Crude oil had a legendary drop during the financial crisis. After a strong bounce and then consolidation for 4 years it dropped again in late 2014. Pundits, traders and everyone else was bamboozled.

First there were calls for $20/barrel and then a rise back to $100. Finally the Famous Dennis Gartman blurb “Crude will never get above $44 per barrel again in my lifetime”. Pro tip to everyone out there. The only time to use the word NEVER is when you are telling people to not use the word NEVER.

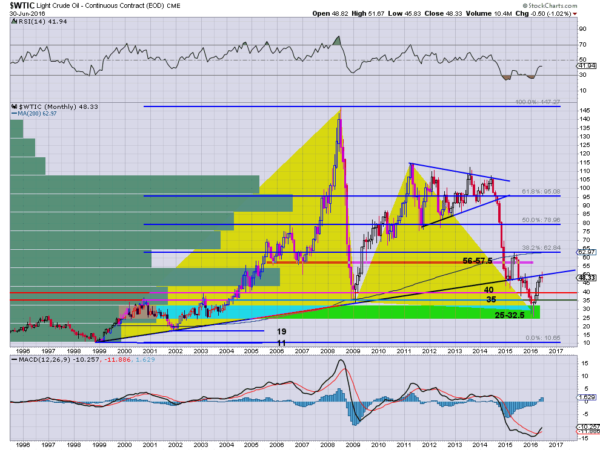

The chart below shows the double bottom with long Hammer reversal candles at the turn of the year. Since then crude oil has moved nearly 100% higher, well over $44 per barrel. But the candle that finished June gives some interesting information about the possible future of crude.

There are four things in this chart to watch for going into July.

The first is what candle will follow the doji printed in June. A doji represents indecision as buyers and seller both win at some point of the month, with crude going higher and also lower, but finishing unchanged. Nobody wins. Many thing of a doji as a reversal candle, but it can be confirmed either way, with buyers or sellers eventually winning out.

The second thing is where that doji rests. It is right below the rising 17 year trend line that had acted as support until mid 2015. Often times a market will break a trend line and then come back to retest it before continuing it path. Will that happen again, or will crude oil break back above that tend line after some consolidation.

The third is the RSI, a momentum indicator. It is considered bullish above 50 and bearish below 50, with some looking for a bit more as confirmation. The RSI has been rising off of the bearish oversold level, but stalled this month. And the stall is in the bearish zone. This is not a good sign for bullish traders. Without a move over 50 or for many over 60, this is nothing more than a big Dead Cat Bounce for crude oil.

Finally look at the MACD at the bottom of the chart. This too is a momentum indicator, or maybe more of an acceleration indicator. It compares the speed of two different moving averages. When the black MACD line is rising that is positive. When it crosses the red signal line even better. And when it becomes positive a trifecta. Two out of three ain’t bad, as Meat Loaf would say.

The trend in crude oil remains upward until the actual price reverses. But these indicators can often give a clue as to what will happen next. And for crude oil the combination of indecision at resistance with accelerating but weak momentum suggests it may be time to tighten stops or add downside protection.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.