Cycles, cycles everywhere. We’ve already discussed the current state of the U.S. business cycle, arguing that the expansion should last for a while, although it is more advanced than in Europe. However, business cycles aren’t the only creatures living in an economic zoo. They are simply the most popular within the modern macroeconomics. The post-war business cycles lasted, on average, almost 6 years. But economists distinguished also shorter cycles, called Kitchin inventory cycles, which are believed to be caused by lags in entrepreneurs’ reaction to the market signals (and the resulting changes in inventory accumulation or reduction), and which average 40 months in length. The typology of cycles also recognizes much longer cycles: the Kuznets swing and the Kondratiev wave. The former is caused by infrastructural investments and lasts 15-25 years, while the latter is linked to changes in technology and keeps on about 45-60 years. As the Kuznets swing is sometimes considered to be a part of the Kondratiev wave, we focus here on the latter.

The idea of “super-cycles” was developed in 1925 by Russian economist Nikolai Kondratiev, who identified three phases of the cycles and believed that their key drivers are social shifts (changes in inequity, opportunity). However, the theory has been refined over the years and it is currently divided into four ‘seasons’:

- Spring: economic upswing, technological innovation which drives productivity, low inflation, bull market in stocks, low level of confidence (winter’s legacy);

- Summer: economic slowdowns combined with high inflation and bear market in stocks, this phase often ends in conflicts;

- Autumn: the plateau phase characterized by speculative fever, economic growth fueled by debt, disinflation and high level of confidence;

- Winter: a phase when the excess capacity is reduced by deflation and economic depression, debt is repaid or repudiated. There is stock market crash and high unemployment, social conflicts arise.

In particular, Joseph Schumpeter significantly modified the original concept, linking the cycles to innovations. Their accumulation leads to technological revolutions, which transforms societies and launch Kondratiev waves.

There have been five such revolutions in the modern capitalist economies:

- The Industrial Revolution (started about 1771)

- The Age of Steam and Railways (1829)

- The Age of Steel and Heavy Engineering (1875)

- The Age of Oil, Electricity, the Automobile and Mass Production (1908)

- The Age of Information and Telecommunications (1971)

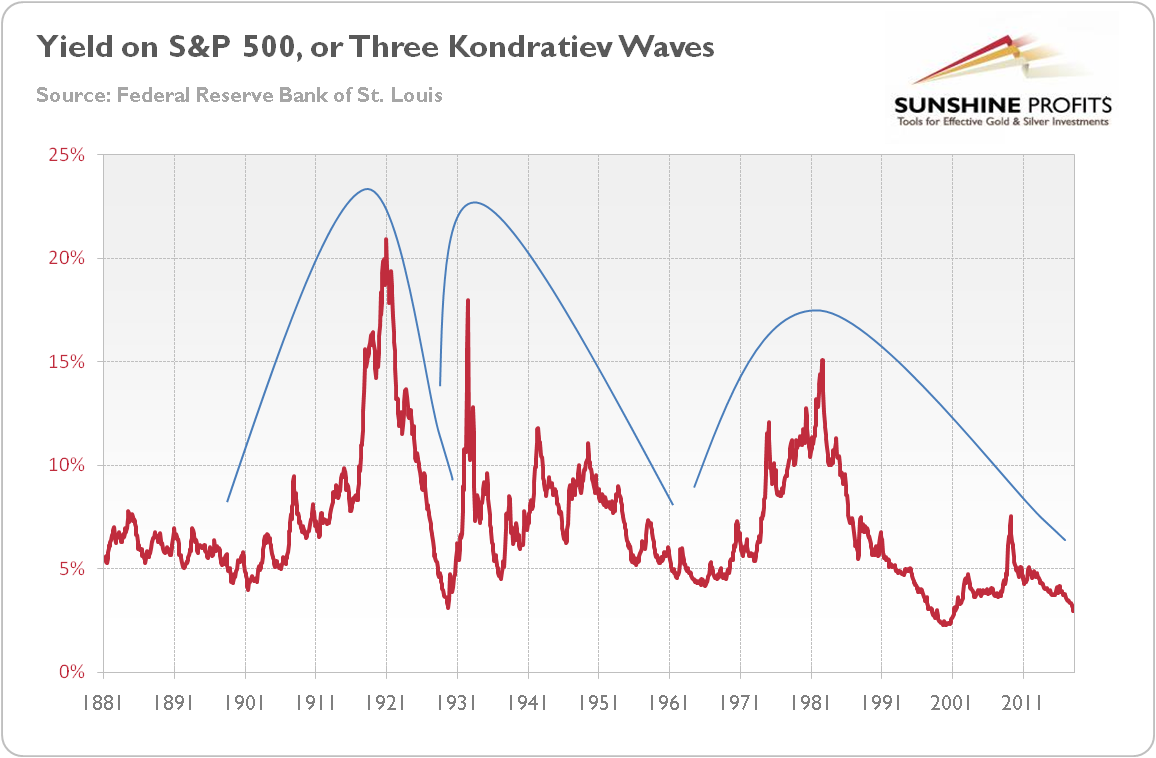

The chart below displays the last three waves, which are approximated by cycles in the rolling 10-year earnings yield (inverted P/E ratio) on the S&P 500 Index. When the new technology enters the scene, the average return starts to increase, while when technology approaches its limits, the average return on equities declines.

Chart 1: Rolling 10-year earnings yield on the S&P 500 Index from 1881 to February 2018.

We currently live in the fifth age, but the sixth technological revolution is coming. Brace yourself for The Age of Cybernetics, High Technology and Clean Energy. Just think about all these technology breakthroughs: nanotechnology, biotechnology, renewable energy, machine learning, artificial intelligence, 3D printing, Internet of Things, robotics, electrical and autonomous vehicles, etc.

OK, robots are great, but what does this have to do with gold? Well, each long wave brings new ways of doing things more efficiently, increasing economic productivity and boosting the pace of growth. Some economists explain the Great Recession and the following slow recovery pointing to reaching the limits of the present technology. Thus, when the sixth revolution arrives, gold may struggle.

However, gold bulls shouldn’t fall into despair. The diffusion of technology takes time – and it occurs with pain on the way. Technological innovations lead to social changes, which can create conflicts or even wars (the new technology empowers certain people who threaten the old elite). Some analysts argue that the third cycle actually peaked with World War I and ended with World War II. As Kondratiev wrote,

it is during the period of the rise of the long waves, that is during the period of high tension in the expansion of economic forces, that, as a rule, the most disastrous and extensive wars and revolutions occur.

The implications are clear. The new technological revolution will bring prosperity, but it will be born in pain. And what it the best cure for pain? You are right, shiny gold, which hedges against economic turmoil. It all depends on the phase we are in right now.

As the global economy recovered and now expands, inflation is low, while stocks still rally, we enjoy spring. This is why gold’s remained in a broad sideways trend in the last few years. However, as we are on the edge of the next technological revolution, confidence is finally rising and there are worries about higher prices, and we could enter the summer phase in the not-so-distant future. As inflation goes out to sunbathe during summers, gold should welcome that transformation.