USD/JPY has ticked lower in Monday trading. In the North American session, the pair is trading slightly below the 109 line. On the release front, Japanese Flash Manufacturing ticked higher to 52.2, above the estimate of 52.3 points. In the US, Existing Home Sales dropped to 5.52 million, well short of the estimate of 5.59 million. Later in the day, the BoJ releases the minutes of its June policy. On Tuesday, the US releases CB Consumer Confidence.

The Japanese economy continues to show improvement, but inflation remains stubbornly low, well below the BoJ’s target of 2%. Last week, there were no surprises from the Bank of Japan, which maintained its ultra-loose monetary policy. The bank kept interest rates at 0.10% and maintained its inflation target at 2.0%. However, in light of the low inflation levels, the BoJ extended the timeline for the inflation target by one year, saying it expected inflation to reach 2% by fiscal year 2020. The BoJ has maintained its inflation target since 2013 and has had to postpone the timeline six times, as the bank’s radical asset-purchase program has failed to end deflation. BoJ Governor Haruhiko Kuroda has insisted that the inflation target is feasible, blaming low inflation on external factors, such as low oil prices. The bank was more upbeat in its economic forecast than in June, but with the bank stubbornly clinging to its inflation target, the markets don’t expect any withdrawal of stimulus until 2018 at the earliest.

It was another bad week for President Trump. Early in the week, Trump’s cherished flagship healthcare proposal, which aims to replace Obamacare, stalled in the Senate after two Republican senators said they would not support the bill. Trump has failed to pass any significant legislation so far in his term, and investors are becoming more skeptical as to whether Trump will have any more success with his tax reform and fiscal spending plans. With the Democrats forming a rock-solid wall of opposition, dissension among Republican lawmakers, many of whom are uneasy about Trump, could doom attempts by the White House to get bills through Congress. There was more bad news as Robert Mueller, the special counsel who is investigating alleged collusion between Trump and Russian officials during the US election, said he would review business transactions involving Trump as well as his associates. Trump has said that Mueller’s scope is limited to Russia, so the stage could be set for a Nixon-type showdown between the president and the special counsel investigating wrongdoing by the president.

USD/JPY Fundamentals

Sunday (July 23)

- 20:30 Japanese Flash Manufacturing PMI. Estimate 52.3. Actual 52.2

Monday (July 24)

- 9:45 US Flash Manufacturing PMI. Estimate 52.3. Actual 53.2

- 9:45 US Flash Services PMI. Estimate 54.3. Actual 54.2

- 10:00 US Existing Home Sales. Estimate 5.59M. Actual 5.52M

- 19:50 BoJ Monetary Policy Meeting Minutes

Tuesday (July 25)

10:00 US CB Consumer Confidence. Estimate 116.2

*All release times are GMT

*Key events are in bold

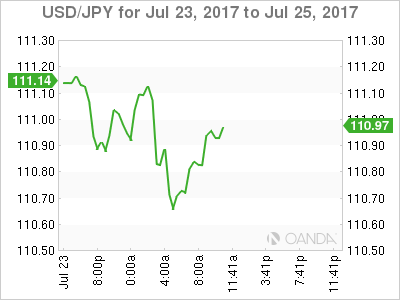

USD/JPY for Monday, July 24, 2017

USD/JPY July 24 at 9:25 EDT

Open: 111.14 High: 112.20 Low: 110.62 Close: 110.92

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 107.49 | 108.69 | 110.10 | 110.94 | 112.57 | 113.55 |

USD/JPY inched lower in the Asian session. The pair edged lower in the European session but has recovered in North American trade

- 110.10 is providing support

- 110.94 has switched to resistance and is fluid

Current range: 110.10 to 110.94

Further levels in both directions:

- Below: 110.10, 108.63 and 107.49

- Above: 110.94, 112.57, 113.55 and 114.37

OANDA’s Open Positions Ratios

In the Monday session, USD/JPY ratio is showing long positions with a majority (54%). This is indicative of trader bias towards USD/JPY reversing directions and moving upwards.