They say a week is a long time in politics, but given the events of the past 24 hours perhaps we can now say this could equally apply to a day. Until 9.59pm last night UK time, all the polls had been forecasting a tight race in the election, with the two major parties running neck and neck and suggesting an outcome that was too close to call. The markets were prepared for uncertainty with either the prospect of a hung parliament, or a possible Labour coalition with the SNP. 60 seconds later, the financial and political landscape changed as a dramatic exit poll was released when voting ended at 10.00 pm UK time suggesting a conservative majority. Within 1 minute the GBP/USD had soared 140 pips having opened at 1.5252 and closed 60 seconds later at 1.5392. As the night progressed, and the results confirmed the exit polls, Cable climbed further finally touching a session high of 1.5522, before retracing as the waters calmed. Even the NFP release later in the US session failed to match the dramatic moves seen in the overnight session with the US dollar closing marginally higher on the day, and in sharp contrast to equities markets which soared higher on the news.

With the weekend now ahead, and financial markets having absorbed the dramatic changes in the UK political landscape, next week will no doubt see a return to more mundane matters, starting with an interest rate decision and statement from the BOE on Monday.

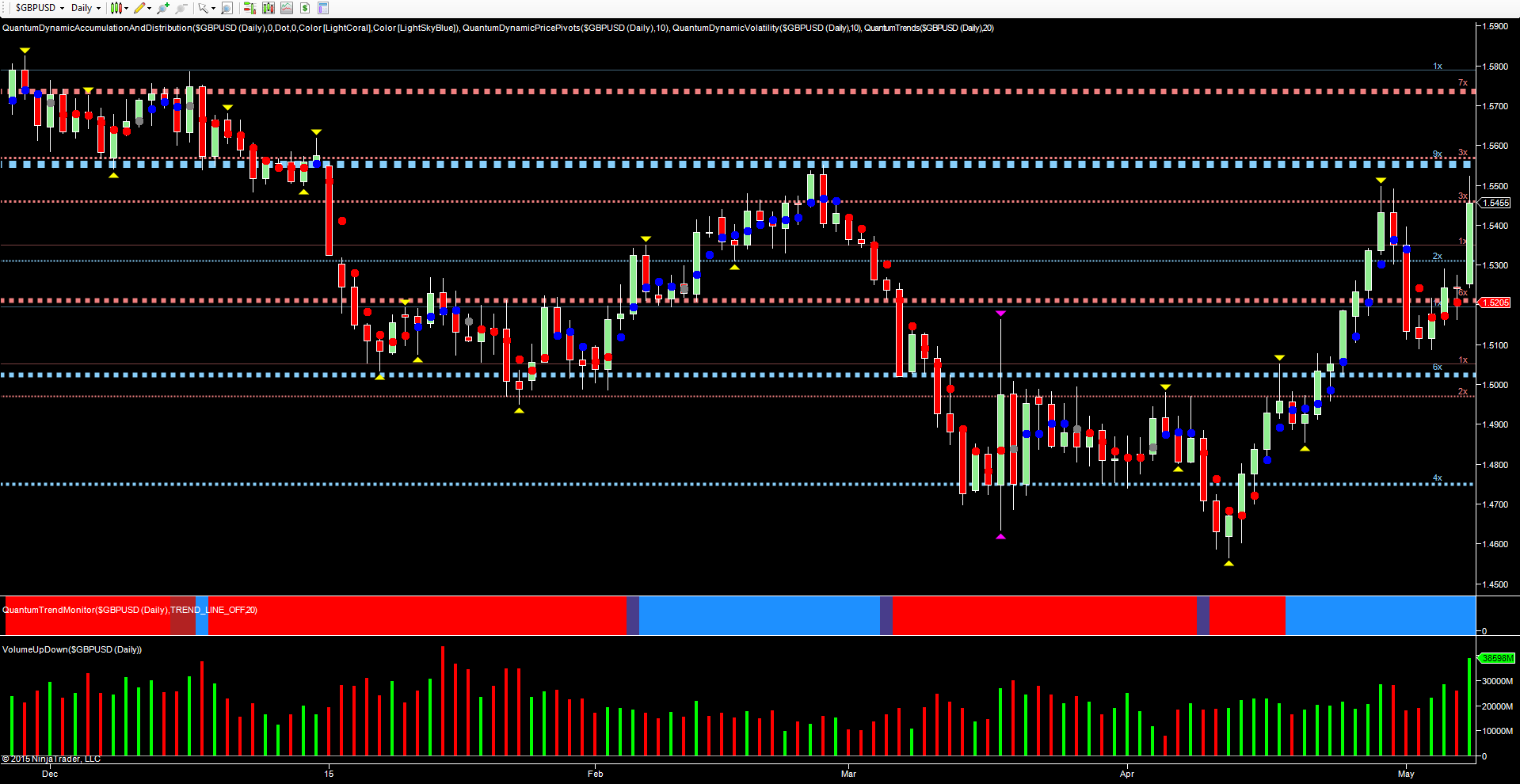

From a technical perspective, today’s price action has taken the GBP/USD back to test a strong level of resistance in the 1.5570 region, as shown with the blue dotted line on the daily chart. This is a level that has been tested previously, most notably in late February when the pair duly reversed from this level, ultimately finding support in the 1.4550 area.

More recently this level was tested once again last week before reversing sharply lower. This area of resistance is now key, and whilst today’s volume confirms the upwards momentum, nevertheless the wick to the top of the candle suggests a degree of selling during the session. Next week’s price action will be pivotal, and for any continuation of the current upwards momentum, the 1.5570 region will need to be breached with rising volume and sufficient to take the pair deeper into the congestion area which now sits between 1.5570 and 1.5720, denoted by the red dotted line.

However, should the current ceiling of resistance hold, then we could see a reversal back to test the 1.5205 platform in place below, but of course much will depend on the US dollar, now that the UK political bandwagon has moved out of town. Today’s NFP data had little impact on the currency of first reserve which managed to claw its way higher having found some support in the 94 area on the dollar index chart. Sentiment for the USD continues to remain bearish given the more doveish comments from the FED coupled with the weak economic data of recent months. This has seen the US dollar slide off the highs of earlier in the year as the prospects of near term rise in interest rates has receded, with June now seen as unlikely and anywhere between September and the end of the year now favourite.