We are in the final quarter of the year and the holiday season is already here. This is also that time of the year, when the investment world turns to the retail and consumer discretionary space, with ETFs being no exception.

After declining 0.3% in September, retail sales rebounded in October on a healing labor market and rising consumer confidence. Bloomberg noted that the job market is in its best ever shape since 1999.

Plunging oil prices have also favored the consumer discretionary stocks and ETFs. In mid November, the national average price of gasoline hit $2.89 per gallon – the lowest figure recorded since December 2010 (read: 2 Sector ETFs to Benefit from the Crude Oil Slump).

Consumer spending is largely related to energy prices. Higher energy bills related to cars and other home appliances normally restrict consumer spending and squeeze discretionary purchases. Thus, with a substantial plunge in oil prices, consumers are now able to pour their money into discretionary items, especially prior to the holiday season – a key selling period.

Per Bloomberg, household consumption making up about 70% of the U.S. economy grew at a 1.8% annualized rate in Q3. On the other hand, income after taxes and adjusted for inflation spiked 2.7% resulting in a 5.5% surge in savings rate in Q3, the maximum quarterly mark from 2012 end. This extra savings should catapult into higher Q4 purchases which involves all-important holiday season (read: Can a Great Holiday Season Rally These Retail ETFs?).

Overall GDP growth of the U.S. remains pretty bullish. After expanding at 4.6% in Q2, the economy logged 3.5% growth rate in Q3 injecting further optimism among consumers and investors. All these have taken consumer confidence to the highest level in seven years spreading optimism in the retail sector.

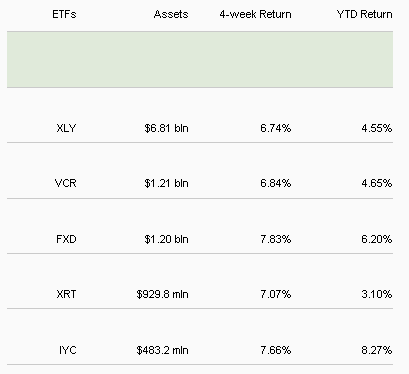

Investors seek to take advantage of the strong trends in the broad space and pour their money into top-notch discretionary and retail ETFs to make the most of them. SPDR Consumer Discr. Select Sector (ARCA:XLY), Vanguard Consumer Discretion (NYSE:VCR), FirstTrust Cons. Discret. AlphaDEX (NYSE:FXD) and SPDR S&P Retail (NYSE:XRT) are some of the funds that have lately garnered a lot of investor attention.

Is IYC a Better Player?

While the aforementioned ETFs returned smartly in the last four-week period, investors should note that one forgotten product iShares US Consumer Services (NYSE:IYC) returned equally or better than the blue-eyed ETFs of investors.

Over the past one month, IYC has added about 7.7% while XLY, VCR, FXD, and XRT have returned about 6.7%, 6.8%, 7.8% and 7.1%, respectively. From the year-to-date outlook, IYC was up 8.3% while XLY, VCR, FXD, and XRT advanced 4.6%, 4.7%, 6.2% and 3.1%, respectively.

Notably, the structure of IYC is slightly different from than that of those superlative asset gatherers. IYC invests about 72% of its assets in consumer discretionary stocks while 15% goes into consumer staples stocks, 6% in industrials, 4% in health care and the rest in technology.

Apart from FXD, which puts 93% of the basket in consumer cyclical stocks, other ETFs are totally discretionary players (read: A Comprehensive Guide to Retail ETFs).

With the major chunk of economic assets still being locked in the hands of high-end consumers (as believed by several market researchers), the road of recovery may be a little bumpy. Also, global growth worries and rising rate concerns may bring in correction any moment in the high-growth retail space. In such a backdrop, focusing on consumer services ETFs looks more convincing against a pure play on discretionary ETFs, though the latter is always the flavor of Q4 (read: All Eyes on Holiday Season: 3 Hot Retail Stocks to Buy Now).