The Japanese yen has posted small gains in the Tuesday session. In North American trade, USD/JPY is trading at 106.17, down 0.03% on the day. On the release front, there are no Japanese indicators on the schedule. In the US, Factory Orders were unexpectedly soft, with a decline of 1.4%. This was well short of the estimate of -0.4%. On Wednesday, the US releases ADP Nonfarm Employment Change and Japan publishes Final GDP.

The Japanese yen continues to look strong, and last week, the dollar dropped close to the 105 line, its lowest level since early November. The yen received a boost on Friday, as Bank of Japan governor Haruhiko Kuroda said that the BoJ would consider exiting from its ultra-accommodative monetary policy if its inflation target of around 2020 was reached in early 2020. Kuroda’s remarks were unusual in that they mentioned a possible “exit” from its stimulus program, and this caught the markets off guard. The BoJ has been lagging behind the Fed and other central banks in winding up stimulus, but Kuroda added that the Bank would normalize policy if “economic conditions become favorable and our price target is achieved”. Although inflation remains well below target, any further hints about normalization from the BoJ could strengthen the yen.

The “tariff tussle” shows no sign of being resolved anytime soon. US President Trump appears set on applying stiff tariffs on steel imports, much to the consternation of the European Union and other US trading partners. However, there is plenty of domestic opposition to Trump’s plan, as Republican lawmakers, including House Speaker Paul Ryan, have come out strongly against the move. If Trump doesn’t back down, the Republicans could even resort to legislation to limit Trump’s authority on tariffs. The announcement of the tariffs last week bolstered the yen, and if the tariffs are introduced, negative investor sentiment could send the greenback to lower levels.

USD/JPY Fundamentals

Tuesday (March 6)

- 10:00 US Factory Orders. Estimate -0.4%. Actual -1.4%

- Tentative – IBD/TIPP Economic Optimism. Estimate 58.2

- 17:30 US FOMC Member Lael Brainard Speaks

Wednesday (March 7)

- 8:15 US ADP Nonfarm Employment Change. Estimate 194K

- 18:50 Japanese Final GDP. Estimate 0.2%

*All release times are EST

*Key events are in bold

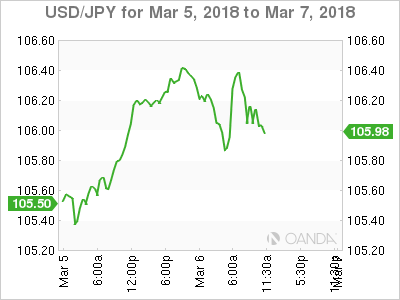

USD/JPY for Tuesday, March 6, 2018

USD/JPY March 6 at 10:50 EST

Open: 106.20 High: 106.46 Low: 105.86 Close: 106.17

USD/JPY Technicals

| S3 | S2 | S1 | R1 | R2 | R3 |

| 103.09 | 104.32 | 105.53 | 106.64 | 107.29 | 108.00 |

USD/JPY ticked higher in the Asian session. In the European session, the pair moved higher but then retracted. The pair is flat in North American trade

- 105.53 is providing support

- 106.64 is the next resistance line

Further levels in both directions:

- Below: 105.53, 104.32 and 103.09

- Above: 106.64, 107.29, 108.00 and 109.11

- Current range: 105.53 to 1.06.64

OANDA’s Open Positions Ratios

USD/JPY is unchanged in the Turatio long positions have a majority (70%). This indicative of trader bias towards USD/JPY continuing to head higher.