Gold prices declined in 2021 and the prospects for 2022 are not impressive as well. However, the yellow metal’s strategic relevance remains high.

Last month, the World Gold Council published two interesting reports about gold. The first one is the latest edition of Gold Demand Trends, which summarizes the entire last year. Gold supply decreased 1%, while gold demand rose 10% in 2021. Despite these trends, the price of gold declined by around 4%, which – for me – undermines the validity of the data presented by the WGC.

I mean here that the relevance of some categories of gold demand (jewelry demand, technological demand, the central bank’s purchases) for the price formation is somewhat limited. The most important driver for gold prices is investment demand. Unsurprisingly, this category plunged 43% in 2021, driven by large ETF outlfows.

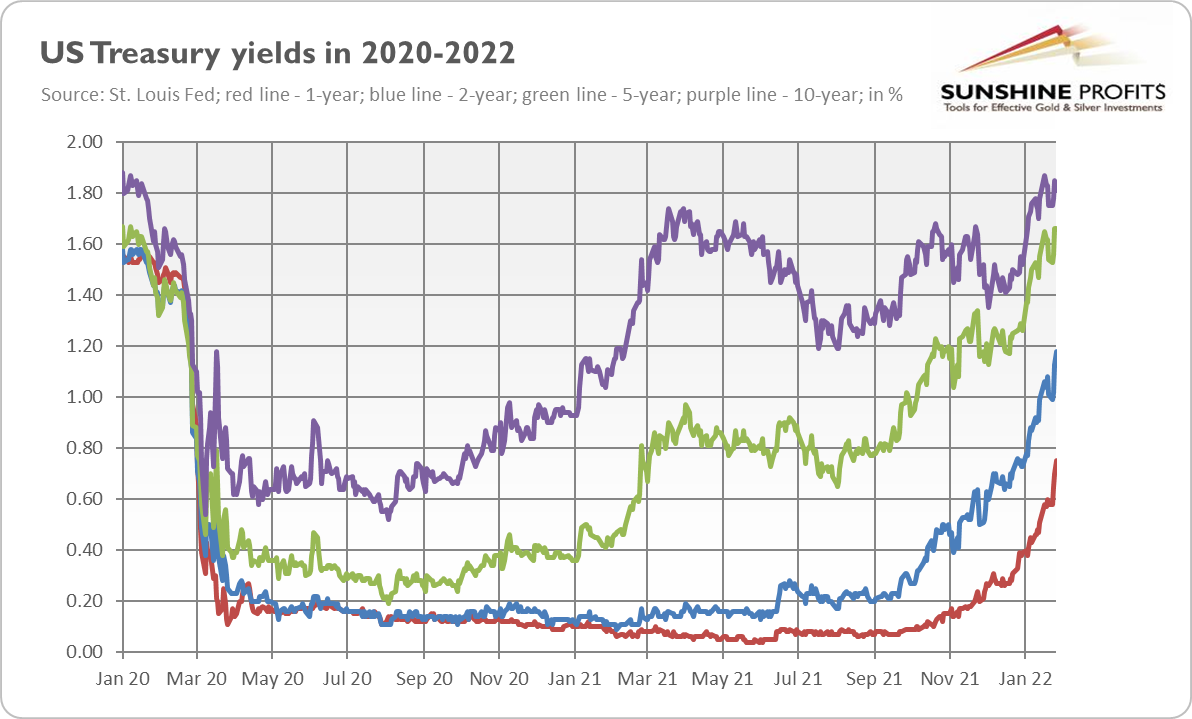

According to the report, “gold drew direction chiefly from inflation and interest rate expectations in 2021,” although it seems that rising rates outweighed inflationary concerns. As the chart below shows, the interest rates increased significantly last year. For example, 10-Year Treasury Yield rose 60 basis points. As a result, the opportunity costs for holding gold moved up, triggering an outflow of gold holdings from the ETF.

As the rise in interest rates is likely to continue in 2022 because of the hawkish stance of the Fed, gold investment may struggle this year as well. The end of quantitative easing and the start of quantitative tightening may add to the downward pressure on gold prices.

However, there are some bullish caveats here. First, gold has remained resilient in January, despite the hawkish FOMC meeting. Second, the Fed’s tightening cycle could be detrimental to the US stock market and the overall, highly indebted economy, which could be supportive of gold prices. Third, as the report points out, “gold has historically outperformed in the months following the onset of a US Fed tightening cycle”.

The second publication released by the WGC last month was “The Relevance of Gold as a Strategic Asset 2022”. The main thesis of the report is that gold is a strategic asset, complementary to equities and bonds, that enhances investment portfolios’ performance. This is because gold is “a store of wealth and a hedge against systemic risk, currency depreciation, and inflation.” It is also “highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time.”

Gold is believed to be a great source of return, as its price has increased by an average of nearly 11% per year since 1971, according to the WGC. Gold can also provide liquidity, as the gold market is highly liquid. As the report points out, “physical gold holdings by investors and central banks are worth approximately $4.9 trillion, with an additional $1.2 trillion in open interest through derivatives traded on exchanges or the over-the-counter (OTC) market.”

Last but not least, gold is an excellent portfolio diversifier, as it is negatively correlated with risk assets, and – importantly – this negative correlation increases as these assets sell off. Hence, adding gold to a portfolio could diversify it, improving its risk-adjusted return, and also provide liquidity to meet liabilities in times of market stress. The WGC’s analysis suggests that investors should consider adding between 4% and 15% of gold to the portfolio, but personally, I would cap this share at 10%.

Implications for Gold

What do the recent WGC reports imply for the gold market? Well, one thing is that adding some gold to the investment portfolio would probably be a smart move. After all, gold serves the role of both a safe-haven asset and an insurance against tail risks. It’s nice to be insured. However, investing in gold is something different, as gold may be either in a bullish or bearish trend.

You should never confuse these two motives behind owning gold! Sometimes it’s good to own gold for both insurance and investment reasons, but not always. When it comes to 2022, investment demand for gold may continue to be under downward pressure amid rising interest rates. However, there are also some bullish forces at work, which could intensify later this year.