In 1999 and 2001, Ole Doc Copper created a double bottom on a monthly basis and started moving higher. Once copper started sharply higher in 2003, commodities and stocks did pretty well in the following years.

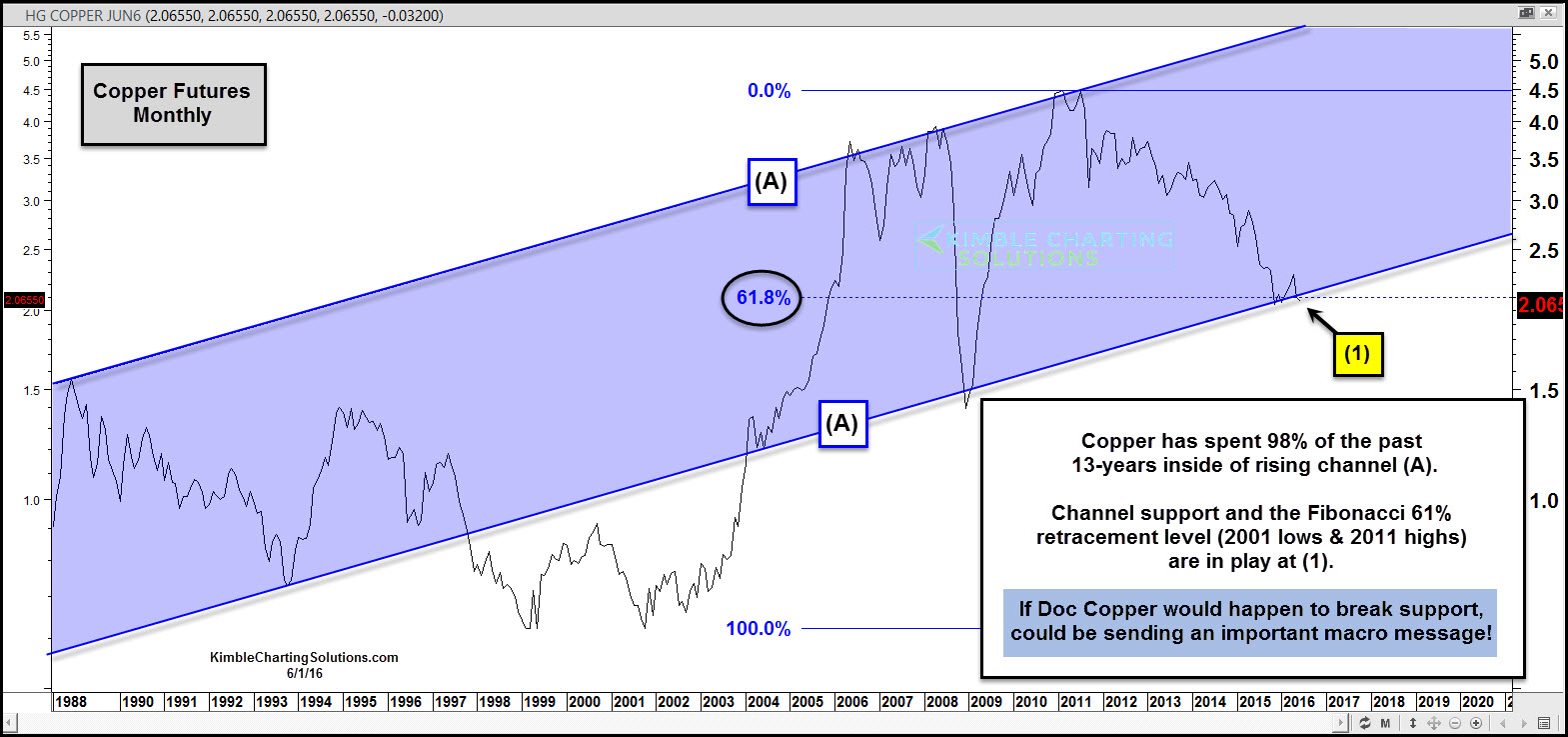

Right now, copper finds itself in what could be a very important price point -- one that could say a good deal about the global macro picture moving forward. For its part, copper spent 98% of the past 13 years inside of a rising channel. Now check out what it's doing below.

In 1999 and 2001, the metal double-bottomed and then began moving higher in the years that followed. By 2011, copper had double-topped and has been moving steadily lower for the past 5 years.

Now it's testing 13-year rising support and the 61% retracement level of the 2001 lows and 2011 highs at (1) above. From a macro point of view, the Power of the Pattern feels it is very important that Doc Copper holds at dual support.

The trend is lower and if support happens to give way, selling pressure in this leading indicator could ramp up. We humbly feel that what Doc Copper does at (1) could be a big deal for stocks and commodities going forward.