After two years lost to a state of emergency in Ethiopia, a new political order has emerged that has allowed KEFI to progress Tulu Kapi to the point of development. All federal government consents have now been received (including from the National Bank of Ethiopia, Ethiopia’s central bank). This now allows KEFI Minerals PLC (LON:KEFI) to trigger the first equity instalment of US$11.4m from its Ethiopian partners into the project, which will fund detailed engineering & procurement (including long lead items), allow community resettlement and defer debt funding until FY20. Importantly, however, it also enables the infrastructure finance bond programme to proceed, such that, on the current timeline, commissioning of the plant is anticipated to start by end-2020, with first gold in April 2021 and full production by mid-2021.

Technically simple

Under the aegis of the new political environment, mining has been deemed a strategic industry in Ethiopia. In this context, Tulu Kapi has several technical advantages, including the fact that the plant will employ a conventional carbon-in-leach process route and that, although a specialised mining ore loading cycle will be required in some instances, less than 10% of the total material movement is categorised as ‘selective’, with the balance being otherwise completely standardised.

Valuation: 207–458% premium to the share price

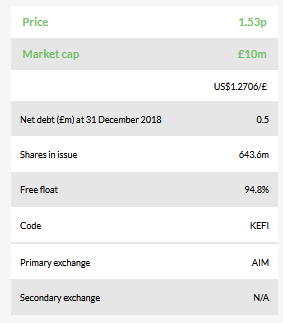

We calculate that Tulu Kapi is capable of generating free cash flow of c £48.0m a year for seven years, from 2021 to 2027. With average (maximum potential) dividends of 0.95p/share for the nine years from 2021 to 2029 inclusive (after deduction of a 55% ‘minority’ interest), and assuming the full conversion of KEFI’s £4m secured convertible loan facility, this implies a valuation for KEFI of 4.70p/share (at a 10% discount rate), rising to 5.69p/share in FY21. However, this valuation increases further, to 5.35p, in the event of the drawdown of only £3m of the convertible loan facility and the conversion of half of that into shares, and to 5.85p in the event that the whole facility is repaid in cash in the manner of conventional debt. Stated alternatively, assuming full drawdown and conversion, we estimate an investment in KEFI shares on 1 January 2019 at a price of 1.53p could generate an internal rate of return to investors of 36.8% over 11 years to 2029 in sterling terms. Note however, that this valuation is based on the projected dividend flow resulting from the execution of the Tulu Kapi project alone, and ignores the exploration and development of the pipeline of targets in the KEFI portfolio. In the event that KEFI is ultimately successful in leveraging its cash flow from the mine into its other assets in the region, our valuation rises to 8.53p/share.

Business description

KEFI Minerals is an exploration and development company focused on gold and copper deposits in the highly prospective Arabian-Nubian Shield – principally the Tulu Kapi project in Ethiopia and, to a lesser extent, the Jibal Qutman project in Saudi Arabia.

To read the entire report Please click on the pdf File Below..