Keysight Technologies, Inc.'s (NYSE:KEYS) 5G virtual drive testing (VDT) Toolset was recently selected by MediaTek, a Taiwanese wireless chipmaker.

MediaTekdeployed Keysight’s robust 5G new radio (NR) UXM-based network emulation solutions. The 5G NR soutions enabled MediaTek to accelerate end-to-end performance validation of 5G multimode devices. This deal bodes well for MediaTek as VDT toolset helps it to bridge the gap between lab and field testing, in turn authenticating 4G devices for operation in high speed train (HST) situations.

Notably, Keysight’s 5G VDT Toolset facilitates end-to-end processes from development to deployment, accelerating the 5G device architecture. The solutions offer cost-efficient test techniques with high flexibility and control capabilities. Moreover, the company’s 5G network emulation solutions are deployed on UXM 5G Wireless Test Platforms and WLAN 802.11ax.

MediaTek, a global fabless semiconductor company has grown rapidly in the last few years by offering its SoCs and reference designs to smaller handset manufacturers in China and other Asian countries, consequently enabling them to compete at the entry level. Its product line includes cheap mobile and tablet chipsets, including Bluetooth, WLAN and GPS chips and NFC SoCs. It is currently the world’s second largest supplier of ARM-based processors.

According to Janne Kolu, head of VDT solutions at Keysight Technologies, "We’re delighted to extend our collaboration with MediaTek to support their efforts in validating 5G devices by simulating real world conditions in the lab."

Encouraging 5G Trends Boost Long-Term Prospects

Per ResearchAndMarkets data, global 5G market is expected to reach $251 billion by 2025, witnessing a CAGR of around 97% from 2020. Further, per MarketsandMarkets estimates, communication test and measurement market is projected to attain a valuation of $6.69-billion by 2020 at a CAGR of 9.3% from approximately $4.28 billion in 2015.

Intensive infrastructure investments in 5G push and positive trial testing results are tailwinds in this regard. Smart connected homes, hospitals, factories and cities along with self-driving vehicles remain key beneficiaries of 5G.

On the back of these aforementioned factors, we believe Keysight is well-poised to capitalize on the ongoing upbeat trends in the 5G market and also strengthen its competitive position in the domain.

Zacks Rank & Other Key Picks

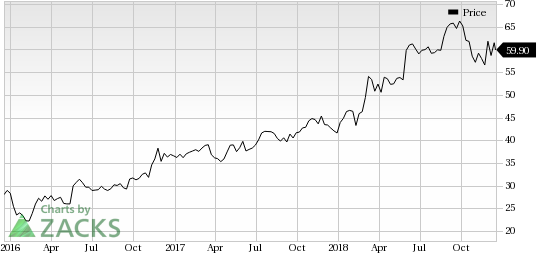

Currently, Keysight carries a Zacks Rank #2 (Buy).

Some top-ranked stocks in the broader technology sector are Upland Software (NASDAQ:UPLD) , Marvell Technology Group Ltd. (NASDAQ:MRVL) and Twitter, Inc. (NYSE:TWTR) , all flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Upland Software, Marvell and Twitter is currently pegged at 20%, 9.4% and 22.1%, respectively.

3 Medical Stocks to Buy Now

The greatest discovery in this century of biology is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating revenue, and cures for a variety of deadly diseases are in the pipeline.

So are big potential profits for early investors. Zacks has released an updated Special Report that explains this breakthrough and names the best 3 stocks to ride it.

Twitter, Inc. (TWTR): Free Stock Analysis Report

Upland Software, Inc. (UPLD): Free Stock Analysis Report

Marvell Technology Group Ltd. (MRVL): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Original post