The USD/JPY pair surged to a four-month high as investors recalibrated their expectations for the Bank of Japan's future actions. The consensus is now that the BoJ's monetary policy will remain accommodative, even with the shift away from negative interest rates.

On Tuesday, the Bank of Japan announced its first interest rate hike in 17 years, indicating its expectation to observe favorable fiscal conditions for some time. However, the yen remains under pressure due to the significant interest rate differential between Japan and the United States.

Japan's negative interest rate period extended over eight years. The recent decision marks a historic move following a prolonged phase of quantitative monetary easing.

The market generally believes that the Bank of Japan's transition to a stable monetary policy is far from complete. This perspective is supported by the BoJ's "soft" statements and the subsequent reaction of the JPY.

The yen plunged by 1% against the US dollar immediately following the BoJ's decision and continues to weaken. The upward trend in the USD/JPY pair began in early January 2024 and has remained strong.

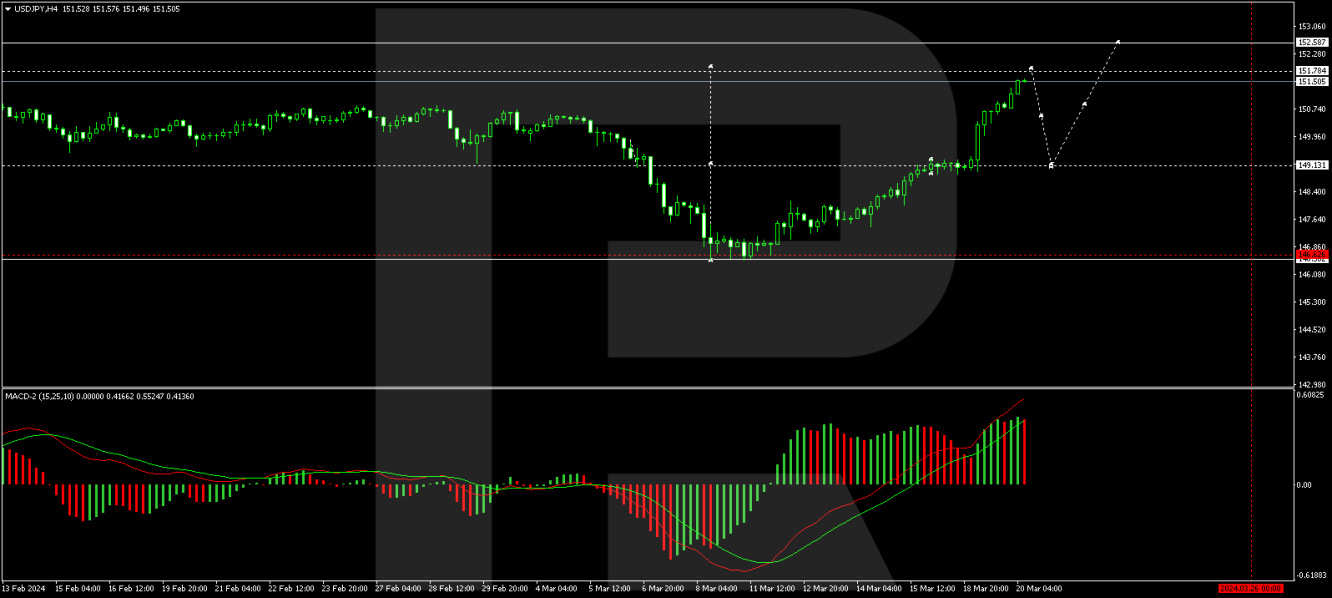

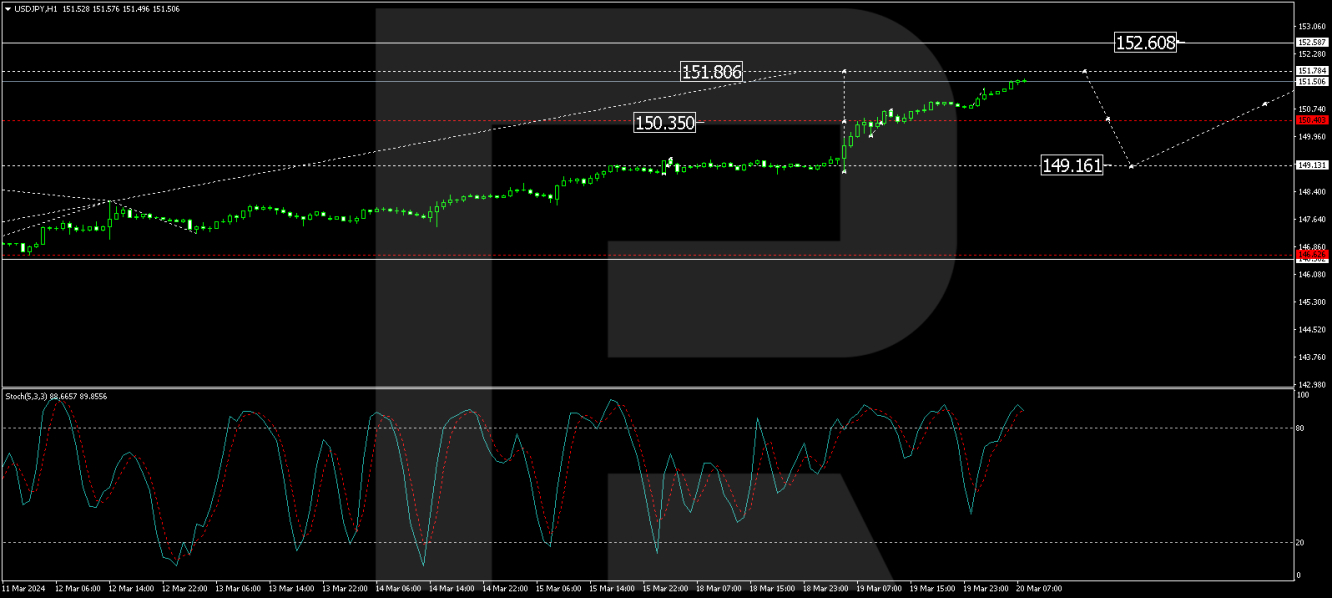

USD/JPY technical analysis

The H4 USD/JPY chart shows a consolidation range formed around the 149.13 level. With an upward breakout, the pair continues to develop a growth wave towards 151.77. A correction phase to 150.00 could follow, then a rise to 152.60. The MACD oscillator supports this scenario, with its signal line strictly pointing upwards and aiming for new highs.

On the H1 USD/JPY chart, a narrow consolidation range has developed around the 150.40 level. Exiting upwards from this range, the growth wave continues towards 151.78. After reaching this level, a potential correction back to 150.40 (testing from above) is considered, followed by a new growth structure towards 152.60. The Stochastic oscillator corroborates this scenario, with its signal line above the 80 mark and preparing to drop to 50.

By RoboForex Analytical Department

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.