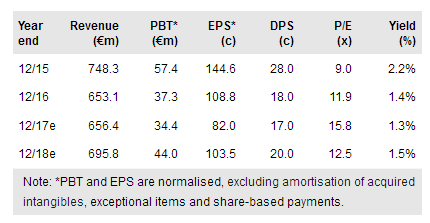

La Doria's (MI:LDO) H117 results demonstrate that the business is solid: despite a tough macroeconomic backdrop in several markets, revenues were up 1.9% during the period, or an impressive 7.4% in constant currency, mainly driven by volumes. The important factor is the outcome of the seasonal 2017 tomato campaign, and – as expected – lower national tomato production, together with the sector destocking following the decrease in production in southern Italy in 2016, resulted in more successful customer negotiations this year, and hence agreed price increases for 2018. As a reminder, this should result in a margin recovery from Q417, when the new contracts start to kick in, and will mainly benefit FY18 margins. We raise our forecasts to reflect the improved outlook and also roll forward our DCF. Our fair value moves to €15.54/share from €12.49.

Positive tomato campaign

Industry forecasts were for a reduction in crop and for a positive outcome to the 2017 campaign as a result of the sector destocking following the Southern Italian production decline in 2016. This did indeed come through, and hence sales prices have increased, which should also have positive margin implications. Pulses also had a better harvest and hence raw material pressures in the canned pulses line should abate from Q417, which should result in higher margins.

To read the entire report Please click on the pdf File Below: