Finding a great growth stock can be a tough task. Not only are there a wide range of choices, but the space can be extremely volatile and fraught with risk as well. But thanks to our new style score system we have been able to identify a few growth stocks which have incredible potential in the near term.

One such company that stands out in this regard is undoubtedly Itron, Inc. (NASDAQ:ITRI) . Not only does this company have a favorable growth score, but it is ranked as a buy too. And while there are numerous reasons why ITRI is so attractive right now, we have highlighted three of the most important—and pertinent to growth investors—below:

Earnings Growth for ITRI

Arguably nothing is more important than earnings growth as surging profit levels is what most investors are after. And for growth investors, earnings growth in the double digits is definitely necessary and it is often an indication of strong prospects (and stock price gains) ahead for the company in question.

While ITRI has put up a historical EPS growth rate of 126.70%, investors should really focus on the projected growth. Here, ITRI is looking to grow at a rate of 218.84%, thoroughly crushing the industry average which calls for EPS growth of just 7.4%in comparison.

Sales/Assets Ratio is Impressive for Itron Stock

The sales/asset ratio is often overlooked by investors, but it can be an important indicator in growth investing nonetheless. This metric—also known as S/TA for short—shows us how much sales are generated from the company’s assets which can indicate that a firm is using its assets effectively.

Right now Itron has a S/TA ratio of 1.16 which means that the company gets $1.16 in sales for each dollar in assets (will need a bit of calculation, 1.25 for the ratio = $1.25 in sales for each dollar in assets, 0.5 for the ratio = 50 cents in sales for each dollar in assets). Compare this to the industry average which is a ratio of 65 and you can say that ITRI is a bit more efficient than the industry at large.

But if you are worried that this ratio is too technical, consider how ITRI is positioned from a sales growth perspective. Itron is projected to see sales growth this year of 5.52%, crushing the industry average of 2.98% and further underscoring the company’s title as a great growth stock.

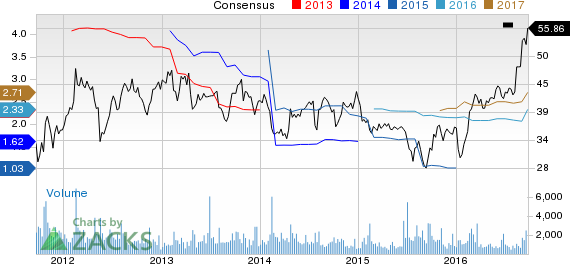

ITRI Earnings Estimate Revisions Moving in the Right Direction

If the metrics outlined above weren’t enough investors should also consider the positive trends that we are seeing on the analyst estimate revision front. Analysts have been raising their estimates for Itron lately, and now the earnings picture is looking a bit more favorable for the company.

Over the past 60 days, 4 EPS estimates have been revised higher compared to none lower, at least for the current year time frame. And the magnitude of these revisions has also been impressive, as the consensus estimate for the full year has surged from $2.09 per share to $2.33 per share today.

Bottom Line

For the reasons outlined above, investors shouldn’t be surprised to note that Company has earned itself a growth score of ‘A’ as well as a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This means that we believe Itron stock is a potential outperformer that is an impressive choice for growth investors, making it a security that you need to keep on your radar in the near term.

Confidential from Zacks

Beyond this Tale of the Tape, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

ITRON INC (ITRI): Free Stock Analysis Report

Original post

Zacks Investment Research