Emerging Markets made a bottom last January like most markets. From there, they rose through mid April, also like most markets. That was followed by a pullback into May and then another push higher. This made a top in September and consolidated in a tight range -- again like other markets. Finally, they pulled back into early November -- like other markets. But that's where the similarity ended.

While US markets have rocketed to new all-time highs following the US election, emerging markets have still not moved over those September highs. But there's some good news if you're an EM investor. The Bottom may be in. The chart below tells the story.

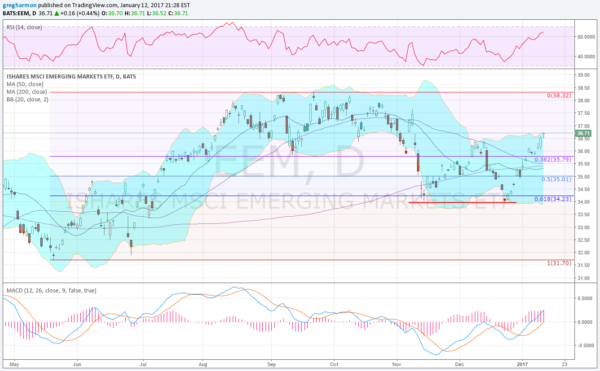

The pullback in November retraced 61.8% of the move higher off of the May low to the September high -- a solid retracement. From there, the bounce only managed to move back up to the 50-day SMA before failing. The pullback that followed stopped at the same low, near that 61.8% retracement at the end of December. Since then, the momentum has started moving higher. The RSI is now in the bullish zone and is still rising. The MACD is also bullish and rising.

But what makes the price action most interesting is that a higher high has been established. This higher high confirms a double bottom reversal and looks for a move to the prior high at 38.32 at least. Emerging markets will still have a long way to go to make new highs above that. But continued strength in risky assets is a positive for this bull market.

Keep your eye on the emerging markets.