Guys, please. As much as we all love a good crisis, this is getting old. The threats, the name-calling, the apocalypse certain to occur if one side doesn’t immediately cave to the other’s unreasonable demands. Seems like your Greek tragedy has been going on forever, and like a long-running TV show that keeps pushing the big reveal into the next season, your audience is beginning to lose interest.

Or is that the goal? Exceed our attention span, send us off to more vibrant stories like Russia or ISIS or Caitlyn Jenner — and then, when no one is looking, hit us with something really crazy. By now, that possibility is all that’s keeping us tuned in.

So…if you do decide to throw the eurozone and by implication the world into chaos, how would you do it? Seems like you have two promising choices:

1) Greece, just default already. Go back to the drachma, devalue the hell out of it and wait for the world’s tourists to shower their cash all over your suddenly very cheap beaches. Since your external debt has, in the past few years, been shifted from commercial banks — which would have taken a serious hit in a default — to central banks which can just create the required euros out of thin air, non-Greek banks wouldn’t have to mark anything to market. No harm no foul.

BUT between default and tourism boom there’s this intermediate step where you have to keep your banks from imploding as everyone with a euro-denominated deposit cashes out, leaving a bunch of empty vaults. Which is to say there will be no euros to convert to drachmas and therefore nothing with which companies and local governments can pay their employees. Sounds messy, especially for politicians hoping to keep their jobs.

2) Eurozone, just pay up, eliminate two-thirds of Greece’s debt and get on with your transformation into the United States of Germany, er, Europe. Greece will take back all the mean things it said about war crimes and loan shark lending practices. And it will promise (wink, wink) to get its finances in order going forward. Crisis averted, for at least another couple of years.

BUT Italy, Spain and Portugal will find your decision very interesting, and will immediately elect home-grown versions of Syriza who demand the same deal. Then you’ve got a bit of a dilemma because those counties are deadbeats of a whole different order. As the old saying goes, if you owe your currency union a few hundred billion it’s your problem. But if you owe them several trillion, it’s their problem.

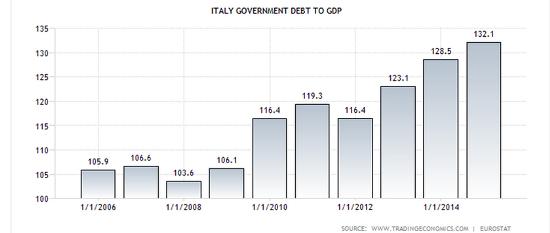

Just to refresh your memory, here’s how Italy has been doing lately. Not only is it piling on debt at an undiminished pace, much of its bonds are held by commercial banks that would be insolvent if those bonds fell in value. So a default is functionally out of the question, which gives Italy and its peers a rock-solid bargaining position. But to waive your monetary wand and cut their debt in half would mean trillions of euros created out of thin air, something that might or might not cause an epic currency crisis. You just won’t know until you try.

With a bunch of loan deadlines nearly upon you, posturing will soon give way to actual policy decisions. Which in turn, damn it, means we have to keep paying attention. So please, Europe, be quick and decisive. Give us something exciting to obsess about.

The Guardian posts a useful running commentary on this process, and Wednesday so far has seen even more than the usual amount of name-calling and impossible demands. Hopefully that means something real is about to happen.