Theme of This Year’s Conference Telling

While the important point will be the market’s reaction to what will be said at Jackson Hole this week, we may be able to garner some insight by examining the title for this year’s gathering of 'prominent central bankers', which is Re-Evaluating Labor Market Dynamics.

Why Does The Market Care?

What is this meeting in Jackson Hole all about? It is described by the Kansas City Fed as follows:

Each year since 1978, the Federal Reserve Bank of Kansas City has sponsored a symposium on an important economic issue facing the U.S. and world economies. Symposium participants include prominent central bankers, finance ministers, academics, and financial market participants from around the world. The participants convene to discuss the economic issues, implications, and policy options pertaining to the symposium topic. The symposium proceedings include papers, commentary, and discussion.

Re-Evaluation Of Labor Market

It may be the title of this year’s conference, Re-evaluating Labor Market Dynamics, turns out to be a politically correct way of saying, “we know the employment data has been improving, but let us lay out the case for keeping rates low for an extended period”. From CNBC:

The topic is broad and offers the opportunity for a lot of discussion. In re-evaluating labor-market dynamics, she must address the changes in the labor market itself. She must discuss why there is still so much slack in the labor market, how much longer she expects the recovery to be, what has been the impact of Fed policy on the labor market and why it has NOT achieved the desired results after 5 years of stimulus. She can talk about the continued weakness in wages and what that really means for labor market dynamics and the future of the U.S. economy.

Market’s Reaction Matters Most

Since it is the market’s interpretation of what is said at Jackson Hole that sets asset prices, our approach will be the same as it is for any Fed-related event. We will wait to see how the market reacts to Jackson Hole and make any necessary adjustments. For now, the title of the Jackson Hole conference has a bullish vibe that aligns with the other areas of improvement we have seen recently.

Investment Implications – The Weight Of The Evidence

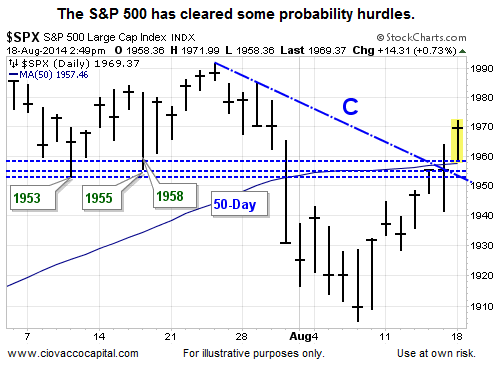

Last Thursday and in the video below, we noted two key bull/bear guideposts: (a) the S&P 500’s 50-day moving average, and (b) Friday’s intraday high of 1964. As shown on the daily S&P 500 chart below, both guideposts were exceeded Monday.

Does Monday’s action mean we are ready to sound the “all clear” for stocks? No. Closing above the 50-day and above Friday’s high tells us the probability of the rally continuing in the days and weeks ahead is better today than it was Friday. Our market model tracks numerous inputs. The S&P 500’s 50-day is one example of observable improvement in the market’s risk-reward profile. This week’s stock market video covers the big picture in more detail.

Incremental Bump To Stocks

Based on numerous pieces of hard evidence aligning with a lower-risk environment, our market model called for an incremental increase to the growth side of our portfolios Monday. We added exposure in large caps (NYSE:IVW) and technology (NYSE:IYW). With Fed minutes coming Wednesday and Jackson Hole kicking off Thursday, we will maintain a flexible stance and see how things unfold.