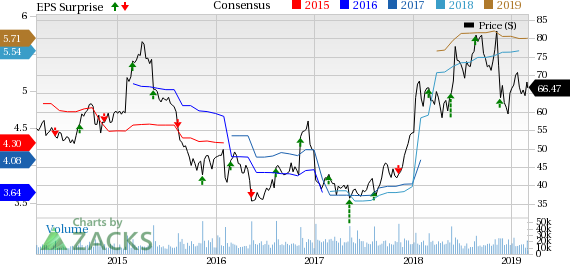

Kohl's Corporation (NYSE:KSS) delivered fourth-quarter fiscal 2018 results, wherein both top and bottom lines came ahead of the Zacks Consensus Estimate. The bottom line also improved year over year.

Notably, this marked the company’s seventh straight quarter of revenue beat, while earnings surpassed the consensus mark for the fifth time in a row. These factors along with management’s impressive earnings guidance for fiscal 2019 seem to have raised investors’ spirits.

Notably, shares of the company gained 5.2% in the pre-market trading session. Further, this Zacks Rank #3 (Hold) stock has increased 2.3% in the past three months, against the industry’s decline of 7%..jpg)

Well, for fiscal 2019, management expects adjusted earnings per share of $5.80-$6.15, which stands above the current Zacks Consensus Estimate of $5.70.

Q4 in Detail

Kohl’s adjusted earnings of $2.24 per share easily surpassed the Zacks Consensus Estimate of $2.17 and rallied 19.8% on a year-over-year basis. We believe that bottom-line growth was backed by lower interest expenses and decline in SG&A costs.

Total revenues came in at $6,823 million, which fell 3.3% from the prior-year quarter’s figure. Nonetheless, the figure came ahead of the Zacks Consensus Estimate of $6,780 million. Net sales also fell 3.4% to $6,535 million, while other revenues dipped 2.4% to $288 million in the quarter.

Further, comps rose 1%, against rise of 6.3% recorded in the year-ago quarter. Well, comps have been positive since the past six quarters. Comps in the quarter were fueled by solid performance in the holiday season.

Moving on, gross margin remained nearly flat at 33.5% in the reported quarter. However, operating income came in at $441 million, down from the prior-year quarter’s $567 million.

Other Financial Details

Kohl’s ended the quarter with cash and cash equivalents of $934 million, long-term debt of $1,861 million and shareholders’ equity of $5,527 million. The company generated net cash from operating activities of $2,107 million during fiscal 2018.

Also, management announced a 10% hike in its quarterly dividend, taking it to 67 cents per share. This is payable on Apr 3, 2019, to shareholders of record as on Mar 20. Additionally, Kohl’s intends to repurchase shares worth $400-$500 million in fiscal 2019.

Kohl’s inaugurated one store and relocated two in fiscal 2018. The company concluded the fiscal with 1,159 stores spread across 49 states.

Other Developments & Guidance

Kohl’s intends to shut down underperforming outlets this April and inaugurate four small-format outlets later this fiscal. The company is on track to consolidate its call centers that support the company’s online and Kohl’s Charge customers.

These factors along with some actions related to employee’s retirement program are likely to result in annual SG&A savings of nearly $20 million. Further, these actions are expected to result in deprecation savings of roughly $5 million.

However, these moves are expected to result in pre-tax charges of about $50-$55 million in the first quarter of fiscal 2019.

Management is focusing on boosting traffic. In fiscal 2019, the company expects comps to be flat to up 2%. Gross margin is likely to rise up to 10 basis points year over year. Further, SG&A costs are anticipated to rise 1-2%.

Don’t Miss These Solid Retail Bets

Boot Barn Holdings (NYSE:BOOT) , with long-term earnings per share growth rate of 20.7%, flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Walmart (NYSE:WMT) , with a Zacks Rank #2 (Buy), has long-term earnings per share growth rate of 5.3%.

Dollar Tree (NASDAQ:DLTR) , another Zacks #2 Ranked stock, has long-term earnings per share growth rate of 13.8%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Walmart Inc. (WMT): Free Stock Analysis Report

Kohl's Corporation (KSS): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

Original post

Zacks Investment Research