This morning, Kefi Minerals Plc (LON:KEFI) announced it is to raise £5.62m (gross) via the issue of 1.7bn shares at a price of 0.33p, including £4.62m from Lanstead. The majority of the funds raised will be expended on the development of Tulu Kapi over the next 12 months, with the next largest segment being directed towards exploration and the balance to corporate costs. Directors and contractors have supported the fund-raising by subscribing for c £0.4m. Afterwards, a 17:1 consolidation of the shares has been proposed (to be voted on, among other things, at a General Meeting of the company’s shareholders on 1 March).

Lanstead agreement provides for higher share price

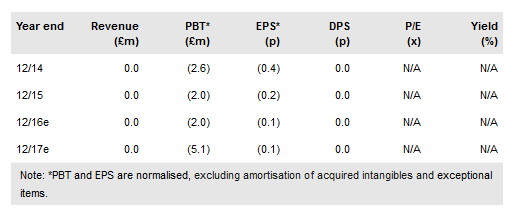

In common with its working practices, the Lanstead agreement involves the issuance of a fixed number of shares and is governed according to a ‘sharing agreement’ and structured relative to a benchmark price, which has been set at 0.44p/share, such that KEFI may receive more than £4.62m if the share price exceeds this level and vice versa if it does not. To this end, £0.693m will be contributed immediately by Lanstead, with the balance being paid in equal instalments of £0.218m per month (subject to adjustment upwards or downwards) for 18 months from shareholder authorisation of the deal. In its aftermath, Lanstead will be KEFI’s largest single shareholder, with approximately 25% of its issued capital, ahead of Odey with c 20%. Note that all of our forecasts continue to be conducted on a pre-consolidation basis.

To read the entire report Please click on the pdf File Below