall predictive rating of Very Dangerous because no matter how low its fees, I expect it to underperform because it holds too many Dangerous-or-worse rated stocks. Low fees cannot boost fund performance. Only good stocks can boost performance.

One of the Dangerous-or-worse-rated stocks held by VGSIX is Ventas Inc. (VTR), to which it allocates over 4% of its value. The company has misleading earnings, dismal returns on invested capital (ROIC), negative cash flow, and an expensive valuation. To justify its current valuation (~$58.53), VTR must grow after-tax profits (NOPAT) at 22% compounded annually for 20 years. It is hard to believe any company will grow that fast for that long, much less one that has misleading earnings. VTR offers investors a poor risk-reward trade-off.

Out of the 97 stocks held by VSGIX, only one earns my Attractive rating and that’s National Health Investors, Inc. (NHI). NHI has proven that it has the ability to allocate capital intelligently. The company has managed to generate double-digit ROIC’s for the past nine years ending with a ROIC of 20% in 2011. This places them in the 90th percentile of all Russell 3000 companies. VGSIX’s fund manager could turn things around and make VGSIX worthy of investment if he allocated more capital to stocks like NHI as opposed to the meager 0.3% he currently allocates.

Figure 3: Distribution of ETFs & Mutual Funds (Count & Assets) By Total Annual Costs Ratings

Source: New Constructs, LLC and company filings

Investors should allocate their capital to funds with both high-quality holdings and low costs because those are the fund that offer investors the best performance potential.

But they do not. Not even close.

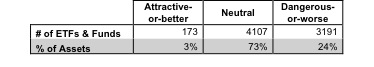

Figure 4 shows that 3% of ETF and mutual fund assets are allocated to funds with low costs and high-quality holdings according to my Predictive Fund Ratings, which are based on the quality of holdings and the all-in costs to investors.

Note the fund industry offers 3191 Dangerous-or-worse ETFs and mutual funds compared to just 173 Attractive-or-better ETFs and mutual funds, nearly 18 times more bad funds than good funds. That means a lot of fees are being paid to managers that do not derive them.

Figure 4: Distribution of ETFs & Mutual Funds (Count & Assets) By Predictive Ratings

Source: New Constructs, LLC and company filings

Investors deserve forward-looking ETF and mutual fund research that assesses both costs and quality of holdings. For example, GMO Trust: GMO US Intrinsic Value Fund (GMVUX) is a fund with both low costs and an Attractive Portfolio Management rating.

Two of the good stocks held by GMVUX are ConocoPhillips (COP) and UnitedHealth Group Inc (UNH). Both stocks get my Attractive rating. They have positive or rising economic earnings, high ROICs and cheap valuations. COP’s current stock price (~$54/share) implies the company’s NOPAT will permanently decline by 70% when our model shows rising economic earnings in 2011. UNH’s current stock price (~$55/share) implies the company’s NOPAT will permanently decline by 20%. Both of these stocks offer Attractive risk/reward because the expectations in their valuations are so low and their economic earnings are strong.

Why is the most popular fund rating system based on backward-looking past performance?

I do not know, but I do know that the lack of transparency into the quality of portfolio management provides cover for the ETF and mutual fund industry to continue to over charge investors for poor portfolio management. How else could they get away with selling nearly 18 times more Dangerous-or-worse ETFs and mutual funds than Attractive-or-better?

John Bogle is correct – investors should not pay high fees for active portfolio management. His index funds have provided investors with many low-cost alternatives to actively managed funds.

However, by focusing entirely on costs, he overlooks the primary driver of fund performance: the stocks held by funds.

Research on the quality of portfolio management of funds empower empowers investors to make better investment decisions. Investors should no longer pay for poor portfolio management.

Disclosure: I own COP. I receive no compensation to write about any specific stock, sector or theme.