The Bank of England will be holding its monetary policy meeting today.

The latest decision on the BoE’s interest rate will be unveiled. No changes are expected from the BoE which will leave rates steady at 0.75%.

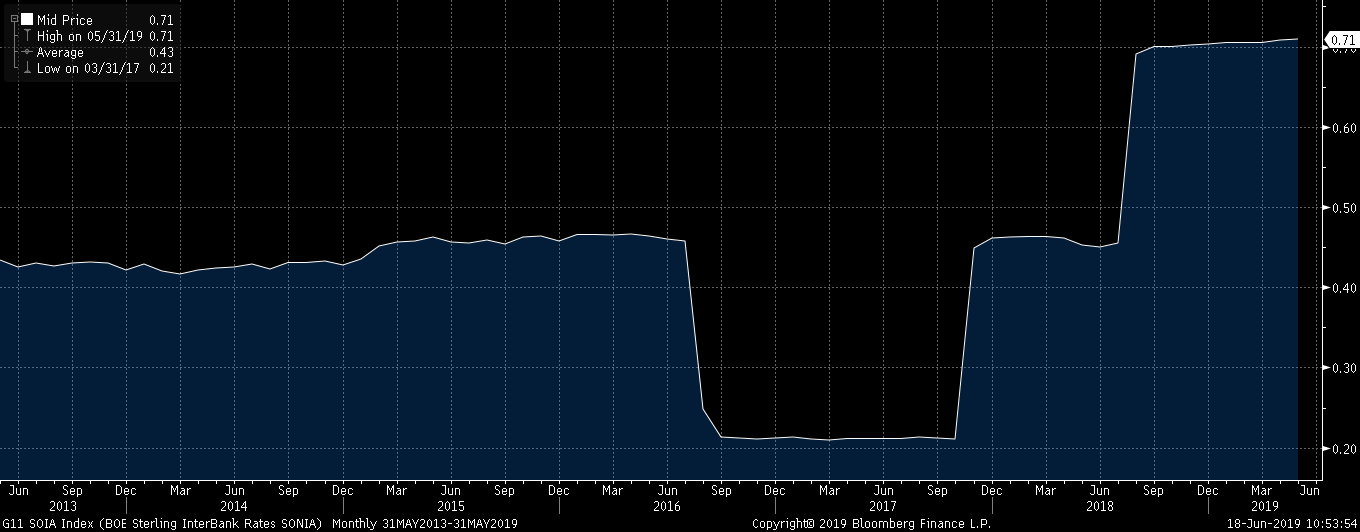

The Bank of England last hiked rates in June 2018 by 25 basis points from 0.50%. Rates were left unchanged at this level since then. The BoE did signal some more rate hikes after June last year.

BoE – Sterling Overnight index Average

BoE – Sterling Overnight index Average

But deteriorating economic conditions left central bank policymakers from hiking rates any further.

Will There Be Some Dissenting Votes?

The decision to keep rates steady could, however, see some dissenting votes. This is because of some of the members of the Monetary policy committee. A few MPC members were in favor of the BoE raising rates in recent comments.

At the previous meeting, the BoE’s MPC voted unanimously to keep rates unchanged. The members who are inclined on the hawkish side are Andy Haldane, the BoE’s chief economist alongside other MPC members, Saunders and Broadbent.

But it is unlikely that the number of dissenting votes will rise to more than two. This comes as the UK is currently locked in a leadership battle to replace the incumbent PM May. May resigned a few weeks ago after the failure to deliver a Brexit deal.

Michael Saunders, the MPC member said that interest rates should rise to keep inflation on track with the BoE’s 2% inflation target rate. He hinted that the markets could be underpricing a rate cut from the BoE.

Saunders further said during his recent comments that the BoE was disconnected due to the Brexit issue at hand.

UK’s Leadership Crisis

Boris Johnson, a former lawmaker is now the frontrunner to become the next Prime minister of the UK. There are doubts as to how the UK will steer through the Brexit crisis.

The UK is now expected to leave the EU by October. The risk of a no-deal Brexit weighs on the economy. This could potentially keep BoE members from making any rate hikes that could further hurt growth and credit.

Central bank officials have been toeing the line that rates could move in either direction if the UK crashes out of the EU with no deal in hand.

Besides the leadership crisis, the BoE will also have to consider a number of other aspects. Heightened global trade tensions are certainly not helping the growth prospects for the UK.

Trade Tensions Remain a Concern for the UK

So far, the Washington administration has been somewhat favorable to the UK. President Trump, during his latest state visit to the UK spoke about a potential deal between the two nations.

But the global trade uncertainty, alongside the domestic environment, makes businesses remain cautious. And, as a result, it’s keeping investments subdued.

Recent economic data from the UK also isn’t helpful. The UK’s economy was seen falling for two consecutive months. This potentially puts at risk a weaker than forecast quarterly growth rate.

The only silver lining has been the UK’s labor market. Despite a few hiccups, wages were seen rising steadily.

But the Brexit uncertainty could dampen the outlook. BoE Governor Mark Carney suggests that the central bank will engage in further stimulus in the event of a no-deal Brexit. This makes the prospects of a rate cut more probable than a rate hike.

The probability of a rate hike in the UK fell to just 5% in April, compared to 50% in the month before. In fact, the markets don’t expect a rate hike even in the coming year. But, of course, this could change over time.

With the October Brexit deadline fast approaching, it would be surprising to see a rate hike from the Bank of England.