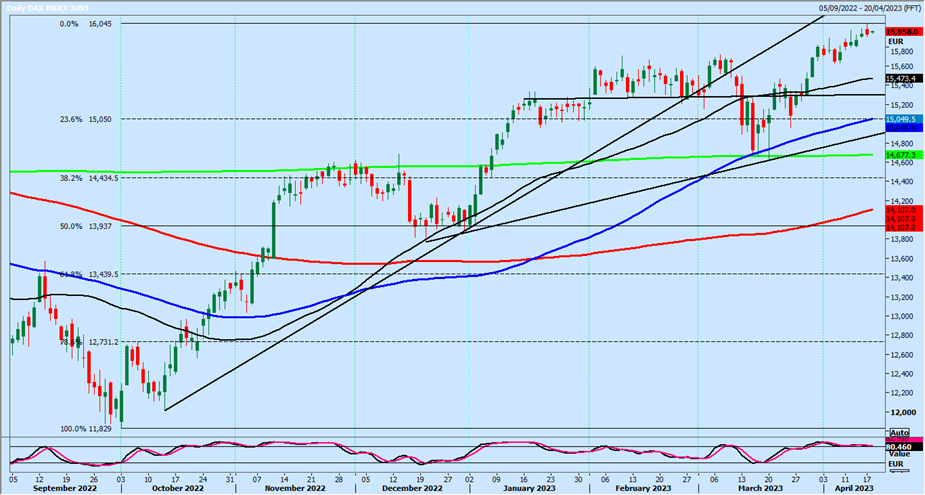

Dax 40 June edges higher again to 16045, not quite as far as my next target of 16070/090.

We closed down on the day in severely overbought conditions as we hover only 300 ticks from the all-time high. Clearly, this opens up double top risk.

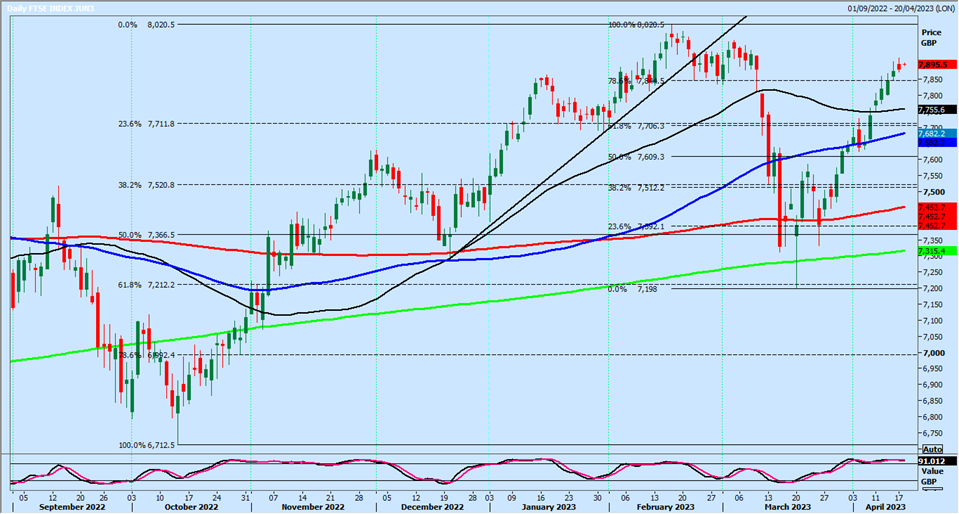

FTSE 100 June continues higher as expected after the latest buy signal, hitting my targets of 7775/80 & 7840/50 with a high for the day.

Today's Analysis

Dax June we are in a bull trend so buying at support remains the favored strategy although I am watching carefully for a sell signal as we approach the all-time high. A double top would be an important longer-term sell signal. We should have support at 15900/850. A break below 15800 however risks a slide to 15720/700, perhaps as far as 15650/630.

A break above 16070/090 retests the all time high at 16275/295.

FTSE June break above 7865 hit my next target of 7910/20 with a high for the day exactly here yesterday. Just be aware that we are severely overbought after an incredible 500 point gain in just 4 weeks. Yesterday we closed lower on the day, which is a minor negative signal. Not a sell signal, I would need to see something more convincing in such a bull trend to suggest short positions, but I certainly would not be surprised to see a small correction to the downside at this stage.

Above 7920 this week look for 7955/65.

First downside target & support at 7855/45. A low for the day is certainly possible. Longs need stops below 7830. A break lower however targets 7810/00, perhaps as far as strong support at 7755/35.

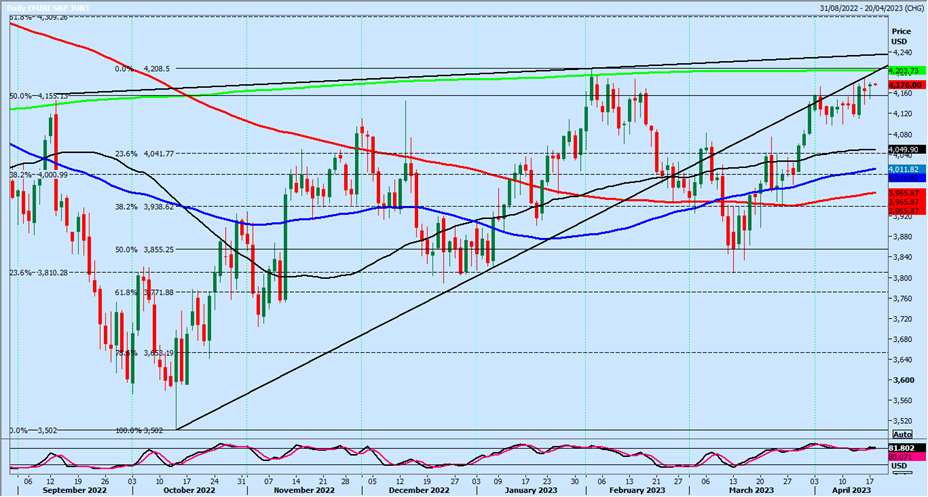

S&P 500 Futures June I warned may establish a sideways range & that certainly has been the case all last week, although these short-term volatile sideways trends are difficult to trade.

Edges towards strong resistance at the February high & 100 week & 500 day moving average resistance at 4200/4210.

THIS IS THE IS THE MOST IMPORTANT LEVEL OF THE WEEK.

Nasdaq June dips longs at strong support at 13000/12950 worked perfectly on the expected bounce to my target of 13180/13220 for a quick 200-tick profit.

We have been stuck in a 400-tick range for 2 weeks so same levels apply for today.

Emini Dow Jones June recovered steep loss on Thursday then collapsed initially on Friday before a recovery. Clearly we are stuck in a short-term volatile sideways trend.

Update daily by 06:00 GMT.

Today's Analysis

Emini S&P June close to a test of the February high & 100 week & 500-day moving average resistance at 4200/4210. Try a short with stop above 4230. A break higher (& holding above 4200) is an important buy signal this week (obviously!!).

Minor support at 4150/40, with a low for the day exactly here yesterday for a quick scalp. Strong support at 4100/80. Longs need stops below 4070. A break lower targets 4040/30, perhaps as far as 4010/00.

Shorts at 4200/4210 can target 4160/50, perhaps as far as 4110/00.

Nasdaq June longs at strong support at 13000/12950 worked perfectly hitting my target of 13180/13220. By Friday we edged a little higher to 13255. A break higher today can retest the April high at 13330/350. A break higher from here meets strong resistance at 13480/520. Shorts need stops above 13560.

We are holding an erratic & volatile sideways channel from 12950 up to 13200/250. Watch for the breakout.

Strong support again at 13000/12950. Longs need stops below 12900. A break lower can target 12740/700.

Dow Jones Futures June bulls need to hold prices above the 4-month descending trend line at 34100/34000 for a buy signal targeting 34280/290 & 34500.

However, bear in mind we are severely overbought after a 3000-point gain in just 1 month. A break below 33800 signals the 4-month trend line has held & is likely to see further losses to at least 33600.